First Busey Corp (BUSE) Q1 2024 Earnings: Misses Analyst EPS Estimates, Aligns with Revenue ...

Net Income: Reported at $26.2 million for Q1 2024, below the estimated $27.39 million.

Earnings Per Share (EPS): Achieved $0.46, falling short of the estimated $0.49.

Net Interest Margin: Increased by 5 basis points to 2.79% during Q1 2024.

Adjusted Noninterest Income: Totaled $33.9 million, representing 30.9% of operating revenue.

Tangible Book Value Per Share: Grew to $16.84, marking an 11.2% increase year-over-year.

Acquisition: Completed the acquisition of Merchants & Manufacturers Bank Corporation on April 1, 2024.

Balance Sheet Repositioning: Executed a strategic two-part repositioning expected to enhance capital and earnings.

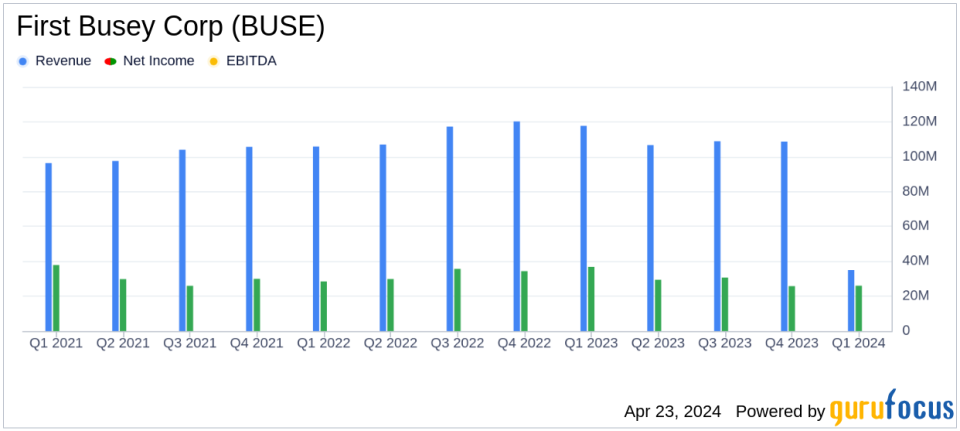

On April 23, 2024, First Busey Corporation (NASDAQ:BUSE), a prominent financial holding company, disclosed its first quarter earnings for 2024 through its 8-K filing. The company reported a net income of $26.2 million and diluted earnings per share (EPS) of $0.46, falling slightly short of analyst expectations of $0.49 per share. However, the company's revenue performance was in line with projections, with reported revenues aligning closely with the estimated $109.09 million.

Company Overview

First Busey Corporation operates primarily through three segments: Banking, FirsTech, and Wealth Management. The banking segment, being the major revenue generator, along with its subsidiaries, offers a wide range of retail and commercial banking services. The company has banking centers in Illinois, Missouri, Florida, and Indiana, and has recently expanded its services through the acquisition of Merchants & Manufacturers Bank Corporation, completed on April 1, 2024.

Financial Highlights and Strategic Moves

The first quarter saw First Busey Corporation achieving a net interest margin of 2.79%, a slight increase from the previous quarter, alongside strategic balance sheet repositioning aimed at enhancing capital and earnings. This period also marked record revenues for its FirsTech segment and a notably successful quarter for the Wealth Management division. The tangible book value per common share increased year-over-year by 11.2%, indicating a strong capital position.

Challenges and Operational Adjustments

Despite the stable financial outcomes, First Busey faced challenges such as a slight decline in EPS compared to the previous year and a modest increase in non-performing assets, primarily attributed to a single commercial credit relationship. The company also navigated an environment of high inflation and strategic adjustments, including a significant acquisition and ongoing balance sheet repositioning efforts aimed at future profitability and growth.

Balance Sheet and Income Statement Analysis

As of March 31, 2024, First Busey reported total assets of $11.89 billion, with a slight decrease in portfolio loans. The company's focus on maintaining a robust and diversified deposit base was evident, with core deposits making up 96.7% of total deposits. The net interest income for the quarter was reported at $75.8 million, reflecting the impacts of strategic financial management and prevailing economic conditions.

Looking Ahead

Looking forward, First Busey Corp remains committed to a conservative banking approach, emphasizing strong asset quality and strategic growth initiatives. The recent acquisition and balance sheet strategies are expected to enhance the company's market presence and financial stability, positioning it well for future challenges and opportunities in the banking sector.

Conclusion

First Busey Corp's first quarter results of 2024 reflect a balanced approach to navigating economic fluctuations and operational challenges. While the EPS fell slightly short of analyst expectations, the alignment of reported revenue with forecasts and strategic corporate actions underscore the company's resilience and forward-looking management strategy. Investors and stakeholders may find reassurance in the company's robust capital position and strategic initiatives aimed at long-term growth.

Explore the complete 8-K earnings release (here) from First Busey Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance