Fee Income Growth to Aid U.S. Bancorp's (USB) Q1 Earnings

U.S. Bancorp USB is scheduled to report first-quarter 2020 results on Apr 15, before the opening bell. While its revenues are expected to have improved year over year, earnings are likely to have declined.

Before we look at the factors that might have impacted first-quarter earnings, let’s take a look at the company’s performance in the last few quarters.

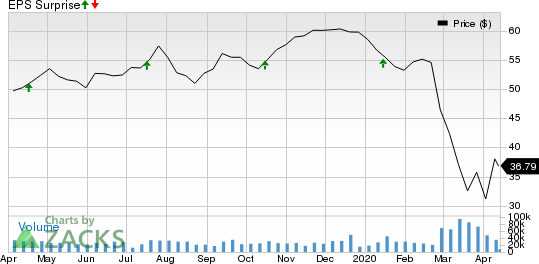

Notably, U.S. Bancorp displays a decent earnings surprise history. It surpassed estimates in two of the trailing four quarters, the average positive surprise being 1.4%.

U.S. Bancorp Price and EPS Surprise

U.S. Bancorp price-eps-surprise | U.S. Bancorp Quote

Key Factors to Note

Net Interest Income Lower: A decent lending scenario, mainly in the commercial & industrial loans front, is expected to have supported net interest income (NII) during the quarter.

Also, the Zacks Consensus Estimate for average interest earning assets of $441.8 billion for the quarter indicates a 5.3% improvement from the year-ago reported quarter.

However, a decline in interest rates in October 2019 and again in March to near-zero level as a move to protect the economy from the impacts of coronavirus outbreak are likely to have hurt U.S. Bancorp’s net interest margin, thereby impacting NII.

The Zacks Consensus Estimate of $3.15 billion for NII suggests a 3.3% year-over-year fall.

Consumer Revenues Higher: Deposits have shown improvement in the quarter, which is likely to have resulted in higher revenues from service charges on deposits. The consensus estimate for deposit service charges indicates 2.3% year-over-year growth.

Further, pickup in refinancing activities on the back of lower mortgage rates during the quarter is likely to have offered support to the company. The Zacks Consensus Estimate for mortgage banking revenues is pegged at $241 billion, suggesting a 35.5% increase from the year-ago reported number.

Payment Service Revenues to Grow: In the first two months of the to-be-reported quarter, demand for online payment of products and services remained decent. Thus, fees charged to merchants for electronic processing of transactions are expected to have shown improvement, despite the pandemic-induced volatility in the economy in March.

The Zacks Consensus Estimate for merchant processing services revenues implies a 2.9% improvement year over year.

Overall Non-Interest Revenues to Rise: Due to the decline in market values as a result of the Covid-19 outbreak, the company’s investment management fees might have declined. In addition, trust income is likely to have disappointed on weak markets.

Nevertheless, given modest growth expectation in most components, the Zacks Consensus Estimate for non-interest revenues is pegged at $2.44 billion, suggesting a 6.5% increase from the year-ago period’s reported number.

Expenses Might Increase: While the absence of considerable legal expenses is encouraging, increased investments in technology to improve digital offerings might have moderately escalated costs.

Here is what our quantitative model predicts:

U.S. Bancorp does not have the right combination of two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for U.S. Bancorp is -7.02%.

Zacks Rank: U.S. Bancorp currently carries a Zacks Rank of 5 (Strong Sell).

The Zacks Consensus Estimate for its earnings of 89 cents indicates an 11% fall on a year-over-year basis.

Stocks That Warrant a Look

Here are some stocks that you may want to consider, as according to our model these have the right combination of elements to post an earnings beat in the quarter to be reported.

CURO Group Holdings Corp. CURO is slated to release quarterly results on May 4. The company has an Earnings ESP of +1.47% and currently flaunts a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Virtu Financial, Inc. VIRT is scheduled to report quarterly earnings on May 7. The company, which sports a Zacks Rank of 1 at present, has an Earnings ESP of +19.34%.

Earnings ESP for Credit Acceptance Corporation CACC is +11.28% and it currently carries a Zacks Rank of 3. The company is set to report quarterly numbers on May 4.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

U.S. Bancorp (USB) : Free Stock Analysis Report

Credit Acceptance Corporation (CACC) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

CURO Group Holdings Corp. (CURO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance