Can FEMSA (FMX) Stock Regain Momentum on Effective Strategies?

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, stays on the list of investors’ favorite beverage stocks, mainly on effective growth strategies and strong market demand. The company continues to progress on the FEMSA forward strategy, which is focused on the long-term value creation of its core businesses — retail, Coca-Cola FEMSA and Digital@FEMSA. Its retail business provides substantial opportunities for long-term growth, backed by improvements in the Proximity division.

FEMSA has been witnessing solid growth trends across all business units. FMX's digital initiatives, business expansion endeavors, and continued strength in OXXO Mexico and OXXO Gas have also been aiding results. Moreover, it displays solid financial flexibility.

However, FEMSA continues to face headwinds in the Health division, which hurt bottom-line results in first-quarter 2024. The company’s Health division is navigating complex, competitive and regulatory environments in certain markets, including Colombia, Ecuador, Mexico and Chile. This translated into disappointing top-line trends and weak operating results for the segment in first-quarter 2024.

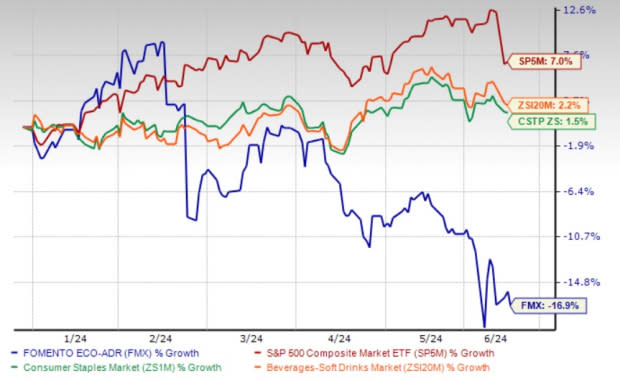

Backed by the disappointment, shares of FEMSA have declined 16.9% year to date against the industry’s growth of 2.2%. The Zacks Rank #3 (Hold) stock also underperformed the sector’s improvement of 1.5% and the S&P 500’s 7% rise.

Image Source: Zacks Investment Research

Strategies in Place

The company is on track with its FEMSA Forward Strategy announced in February 2023, which is focused on the long-term value creation of its core businesses — retail (including the Health Division), Coca-Cola FEMSA and Digital@FEMSA. The plan also focuses on exploring alternatives for strategic businesses, including the divestment of these businesses.

As part of the FEMSA Forward strategy, FEMSA sold 13.9% of the outstanding shares of Heineken in 2023, retaining less than 1% of the outstanding shares of Heineken. Additionally, the company expects to divest its interests in Solística and other non-core businesses by April 2025, which will consequently reduce its contribution to its consolidated results of operations. In 2023, FMX merged Envoy Solutions with BradyIFS and retained an ownership stake of 37% in the combined entity.

FEMSA has been gaining pace in the digital space through its tech and innovation business unit, Digital@FEMSA, which is focused on building a value-added digital and financial ecosystem for end customers and businesses.

The company’s Coca-Cola FEMSA is leading the way with its omni-channel business, while the Proximity division is progressing with the adoption of digital initiatives for the OXXO stores. Within its OXXO store chains, the company is on track with investing in digital offerings, loyalty programs and fintech platforms to evolve stronger over the long term.

Additionally, FEMSA’s Proximity and Health retail businesses provide substantial opportunities for long-term growth and value creation. The company remains on track to accelerate earnings growth in its retail division, mainly on organic expansion, and continually adding layers of value for consumers across formats and markets. OXXO Mexico is a mainstay of FEMSA's retail operations mainly due to its efforts to evolve and improve its value proposition while expanding its footprint and growing its scale to better serve customers. The company’s OXXO store footprint in Mexico has improved over time and reached the current level of more than 1,000 stores, with increasing store productivity.

Following its success in Mexico, the company is accelerating its organic expansion efforts with OXXO in several markets in South America, having reached the 500-store mark in Brazil and soon in Colombia. It expects OXXO in South America to reach a scale comparable to Mexico over time. Moreover, the company sees organic expansion opportunities for the OXXO brand through entry into the United States. FMX believes that its closeness to the U.S. market and broad recognition of the OXXO brand among demographics can serve as a launching pad for the OXXO U.S. value proposition, among other possibilities.

Bottlenecks

FEMSA’s Health division is currently in a weak spot due to its operations in varied, diversified, and often challenging macroeconomic and commercial environments. The company noted that the Health division is currently navigating complex, competitive and regulatory environments in certain markets. Thanks to these challenges, total revenues for the segment declined 2.3% year over year in the first quarter, while same-store sales dipped 0.1% in Mexican pesos.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely The Vita Coco Company Inc. COCO, Vital Farms VITL and PepsiCo Inc. PEP.

Vita Coco, a producer and marketer of coconut water products under the Vita Coco brand name, currently flaunts a Zacks Rank of 1 (Strong Buy). COCO has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COCO’s current financial-year sales and earnings suggests growth of 3.5% and 40.5%, respectively, from the year-ago reported figures.

Vital Farms offers a range of produced pasture-raised foods. VITL presently sports a Zacks Rank of 1. It has a trailing four-quarter earnings surprise of 102.1%, on average.

The consensus estimate for Vital Farms’ current financial year’s sales and earnings per share indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported figures.

PepsiCo, a leading global food and beverage company, currently carries a Zacks Rank #2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PEP’s current financial-year sales and earnings indicates growth of 3.4% and 7.1%, respectively, from the year-earlier actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance