Finding Fantastic Momentum Stocks to Buy this Summer

The S&P 500 and the Nasdaq closed at fresh records on Monday. Stocks were mixed through early afternoon trading on Tuesday ahead of a potentially big day for Wall Street on Wednesday.

May CPI data will be released tomorrow before the Fed’s next official announcement on interest rates.

The bulls are in control to start the second full week of June, fueled by a combination of projected rate cuts, earnings growth, massive AI spending, and FOMO. But that doesn’t mean all stocks are trending in the right direction. Roughly 200 S&P 500 stocks are currently in the red YTD.

Today we explore a screen that helps investors find stocks experiencing impressive upward earnings revisions activity, helping them earn Zacks Rank #1 (Strong Buys).

The stocks we screen for are also momentum names trading near 52-week highs that might be worth buying in early June and the rest of the summer.

Screen Basics

The screen we are looking into today comes loaded with the Research Wizard. The screen helps investors dig through all of the Zacks Rank #1 (Strong Buy) stocks, of which there are over 200 at any given time, to find some of the top momentum names.

The screen narrows down the list of Zacks Rank #1 (Strong Buy) stocksto those with upward price momentum that are also trading within 20% of their 52-week highs. The screen then uses the PEG ratio and the Price to Sales ratio to help make sure investors are getting value as well. The screen then makes your life a little easier and narrows it down to just seven stock picks.

The screen basics are listed below…

· Zacks Rank = #1 (Strong Buy)

· Current Price/52-week High >= 0.8

· PEG Ratio: P/E F(1)/EPS Growth <= 1

· Price/Sales <= 3

· Percentage Change Price -12 Weeks = Top # 7

This strategy comes loaded with the Research Wizard and it is called bt_sow_momentum_method1 It can be found in the SoW (Screen of the Week) folder.

The screen is pretty simple, yet powerful. Here is one of the seven stocks that made it through this week's screen…

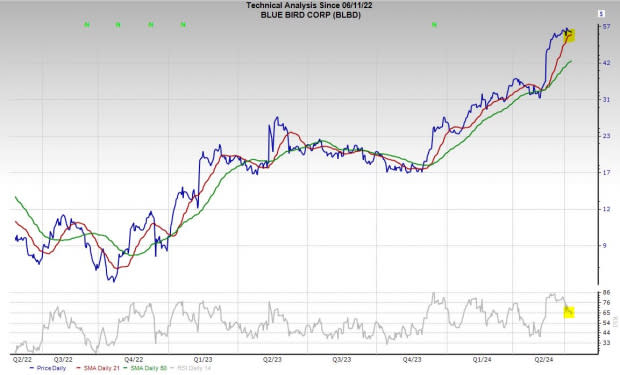

Blue Bird (BLBD)

Blue Bird is a historic maker of school buses that’s been in business for roughly 100 years. Blue Bird has pushed forward into new areas of automotive technology, including alternative fuels and EV buses. The firm is a leader in low- and zero-emission school buses with more than 20,000 propane, natural gas, and electric powered buses in operation today. Blue Bird has roared back after Covid briefly crushed its business.

Blue Bird posted 17% revenue growth in 2022 and 42% sales expansion last year. BLBD posted blowout Q2 FY24 earnings results in early May. The firm said demand for its school buses “remains very strong” with over 5,900 units in its order backlog.

Blue Bird is expanding its leadership position in alternative-power, closing last quarter with nearly 500 electric orders in its backlog. BLBD is also benefiting from the U.S. government’s push to transition more schools to EV buses and other non-fossil fuel offerings.

Image Source: Zacks Investment Research

Blue Bird is projected to boost its revenue by 17% in FY24 and 13% next year to reach $1.50 billion vs. $684 million in 2021. The company’s bottom line outlook appears even more impressive, with its adjusted earnings projected to soar 155% in FY24 from $1.07 to $2.73 per share and then jump again next year.

Blue Bird’s FY24 and FY25 earnings estimates have surged 30% since its last release to help land its Zacks Rank #1 (Strong Buy).

Blue Bird shares have skyrocketed 430% in the last two years and over 100% YTD. BLBD has cooled off a bit recently and it is attempting to find support at its 21-day moving average. The stock has climbed 475% in the last 10 years vs. it’s the Auto-Tires-Trucks sector’s 1% climb and the S&P 500’s 170%. Yet, Blue Bird’s booming earnings outlook help it trade near its 10-year median and 75% below its highs at 21.6X forward earnings.

Get the rest of the stocks on this list and start looking for the newest companies that fit these criteria. It's easy to do. And it could help you find your next big winner. Start screening for these companies today with a free trial to the Research Wizard. You can do it.

Click here to sign up for a free trial to the Research Wizard today.

Want more articles from this author? Scroll up to the top of this article and click the FOLLOW AUTHOR button to get an email each time a new article is published.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: www.zacks.com/performance_disclosure

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blue Bird Corporation (BLBD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance