FirstEnergy (FE) Completes Annual Transmission Line Inspections

FirstEnergy Corporation FE and its transmission subsidiaries completed the necessary inspection and maintenance of its transmission system. This proactive annual probe ensures that FE’s transmission lines can operate efficiently during the summer and transfer high-voltage power from generation units to the designated locations.

The company used helicopters for quick and efficient execution of the job. The helicopter patrols conducted inspections of nearly 18,000 miles of high-voltage power lines, with personnel examining the wires, equipment and structures for potential maintenance issues.

FirstEnergy uses thermovision cameras to take infrared pictures of electrical equipment, assisting in the identification of possible issues in power lines and substations. It also trimmed trees along transmission lines in order to safeguard them against disruptions caused by trees during severe weather events.

Need for Investments & Maintenance

The company’s strategic investment will help it serve its 6 million customers more efficiently. In the past several years, Regulated Distribution has experienced rate base growth through investments. FirstEnergy’s ‘Energizing the Future’ plan is aimed at enhancing and expanding its regulated transmission capabilities. Through 2022, the company invested more than $10 billion in the plan. The idea was to modernize and improve the reliability and resiliency of its transmission system.

FE expects to invest nearly $11.4 billion in the 2023-2025 period to further strengthen its existing operations. The company projects an investment of $5.9 billion and $5.4 billion in regulated distribution and regulated transmission, respectively, during the same period. Strengthening of the transmission lines will allow FirstEnergy to transmit electricity even during adverse weather conditions.

A rise in temperature not only increases the demand for electricity but also poses a threat to electric infrastructure. These inspections and maintenance tasks are crucial to maintaining service reliability and ensuring customer satisfaction.

Utilities’ Focus on Infrastructure

In order to provide reliable service to customers, utilities make systematic investment to upgrade transmission and distribution lines and develop new substations. The objective is to warrant proper supply of electricity to millions of customers across the United States.

Along with FirstEnergy, other electric power companies like Xcel Energy, Inc. XEL, Exelon Corporation EXC and Duke Energy DUK are adopting measures to strengthen their existing infrastructure.

Xcel Energy aims to spend $29.5 billion during 2023-2027, out of which the company plans to invest nearly $18 billion in strengthening its electric distribution and transmission operations.

XEL’s long-term (three to five years) earnings growth rate is 6.3%. The Zacks Consensus Estimate for 2023 earnings per share (EPS) implies a year-over-year improvement of 6%.

Exelon invests substantially in infrastructure projects. It plans to spend nearly $31.3 billion during 2023-2026 on regulated utility operations for grid modernization and enhancement of its infrastructure’s resilience.

EXC’s long-term earnings growth rate is 6.68%. The Zacks Consensus Estimate for 2023 EPS implies a year-over-year improvement of 4%.

Duke Energy remains focused on expanding its scale of operations and implementing modern technologies at its facilities. It invests heavily in infrastructure and expansion projects. Almost 85% of the company’s planned investment funds its generation fleet transition and grid modernization. This includes approximately $75 billion to modernize and strengthen its transmission and distribution infrastructure.

DUK’s long-term earnings growth rate is 6.18%. The Zacks Consensus Estimate for 2023 EPS implies a year-over-year improvement of 6.64%.

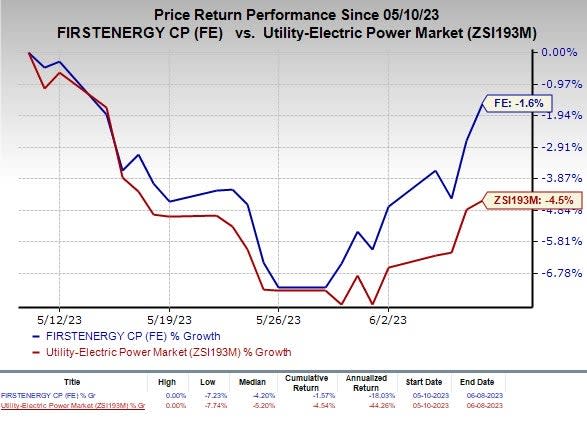

Price Performance

In the past month, shares of FirstEnergy have lost 1.6% compared with the industry’s 4.5% decline.

Image Source: Zacks Investment Research

Zacks Rank

FirstEnergy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exelon Corporation (EXC) : Free Stock Analysis Report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance