Finning International: A Reasonable Buy Here

Written by Kay Ng at The Motley Fool Canada

By simply observing Finning International’s (TSX:FTT) stock price over the last five and 10 years versus the Canadian stock market, investors can easily spot that it is an above-average volatile stock.

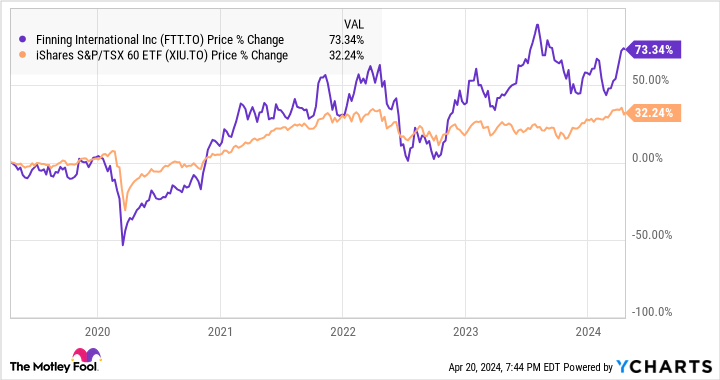

Over the last five years, Finning stock beat the Canadian stock market with or without dividends. The charts below exclude dividends and cash distributions as an illustration of the volatility of the stock.

FTT and XIU five-year data by YCharts

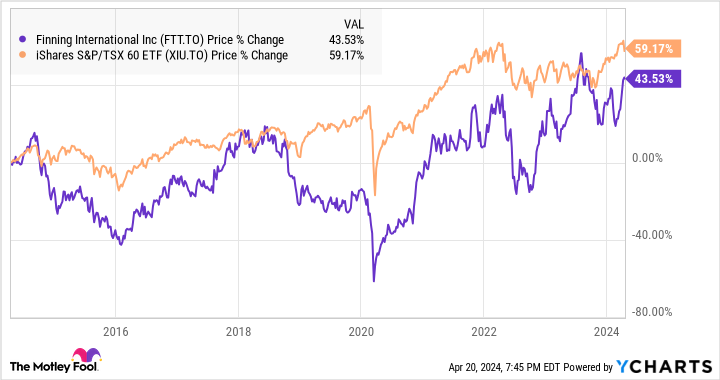

However, over the last 10 years, it underperformed the market. This goes to show that investors seeking to invest in the stock should be more picky about when to buy and sell.

FTT 10-year data by YCharts

Cyclical stock

Indeed, Finning International is a cyclical business. Over multiple years, its adjusted earnings typically move like a roller-coaster ride, going up and down. For instance, in 2008 and 2009, adjusted earnings per share fell 49%. In 2014-16, its earnings fell 55%. During the pandemic year of 2020, its earnings dropped 31%.

However, in other years, it experienced earnings growth — sometimes double-digit growth. This means that its earnings are sensitive to economic expansion and recession. So, for patient investors, the cyclical stock is likely an excellent buy for a multi-year turnaround on drops of over 40% from a high.

Now is not the safest time to buy the stock. However, over the next three to five years, it could still deliver total returns north of 10% per year.

Dividend stock trading at a fair valuation

Although a cyclical company, Finning International has maintained a safe and growing dividend. According to the Canadian Dividend All-Star List, the company has paid growing dividends for 22 consecutive years with a three-, five-, 10-, 15-, and 20-year dividend-growth rates of 6.3%, 4.5%, 5.1%, 5.7%, and 8.9%, respectively. Its payout ratio is estimated to be sustainable at about 25% this year.

Its dividend yield is almost 2.4% at writing. Its dividend growth, especially in recent years, hasn’t been spectacular. So, again, it signals the importance of buying the stock when it’s down and cheap for the long term.

At $42.07 per share at writing, it trades at about 10.7 times earnings. According to TMX Group’s analyst consensus 12-month price target of $47, the stock trades at a discount of over 10% and is considered to be fairly valued.

The business

Headquartered in Surrey, British Columbia, Finning International is the largest dealer of Caterpillar equipment. It sells, rents, and provides Caterpillar equipment, parts, services, and performance solutions in Western Canada, Chile, Argentina, Bolivia, the United Kingdom, and Ireland.

Last year, Finning generated $10.5 billion in revenue, resulting in a three-year growth rate of 19%. Operating income growth in the period was north of 28% per year, arriving at $933 million in 2023. It also achieved net income growth of 31% annually, leading to 2023 net income of $523 million. Investors should recognize this period as a tremendous turnaround post-pandemic.

Investor takeaway

To summarize, Finning International is a cyclical dividend stock that offers decent long-term returns potential of north of 10%. It’s reasonably valued and offers a safe dividend, yielding close to 2.4% today and has the will and ability to continue increasing its dividend.

The post Finning International: A Reasonable Buy Here appeared first on The Motley Fool Canada.

Should you invest $1,000 in Finning International Inc. right now?

Before you buy stock in Finning International Inc., consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Finning International Inc. wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool recommends TMX Group. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance