First Interstate BancSystem Inc. Reports Q1 Earnings: A Detailed Analysis

Net Income: Reported $58.4 million for Q1 2024, up from $56.3 million in Q1 2023, exceeding estimates of $51.74 million.

Earnings Per Share (EPS): Achieved $0.57, surpassing the estimated $0.50, and showing an increase from $0.54 in Q1 2023.

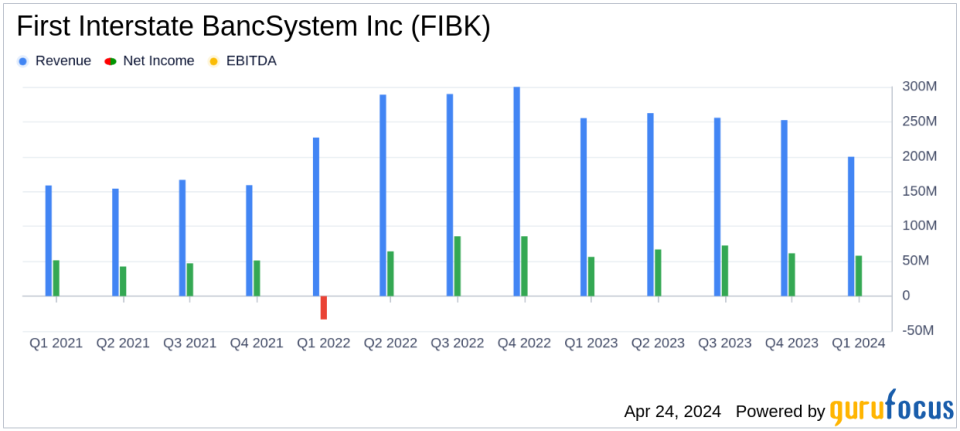

Revenue: Net interest income fell to $200.1 million, a decrease of 16.2% from $238.9 million in Q1 2023, and below the estimated $241.28 million.

Dividends: Declared a quarterly dividend of $0.47 per share, reflecting a 6.9% annualized yield based on the quarter's average stock price.

Loan Portfolio: Loans held for investment decreased slightly by $76.8 million to $18,202.8 million at the end of Q1 2024.

Deposits: Total deposits decreased by $513.1 million to $22,810.0 million, a 2.2% reduction from the previous quarter.

Non-Performing Assets: Increased by $61.6 million, primarily due to a significant non-accrual commercial and industrial loan.

On April 24, 2024, First Interstate BancSystem Inc. (NASDAQ:FIBK) disclosed its financial outcomes for the first quarter of 2024 through its 8-K filing. The company reported a net income of $58.4 million, or $0.57 per share, slightly surpassing the analyst's estimated earnings per share of $0.50. This performance also shows a modest increase from the $56.3 million, or $0.54 per share, reported in the same quarter of the previous year.

First Interstate BancSystem Inc., a prominent financial holding entity, operates through First Interstate Bank across various states, offering extensive banking and financial services. The bank primarily generates income from interests on loans and investments.

Financial Highlights and Challenges

The company experienced a decrease in net interest income, which fell by 16.2% year-over-year to $200.1 million, mainly due to higher costs of interest-bearing liabilities. Notably, the net interest margin also saw a reduction to 2.91%. On the brighter side, non-interest expense witnessed a decrease, dropping by $5.8 million from the previous quarter, reflecting effective cost control measures.

However, First Interstate BancSystem faced challenges such as a significant $513.1 million drop in total deposits and an increase in non-performing assets, primarily due to a non-accrual commercial and industrial loan. These factors could pose risks to the bank's liquidity and asset quality in future quarters.

Operational and Market Performance

Despite the mixed financial metrics, the bank declared a dividend of $0.47 per common share, indicating confidence in its capital and liquidity levels. The bank's CEO, Kevin P. Riley, emphasized the strong execution in the first quarter and the bank's solid positioning for the remainder of 2024.

"We executed well in the first quarter, with results generally in-line with our expectations, which we believe positions us well for the remainder of 2024," stated Kevin P. Riley, President and CEO.

The bank's balance sheet reflected a decrease in total assets, primarily due to reductions in investment securities and loans. The loan portfolio showed a slight contraction, with loans held for investment decreasing by $76.8 million.

Strategic and Regulatory Insights

First Interstate BancSystem continues to navigate through a complex regulatory environment and a competitive banking landscape. The bank's strategic focus on maintaining robust capital levels and managing costs effectively is evident from its quarterly performance. However, the increase in non-performing assets and the challenges in the loan portfolio will require continued strategic oversight.

The bank remains well-capitalized, surpassing regulatory requirements, which supports its strategy to provide stable dividends and potentially weather economic fluctuations.

Conclusion

First Interstate BancSystem's first-quarter performance presents a picture of resilience amid challenges. While it surpassed earnings estimates and maintained a strong dividend, the bank faces ongoing pressures from increased non-performing assets and fluctuating interest margins. Investors and stakeholders will likely watch how the bank manages these challenges in the evolving economic landscape.

For detailed financial figures and further information, refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from First Interstate BancSystem Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance