First Mover Americas: A Bleak Month for Crypto as Bitcoin Slides, Ether Stalls and Solana Tanks

Price Point: Bitcoin hovers around $20,300, and some altcoins posted gains.

Market Moves: A look at how crypto products performed in August. Ethereum-based products saw gains, while bitcoin products struggled, perhaps because of the attention on Ethereum ahead of the much-anticipated Merge.

Chart of the Day: Bitcoin underperforms against the rest of the market in August.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price point

Market conditions remained choppy on Wednesday with bitcoin (BTC) hovering around $20,300, down slightly on the day. Stocks were mixed and futures tied to the Dow Jones Industrial Average and S&P 500 wavered.

“There's clearly a lack of conviction in the markets following a lot of hawkish central bank commentary in recent days,” Oanda analyst Craig Erlam wrote in a note Wednesday.

“The narrative that investors want to believe is that inflation has peaked and is falling in the U.S. and that a soft landing is plausible. That doesn't necessarily align with what we're hearing,” Erlam wrote.

The U.K., U.S. and European Union are all on track for 75 basis point (0.75 percentage point) interest-rate hikes next month, making it unsurprising that investors are taking a more cautious stance, according to Erlam.

In the news, decentralized finance (DeFi) lending protocol Compound has suffered a critical failure, effectively halting the trade of compound ether (cETH), after a bug was discovered in the code that causes transactions for suppliers and borrowers of ether to revert.

A report from Morgan Stanley said the combined market capitalization of the two largest stablecoins, tether (USDT) and USD coin (USDC), has begun to fall again, a sign that quantitative tightening in the crypto financial system has resumed.

And finally, Pantera Capital Chief Operating Officer Samir Shah appears to have left the cryptocurrency-focused investment firm after barely two months, according to his LinkedIn profile.

Biggest Gainers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Terra | +3.1% | ||

Cosmos | +2.7% | ||

Polygon | +2.2% |

Biggest Losers

Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

Loopring | −1.1% | ||

Gala | −1.1% | ||

Shiba Inu | −1.0% |

Market Moves

August recap

In August, the top 10 cryptocurrencies by market value all mostly traded in the red. Solana’s SOL took the largest hit, down 21%. Bitcoin fell 12%, and ether lost 2%.

Bitcoin products struggle

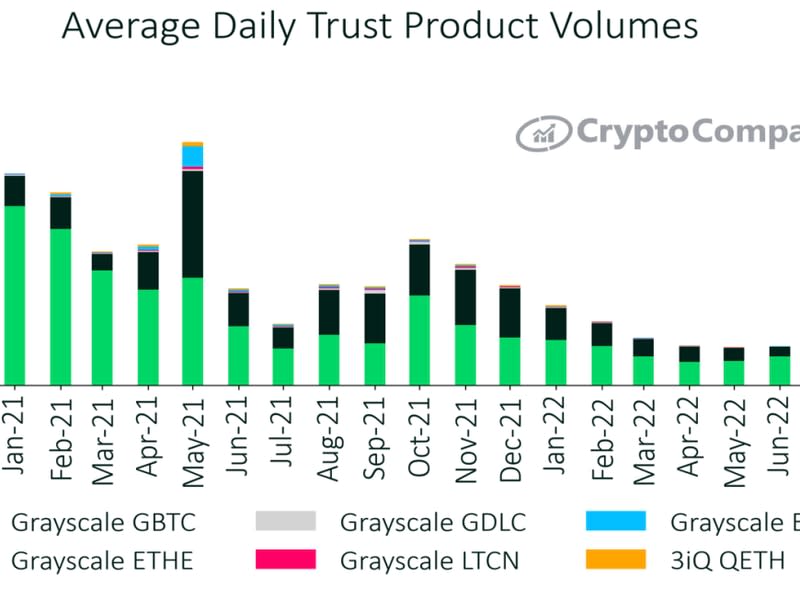

In August, bitcoin products struggled, while Ethereum-based products saw gains. According to a report from CryptoCompare, bitcoin-based products fell 7.2% to $17.4 billion in August, while Ethereum-based products saw gains of 2.36% to $6.81 billion.

“We could be seeing interest move away from bitcoin in the short term, as Ethereum-based products hold the attention with the much-anticipated Merge on the horizon,” the report said, referring to a software update on the Ethereum blockchain that is expected to occur next month.

Ethereum trusts gained volume supremacy

Grayscale Investments' Bitcoin Trust (GBTC) lost its position as the most traded trust product, according to data from CryptoCompare. (Grayscale is owned by Digital Currency Group, which also owns CoinDesk.)

The average daily volume of the fund totaled $42.3 million in August, down 24.4% from July. Grayscale’s Ethereum Trust took the top spot with an average daily volume of $48.7 million, up 23.2% from July.

Chart of the Day

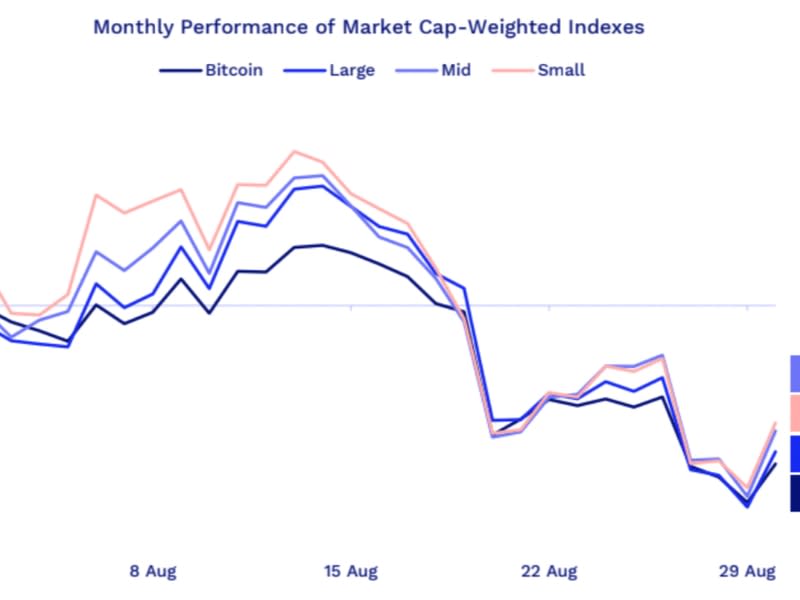

Bitcoin Underperforms the Rest of the Market in August

Data tracked by Arcane Research shows that bitcoin has underperformed all indexes in August with a monthly loss of 13%.

All altcoin indexes continue to move in tandem in August, with performances ranging from -12% to -10%.

Latest Headlines

Morgan Stanley Says Stablecoin Market Cap Is Contracting Again: The bank said it sees little evidence of leverage rebuilding in the decentralized finance ecosystem.

What to Expect From the UK’s Royal Mint NFT Collection: An NFT range issued with the endorsement of the U.K. government must come with perks to succeed, industry members say.

British National Accused in OneCoin Scam Set to Face US Extradition, Law360 Reports: Co-accused Robert McDonald avoided extradition on human rights grounds.

South Korean City Busan Taps FTX to Develop Crypto Exchange, Promote Blockchain Businesses: Busan aims to develop a blockchain zone in the coming years and had also signed on crypto exchange Binance last week.

Yahoo Finance

Yahoo Finance