UP Fintech Holding Limited's (NASDAQ:TIGR) 38% Cheaper Price Remains In Tune With Earnings

Unfortunately for some shareholders, the UP Fintech Holding Limited (NASDAQ:TIGR) share price has dived 38% in the last thirty days, prolonging recent pain. Looking at the bigger picture, even after this poor month the stock is up 30% in the last year.

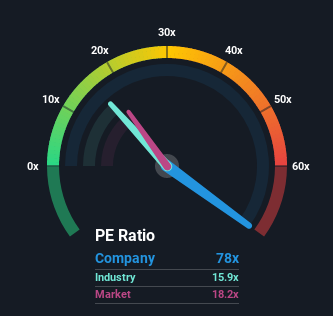

In spite of the heavy fall in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 18x, you may still consider UP Fintech Holding as a stock to avoid entirely with its 78x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, UP Fintech Holding has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for UP Fintech Holding

Want the full picture on analyst estimates for the company? Then our free report on UP Fintech Holding will help you uncover what's on the horizon.

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like UP Fintech Holding's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 457%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 95% per year over the next three years. That's shaping up to be materially higher than the 12% per annum growth forecast for the broader market.

With this information, we can see why UP Fintech Holding is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

UP Fintech Holding's shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of UP Fintech Holding's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with UP Fintech Holding, and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than UP Fintech Holding. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance