Five Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- Wild weather is taking a toll on commodities markets. Cocoa’s rally is cooling. And Americans can feast on hamburgers at July 4 holiday barbecues without breaking the bank.

Most Read from Bloomberg

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

24-Hour Stock Trading Is Booming – and Wall Street Is Rattled

Trump as President or Private Citizen: Why Supreme Court’s Immunity Ruling Is a Test

Here are five notable charts to consider in global commodity markets as the week gets underway.

Climate

An era of extreme weather has gripped the globe as climate change ushers in a phenomenon known as “compound events” — when weather goes haywire in back-to-back or overlapping spells. For an example, consider Texas. The Lone Star state has been the US epicenter of wild weather for decades, racking up 176 weather disasters costing $1 billion or more since 1980, according to the US National Centers for Environmental Information. Texas also logged the most extreme-weather costs of any US state, with damages totaling at least $300 billion over the period — and the pace is picking up as climate change amplifies the risks.

Commodities

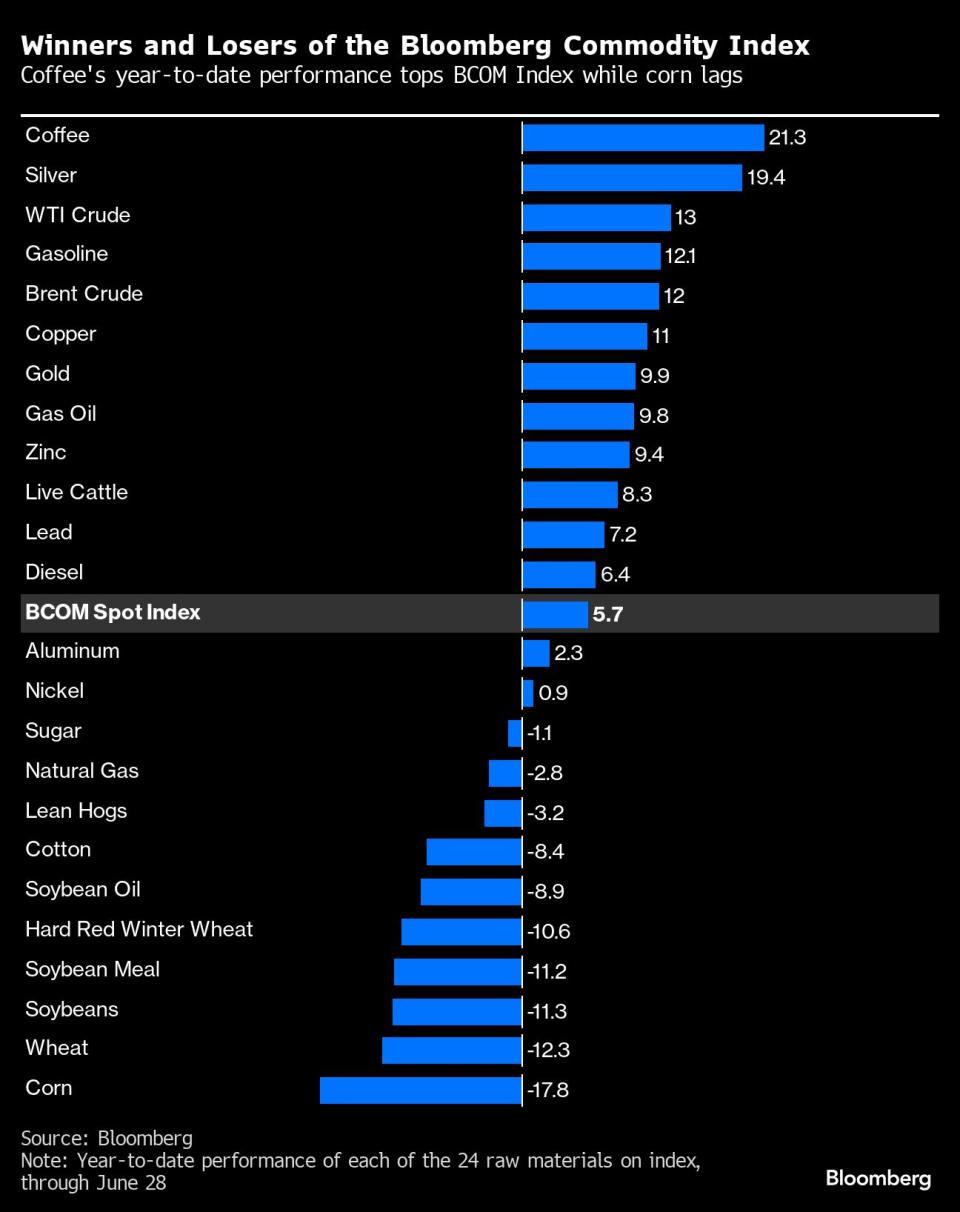

Coffee, silver and crude have helped give commodities a boost in the first six months of 2024, helping counter weakness in grains. The Bloomberg Commodities Spot Index — a basket of futures contracts for 24 raw materials — has risen 5.7% in the first half of this year, thanks to back-to-back quarters of increases. While a far cry from the gains seen earlier in the pandemic, the commodities gauge is now faring better than in most quarters over the previous two years.

Meat

Many Americans will be firing up the barbecue on July 4 to celebrate Independence Day, with hamburgers, pork sausages and chicken breasts among the perennial favorites for the summer holiday. Poultry fans may be in for a bit of sticker shock, though: wholesale boneless chicken breasts have soared 67% this year, more than quadruple beef and pork prices. Wholesale prices offer a leading indicator for what shoppers will eventually pay at the supermarket.

Cocoa

Cocoa futures in New York ended the quarter with a loss for the first time in two years, with a 21% drop cooling a breakneck rally that brought prices to an all-time high in April. Production struggles in top growers Ivory Coast and Ghana still leave the world on track for a massive 439,000-ton cocoa shortage this season. But focus is shifting to a brighter outlook for the upcoming season, with production from Ivory Coast expected to rebound to 2 million tons for the crop year starting in October. Cocoa futures slumped in New York on Monday.

Oil

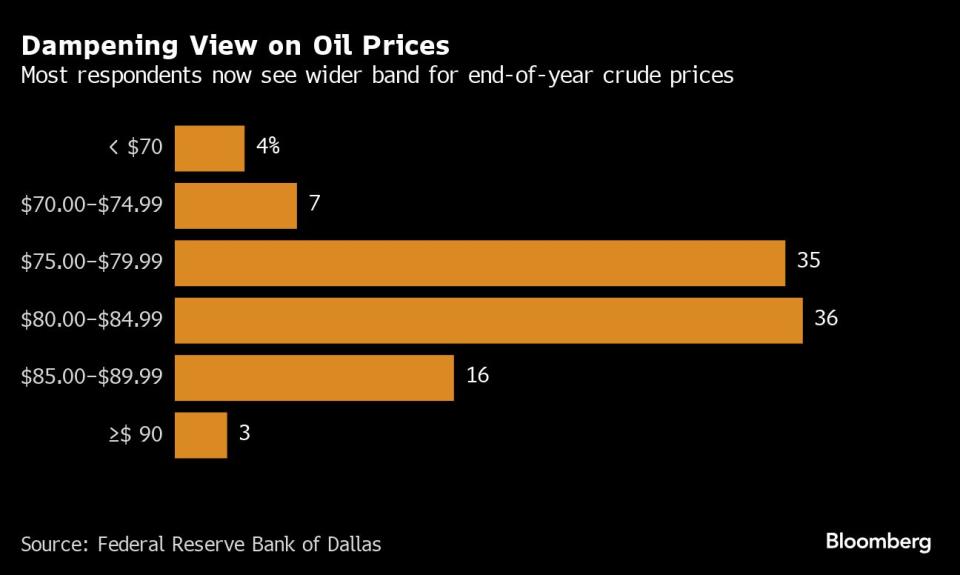

American shale executives turned a little more bearish on oil prices despite slowing US output growth and global optimism for increased demand. A report from the Federal Reserve Bank of Dallas last week showed that surveyed executives now see West Texas Intermediate crude ending the year below $80 on average. More than two-thirds of respondents expect year-end prices to fall to between $75 and almost $85 a barrel. That’s down from a first-quarter survey, when the most common forecast was for oil to end the year in the $80-$85 range. Oil edged higher on Monday to about $82.

--With assistance from Michael Hirtzer and Brian K. Sullivan.

(Adds cocoa prices in sixth paragraph, oil in seventh.)

Most Read from Bloomberg Businessweek

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Japan’s Tiny Kei-Trucks Have a Cult Following in the US, and Some States Are Pushing Back

RTO Mandates Are Killing the Euphoric Work-Life Balance Some Moms Found

The FBI’s Star Cooperator May Have Been Running New Scams All Along

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance