FirstEnergy (FE) Rides on Investments, Infrastructure Upgrade

FirstEnergy Corporation FE continues to benefit from a growing regulated base, and the expansion of distribution and transmission lines is expected to further improve operations. The company’s strategic investment is likely to increase grid reliability and enable efficient customer service. FE’s Energize365 initiative will add to its overall operational strength.

However, this Zacks Rank #3 (Hold) company faces risks related to the timely completion of projects and seasonal factors.

Tailwinds

The utility’s efforts to expand its regulated generation mix provided stability to its earnings trajectory. In the last few years, the company witnessed a successful broadening of regulated operations and a transition to become a fully-regulated utility company.

Through 2025, the company expects to deploy 1.2 million smart meters, along with the supporting communications infrastructure and data management systems, to enhance the delivery of safe, reliable power for customers.

FE’s Energize365 is a multi-year grid evolution platform, focused on enhancing customer experience while maintaining its strong affordability with rates at or below its in-state peers. With planned investments of $26 billion between 2024 and 2028, the company is expected to install advanced equipment and technologies that will strengthen and modernize its transmission and distribution infrastructure. Strengthening of the transmission and renewable generation assets should allow FE to transmit electricity even during adverse weather conditions.

Headwinds

The sale of electric power is generally a seasonal business, and weather patterns can have a material impact on FirstEnergy’s Regulated Distribution segment’s operating results. Demand for electricity in the service territories historically peaks during the summer and winter months. Mild weather conditions may result in lower power sales and consequently lower revenues, earnings and cash flow.

Any delay in the timely completion of the capital projects might result in additional operating expenses and lower the company’s profitability.

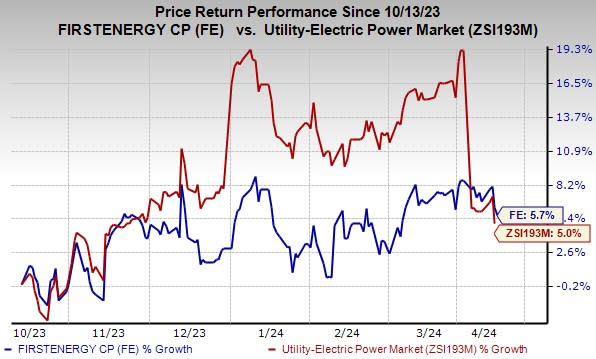

Price Performance

In the past six months, shares of FirstEnergy have risen 5.7% compared with the industry’s 5% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the same industry are DTE Energy DTE, Pinnacle West Capital Corporation PNW and NiSource Inc. NI, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DTE’s long-term (three to five years) earnings growth rate is 6%. The Zacks Consensus Estimate for DTE’s 2024 earnings per share (EPS) indicates an increase of 16.9% from the previous year’s recorded number.

PNW’s long-term earnings growth rate is 7.55%. The Zacks Consensus Estimate for 2024 EPS implies an improvement of 7.9% from the bottom line recorded in 2023.

NiSource’ long-term earnings growth rate is 6%. The Zacks Consensus Estimate for 2024 EPS implies a year-over-year increase of 6.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NiSource, Inc (NI) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance