Is Fifth Third Bancorp (NASDAQ:FITB) A Great Dividend Stock?

Today we'll take a closer look at Fifth Third Bancorp (NASDAQ:FITB) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A high yield and a long history of paying dividends is an appealing combination for Fifth Third Bancorp. It would not be a surprise to discover that many investors buy it for the dividends. The company also bought back stock during the year, equivalent to approximately 9.9% of the company's market capitalisation at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Fifth Third Bancorp!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Fifth Third Bancorp paid out 29% of its profit as dividends, over the trailing twelve month period. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Remember, you can always get a snapshot of Fifth Third Bancorp's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

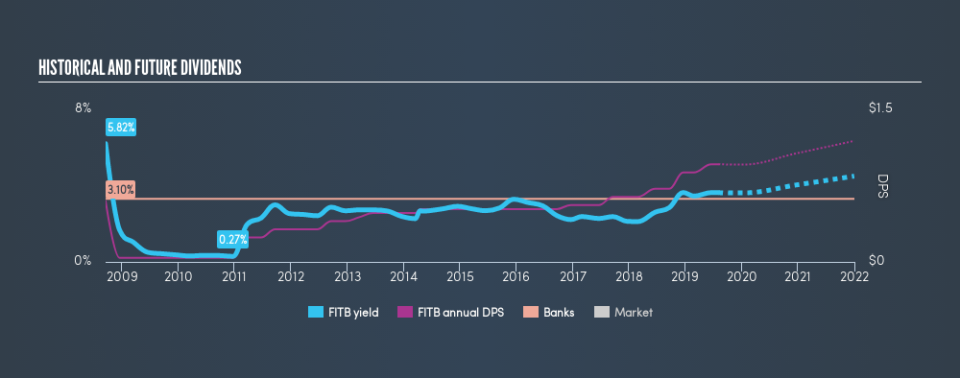

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Fifth Third Bancorp's dividend payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was US$0.60 in 2009, compared to US$0.96 last year. This works out to be a compound annual growth rate (CAGR) of approximately 4.8% a year over that time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments, we don't think this is an attractive combination.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Fifth Third Bancorp has grown its earnings per share at 7.7% per annum over the past five years. Earnings per share have been growing at a credible rate. What's more, the payout ratio is reasonable and provides some protection to the dividend, or even the potential to increase it.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're glad to see Fifth Third Bancorp has a low payout ratio, as this suggests earnings are being reinvested in the business. Unfortunately, the company has not been able to generate earnings per share growth, and cut its dividend at least once in the past. Fifth Third Bancorp might not be a bad business, but it doesn't show all of the characteristics we look for in a dividend stock.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 19 analysts we track are forecasting for Fifth Third Bancorp for free with public analyst estimates for the company.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance