Financially Strong And High Growth Stocks

High growth companies such as Espial Group and Power Financial has a positive future outlook in terms of their returns, profitability and cash flows. The prospects of these companies tend to outperform others, regardless of how the stock market is generally doing. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them a good investment if you believe the growth has not already been reflected in the share price.

Espial Group Inc. (TSX:ESP)

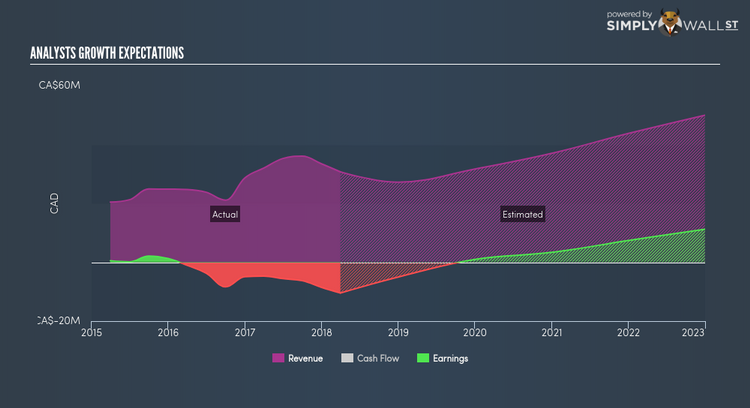

Espial Group Inc. develops and markets computer software solutions in North America, Europe, and the Asia Pacific. Founded in 1997, and now led by CEO Jaison Dolvane, the company provides employment to 174 people and with the stock’s market cap sitting at CAD CA$56.65M, it comes under the small-cap group.

ESP is expected to deliver an extremely high earnings growth over the next couple of years of 67.49%, driven by a positive revenue growth of 7.40% and cost-cutting initiatives. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with operating cash flow expansion. ESP’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering ESP as a potential investment? I recommend researching its fundamentals here.

Power Financial Corporation (TSX:PWF)

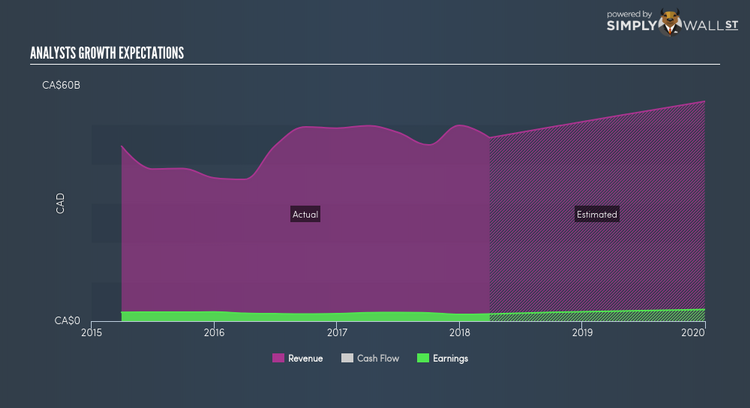

Power Financial Corporation provides financial services in Canada, the United States, Europe, and Asia. Formed in 1940, and now run by Robert Orr, the company provides employment to 26,808 people and with the market cap of CAD CA$23.19B, it falls under the large-cap stocks category.

Considering PWF as a potential investment? Take a look at its other fundamentals here.

Gear Energy Ltd. (TSX:GXE)

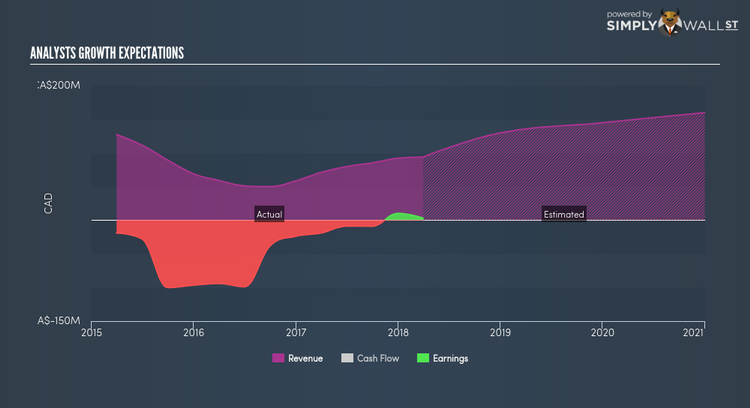

Gear Energy Ltd. engages in acquiring, exploring, developing, and holding interests in petroleum and natural gas properties and assets in Canada. The company provides employment to 35 people and with the company’s market cap sitting at CAD CA$232.01M, it falls under the small-cap group.

GXE is expected to deliver an impressive top-line growth of 58.34% over the next couple of years, according to market analysts. Furthermore, the 95.13% growth in operating cash flows indicates that a large portion of this revenue increase is high-quality, day-to-day cash generated by the business, rather than one-offs. The market’s bullish sentiment on GXE’s capacity to grow at such high rates makes it an interesting stock to dig into deeper. Should you add GXE to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance