First American Financial Corp (FAF) Q1 2024 Earnings: Misses Analyst Revenue and EPS Estimates

Earnings Per Share (EPS): Reported at $0.45, falling short of the estimated $0.62.

Net Income: Achieved $46.7 million, below the estimated $68.30 million.

Revenue: Totalled $1.424 billion, slightly below the estimated $1.4267 billion.

Investment Income: Declined to $117 million, a decrease of 6% year-over-year.

Commercial Revenues: Dropped to $143 million, down 4% compared to the previous year.

Home Warranty Segment: Showed a pretax margin improvement to 19.3% from 15.3% year-over-year.

Debt-to-Capital Ratio: Reported at 30.3%, adjusted to 22.5% when excluding secured financings payable.

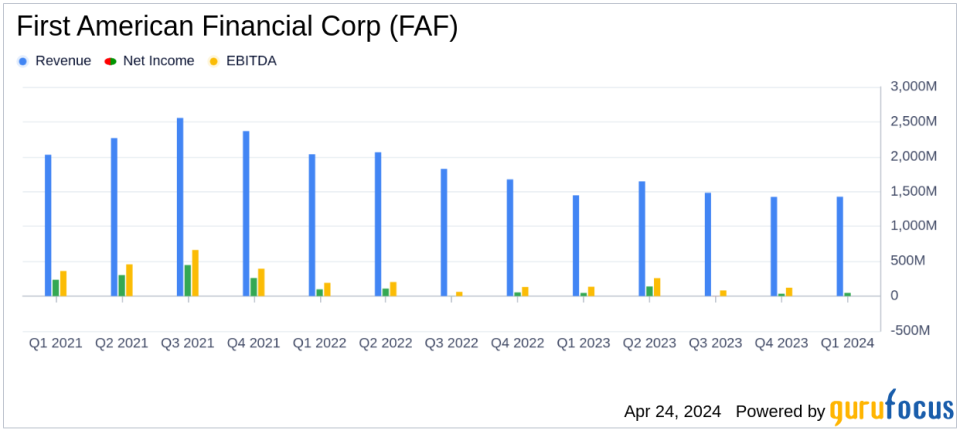

On April 24, 2024, First American Financial Corp (NYSE:FAF) released its 8-K filing, detailing the financial results for the first quarter ended March 31, 2024. The company reported earnings per diluted share of $0.45, falling short of the estimated $0.62, and total revenue of $1.4 billion, which also did not meet the expected $1.426 billion. This performance reflects a decrease in revenue by 1 percent compared to the previous year.

Company Overview

First American Financial Corp is a leading provider of title insurance, settlement services, and risk solutions for real estate transactions. It operates primarily through its Title Insurance and Services segment, offering products and services necessary for the transfer of property. The Home Warranty segment provides residential service contracts covering essential home systems and appliances. The majority of the company's revenue is generated from the Title Insurance and Services segment in the United States.

Financial Highlights and Challenges

The Title Insurance and Services segment saw a decrease in total revenue to $1.319 billion, down 2 percent from the previous year, with a pretax margin of 5.5 percent. This decline was attributed to a 4 percent decrease in the number of direct title orders closed. Conversely, the Home Warranty segment showed slight growth, with revenues increasing to $105 million, up 1 percent from the previous year, and an improved pretax margin of 19.3 percent.

CEO Ken DeGiorgio highlighted the ongoing market challenges, including elevated mortgage rates and low inventory levels, which have kept transaction volumes near historically low levels. Despite these challenges, the company remains focused on managing operating expenses and investing in strategic initiatives to enhance efficiency and customer experience.

Operational and Strategic Developments

First American Financial continues to invest in technology to lead the digital transformation of the title insurance and settlement services industry. The company has been recognized for its workplace culture, being named one of the 100 Best Companies to Work For by Great Place to Work and Fortune Magazine for the ninth consecutive year.

Financially, the company's debt-to-capital ratio stood at 30.3 percent, with an adjusted figure of 22.5 percent when excluding secured financings payable of $689 million. Investment income for the Title Insurance and Services segment was $117 million, down $8 million from the previous year, primarily due to lower average interest-bearing balances.

Looking Forward

Despite the first quarter's underperformance relative to analyst expectations, First American Financial is optimistic about achieving modest revenue growth and maintaining similar title margins as in 2023. The company's strategic investments and operational adjustments are aimed at navigating the current market conditions effectively.

For detailed financial figures and future projections, investors and stakeholders are encouraged to view the full earnings report and join the upcoming teleconference to discuss these results in greater detail.

This comprehensive analysis of First American Financial Corp's Q1 2024 performance provides valuable insights for investors and market watchers, highlighting the impacts of market dynamics on its operations and strategic responses.

Explore the complete 8-K earnings release (here) from First American Financial Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance