Financially Sounds Stocks Poised For High Growth

Looking to enhance your portfolio with high-growth, financially-robust stocks, but not sure where you should even begin? Stocks such as Opsens and WeedMD are deemed to be superior in terms of how much they’re expected to earn and return to shareholders, according to analysts. I would suggest taking a look at my list of companies that compare favourably in all criteria, and consider whether they would add value to your current portfolio.

Opsens Inc. (TSX:OPS)

Opsens Inc. develops, manufactures, installs, and sells fiber optic sensors for interventional cardiology, fractional flow reserve (FFR), oil and gas, and industrial applications. The company now has 130 employees and with the stock’s market cap sitting at CAD CA$89.86M, it comes under the small-cap stocks category.

An outstanding 73.93% earnings growth is forecasted for OPS, driven by an underlying sales growth of 47.69% over the next few years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with high top-line expansion. Furthermore, the 77.13% growth in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. OPS’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add OPS to your portfolio? Check out its fundamental factors here.

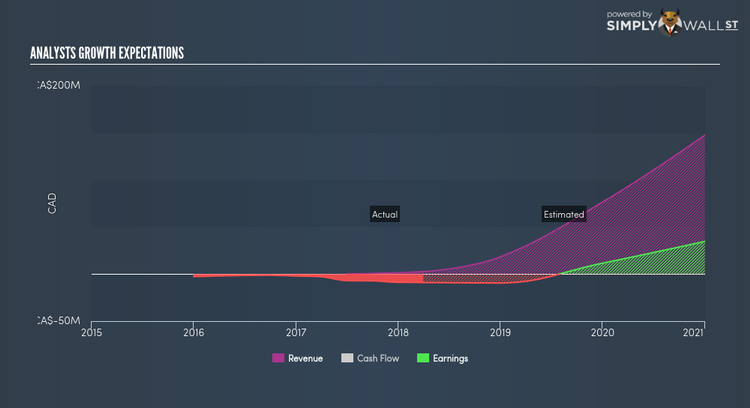

WeedMD Inc. (TSXV:WMD)

WeedMD Inc. produces and sells medical marijuana, including dried marijuana, cannabis oil, cannabis resin, marijuana plants, and marijuana seeds in Canada. The company employs 37 people and with the stock’s market cap sitting at CAD CA$205.98M, it comes under the small-cap category.

WMD is expected to deliver a triple-digit high earnings growth over the next couple of years, bolstered by a significant revenue which is expected to more than double. It appears that WMD’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. WMD ticks the boxes for high-growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about WMD? Have a browse through its key fundamentals here.

Lithium Americas Corp. (TSX:LAC)

Lithium Americas Corp. operates as a resource company in the United States. Started in 2007, and currently headed by CEO William Hodgson, the company size now stands at 450 people and with the company’s market cap sitting at CAD CA$624.36M, it falls under the small-cap stocks category.

LAC’s projected future profit growth is a robust 22.64%, with an underlying triple-digit growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. Furthermore, the 43.17% growth in operating cash flows indicates that a good portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. LAC ticks the boxes for high-growth generation, which makes it an appealing stock to dig into deeper. Want to know more about LAC? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance