First Eagle Perspective- Election 2024: Casting a Vote for Persistence

Key Takeaways

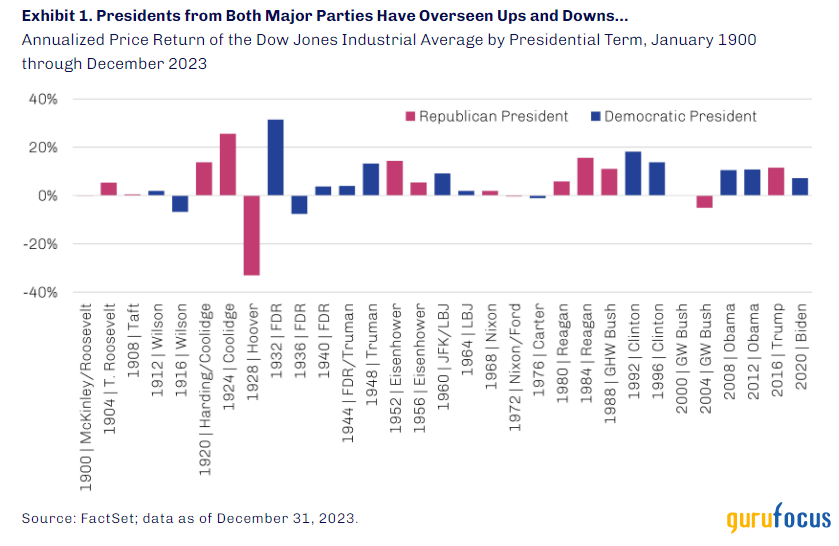

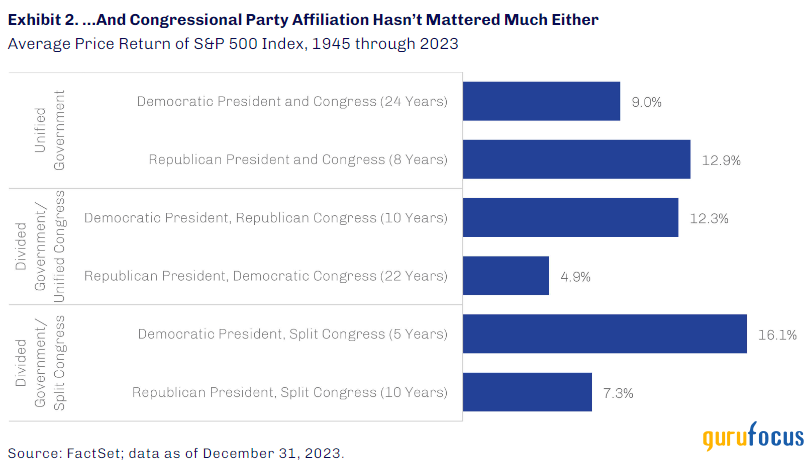

The US president's party affiliation historically has had little connection to financial market performance, and the same can be said about the balance of power in Congress. The expression of partisan biases in an investment portfolio has proven costly over time.

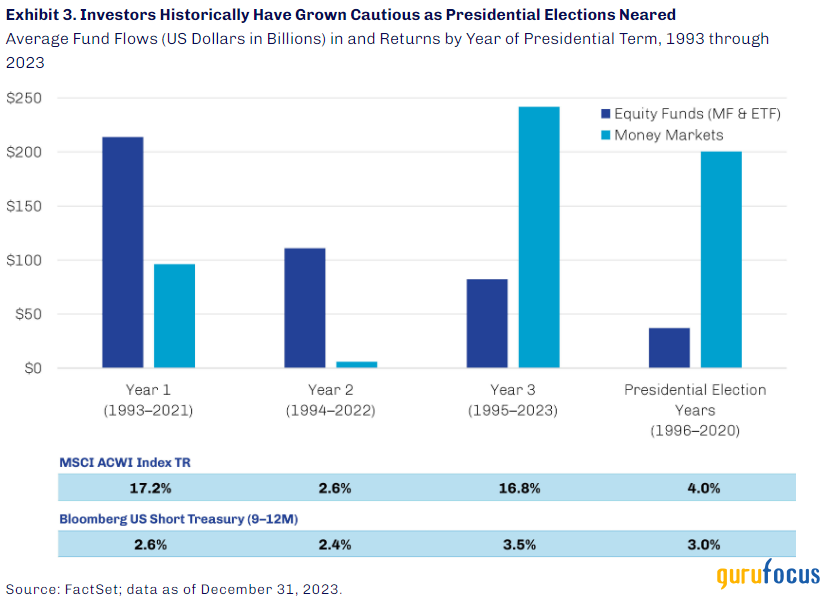

Surging market money fund flows in the years of and prior to a presidential election suggest to us that investors may be seeking perceived safety amid electoral uncertainty, a form of timing the market with a poor track record.

While there are a range of fundamental concerns that could trip up financial markets in 2024, sitting on the sidelines is not likely the most effective countermeasure. It's been our experience that maintaining a thoughtfully considered allocation to a diversified basket of what we consider to be resilient assets may be a good way to potentially mitigate markets' downside and build wealth over time.

More than $4 million.

That would have been the cost of playing partisan politics with a $10,000 investment from 1900 through 2023 rather than remaining invested across the 31 US presidential administrations over this period.1 And while a century-plus may seem like an improbably long investment horizon, an examination of shorter, more recent timeframes leads to the same conclusion: Party control of the White House has not been a reliable indicator of market performance.

And yet, investors have consistently demonstrated a tendency to seek refuge as presidential elections near, often sacrificing the potential upside of risk assets in favor of the perceived safety of cash as they await greater clarity on national leadership. This strikes us as ill-advised. In our view, periodically setting aside well-crafted long-term investment plans while waiting for the election dust to settle is not considered investing, but timing the marketa practice that historically has been a source of subpar returns for investors.

This is not to say that there are no reasons for investors to be wary; in fact, we believe there are numerous issues that have the potential to be more directly impactful on markets than the president's party affiliation. These include the Federal Reserve's ongoing efforts to engineer a soft landing for the US economy, massive fiscal imbalances throughout the developed world, and acute geopolitical tensions. But fear of the unknown is a poor trade signal and is unlikely to help build investor wealth over the long term. Instead, we advocate for adherence to a thoughtfully planned allocation across a diverse mix of assets, including those with the potential to provide some cushion against challenging markets while also participating in the market's upside over time.

Noise AnnoysThe noise surrounding the 2024 presidential election shows no signs of abating as we hurtle toward what seems destined to be a replay of 2020. From now until well after November 5, pundits will weigh in on what a Democratic or Republican victorynot only in the race for president, but also for the 33 seats up for grabs in the Senate and the biennial turnover of all 435 seats in the House of Representativesmeans for the economy and markets. Historically, however, the party ultimately holding power has had little connection with equity market performance, as shown in Exhibits 1 and 2.

Despite the inconsequential market influence of political party control, investors have a track record of favoring cash exposures as presidential elections loom. Exhibit 3 depicts equity and money market fund flows during each of the four years comprising a presidential term beginning in 1993, the first year of Bill Clinton's presidency. As shown, flows to money funds dwarf those to equity products in election years and the ones preceding them, while the opposite is true in years one and two of the new administration. Such skittishness can be costly to long-term portfolio returns, as shown in Exhibit 3. Though the magnitude has varied, global equity markets on average have outperformed short-term Treasuries each year of these cycles, suggesting a consistent asset allocation may be a good approach to consider.

Meaningful Fundamental Market Risks PersistWhile the particulars change over time, risk is omnipresent in equity markets. We believe there are a few key risks today with the potential to inspire a newfound sense of risk aversion, to the detriment of a range of financial assets.For example, current market valuations suggest complacency about the inevitability of a soft landing; in our view, the risk of an adverse outcome only increases the longer the Fed continues to circle the runway without touching down. We have long been skeptical of the central bank's ability to achieve a soft landing and remain so today. Beyond the scarcity of previous successful attempts, the persistent strength of the domestic labor market makes it hard for us to envision a scenario in which wage growth spontaneously returns to a level consistent with target-level inflation absent a meaningful increase in unemployment.

We're also concerned about the unsustainable fiscal trajectory of the US and other advanced economies. Financial repression via unconventional monetary policies through much of this century kept interest rates artificially low and tempered interest expenses even as debt balances continued to swell. Though the rollback of crisis-era monetary accommodations has pushed the cost of capital to more normal levels, fiscal discipline has not followed suit and there appears to be little appetite for it on either side of the DC aisle. A path toward meaningful fiscal reform seems nearly incomprehensible at this point, which could have significant near- and long-term implications.

Macroeconomic risks have been further complicated by a new geopolitical theater of uncertainty. Recent years have seen the emergence of a loose coalition of authoritarian countries like China, Russia, North Korea and Iran, a heartland axis that control a vast, near-contiguous swath of land rich with natural resources across Eurasia and into the Middle East and northern Africa. At a minimum, these new alliances set the stage for greater friction in economic relations, and there are many ways in which current localized armed conflicts such as Ukraine/Russia and Israel/Hamas could escalate into something more far-reaching. Meanwhile, China's reputed intentions in Taiwan remain vexing to diplomats and investors alike.

Despite these hazards, the term premium on US Treasuries trended lower since the global financial crisis and spent much of the past five-plus years in negative territory. The lack of a persistently positive term premium suggests markets may not agree with our assessment of the risksor, at the very least, they are untroubled amid the many potential triggers for a re-rating of US Treasuries. And while we can't speculate about what may finally cause investors to demand meaningful premia for the uncertain long-term fiscal trajectory of issuers, we note that changes in sentiment can happen quickly and reverberate broadly across markets.

Continue reading here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance