Fed officials split over October cut but now see interest rates as 'well calibrated'

Federal Reserve officials appear to be on pause after cutting rates by 75 basis points, according to minutes covering the Fed’s October policy-setting meeting.

October 30 was the third consecutive meeting in which the Fed cut the federal funds rate by 25 basis points. In notes released on Wednesday, the policy-setting Federal Open Market Committee said that 75 basis points of total easing is “well calibrated” to support the U.S. economy. The minutes add that the Fed would need to see a “material reassessment” to rethink further rate moves, but cautioned that the central bank is “not on a preset course.”

The minutes noted that “several” participants felt better about the yield curve, which flashed worries about a recession in the summer. Since that point in time, the yield curve has uninverted, suggesting that the “likelihood of a recession occurring over the medium term had fallen somewhat.”

While some Fed participants saw signs that trade tensions were easing among the discussion of a Phase One trade deal, the Fed continued to note that risks to the U.S. economy “remained tilted to the downside.”

On the Fed’s efforts to rein in control of interest rates, the minutes revealed that all participants supported plans to expand the balance sheet at a $60-billion-per-month pace at least through the second quarter of 2020. But participants disagreed over the pace of those purchases, with “many” officials favoring a “relatively rapid pace” while “others” support a “more moderate pace.”

The minutes noted that “many” participants wanted to explore the idea of a “standing” repo facility to provide overnight funding to the money markets.

A 50/50 split?

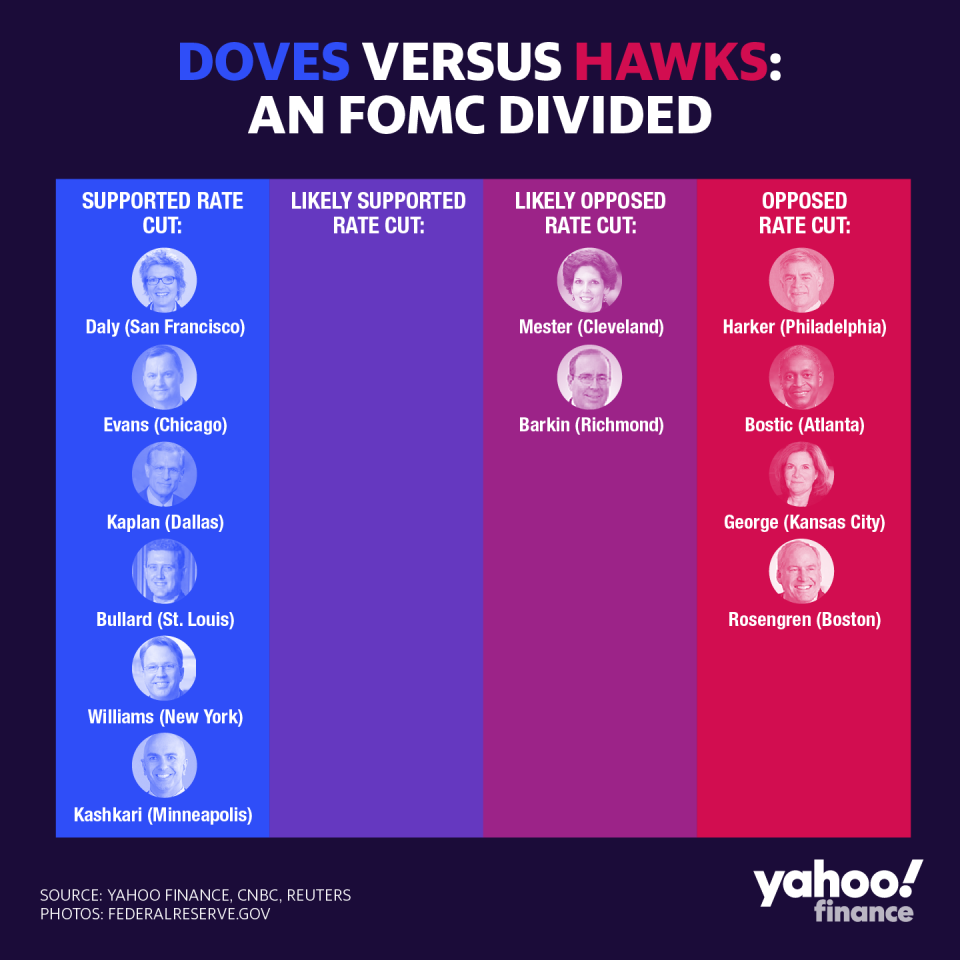

The minutes did not reveal the exact count of which Fed officials supported or opposed the October rate cut, but a flurry of speeches from Federal Reserve officials in recent weeks has revealed a continued divide over where interest rates could go from here.

At issue: whether trade headwinds and sluggish global growth are risky enough to warrant easier monetary policy. Fed officials have also diverged slightly on the proper level of interest rates necessary to nudge inflation up to its 2% target. Ultimately, unanimity among the Fed’s five governors ultimately tilted the scale toward a rate cut.

Prior to the release of the minutes on Wednesday, Grant Thornton chief economist Diane Swonk noted that the minutes would reveal the split in deeper detail.

“There is a clear sense of rate-cut fatigue growing within the ranks of the Federal Reserve,” Swonk wrote after the October meeting decision.

With no promise from the Fed on any rate changes in the near future, the central bank could also create some market noise in its December 11 meeting, when it will release a new “dot plot” projection mapping out expectations for where interest rates will go in 2020.

A divide among the Fed on what to do next could make that dot plot a messy guide for markets to refer to when navigating the next year.

The Doves

The FOMC consists of all Fed governors based out of Washington, D.C. in addition to all 12 of the Fed’s regional presidents. In addition to all Fed governors and the New York Fed president, four presidents chosen on a rotational basis yearly have votes that ultimately determine interest rate changes.

In the Fed’s October meeting, all five of the Fed governors, New York Fed President John Williams, Chicago Fed President Charles Evans, and St. Louis Fed President James Bullard voted in favor of the rate cut.

Evans told Yahoo Finance Nov. 6 that the cuts were warranted as a “mid-cycle correction” to hedge against the ongoing trade risk and tepid inflationary pressures.

The Dallas and Minneapolis Fed presidents, who are not voters, have clarified in speeches that they mostly supported the rate cuts.

Dallas Fed President Robert Kaplan reportedly supported the rate cut on the condition that the Fed would then pause on further rate decreases unless the economic outlook seriously changed. Reuters reported Nov. 1 that Kaplan wanted to clearly message to markets that it should “not expect an additional action beyond the three fed funds decreases that we’ve done.”

Minneapolis Fed President Neel Kashkari, meanwhile, told CNBC Nov. 4 that he was “really happy” with the Fed’s three cuts so far and hoped the easier policy would push inflation to its target.

San Francisco Fed President Mary Daly told reporters that same day that she was “very supportive” of all three rate cuts this year, arguing that she was similarly comfortable allowing the economy to run “hot” to push inflation higher. Daly marked the sixth Fed president to have revealed that she supported the October cut.

The Hawks

But the other six Fed presidents have been more skeptical of the need for as much accommodation as the FOMC ultimately delivered on.

Two FOMC-voting Fed presidents, Kansas City’s Esther George and Boston’s Eric Rosengren, dissented against the October cut and two non-voting Fed presidents have explicitly said they did not support the action.

Reuters reported Nov. 7 that Atlanta Fed President Raphael Bostic said the 25 basis point cut in October made policy “a bit accommodative,” adding that the negative headwinds of the looming U.S.-China tariff war don’t appear to be too adverse.

“[T]rade policy's impact on the business sector as a whole remains modest, slowing capital expenditures by a few percentage points and leading to a small change in overall employment,” Bostic said, acknowledging that the situation still remains “murky.”

On Thursday, Philadelphia Fed President Patrick Harker said he did not support the September or October rate cuts, predicting that the Fed was on pace to nudge inflation up to its 2% target within the next 18 to 24 months.

Richmond Fed President Thomas Barkin has not explicitly said if he supported the rate cut in October, but in a speech last week he expressed worry about whether lowering rates now would weaken the power of lowering interest rates when the economy needs it more.

“For that reason, I’m closely monitoring whether the recent ‘insurance’ the FOMC purchased will have its intended effect,” Barkin said.

Cleveland Fed President Loretta Mester has not made public remarks on interest rate policy since the October meeting, but her remarks before the decision revealed that she did not support the Fed’s first rate cut.

Divergence is ‘healthy’

Fed Chairman Jerome Powell is not concerned about the divide, saying in September that the difference is natural given the pivot that the Fed made this year, from raising rates to cutting rates.

“This is a time of difficult judgments and, as you can see, disparate perspectives,” Powell said September 18. “I really do think that’s nothing but healthy.”

In that FOMC meeting, Powell faced a record three dissents.

The Fed’s final policy-setting meeting for 2019 will take place December 10 and 11.

In 2020, four new Fed presidents will rotate in: Cleveland’s Mester, Philadelphia’s Harker, Dallas’ Kaplan, and Minneapolis’ Kashkari.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Fed Chair Powell on economic expansion: 'No reason why it can't last'

Philly Fed's Harker: Central bank should 'hold steady for a while'

Fed Chair Powell: Negative interest rates 'would certainly not be appropriate'

Nobel Prize winner: Reducing poverty can rebuild 'trust' in economics

‘The weirdest place in the world’: What the Fed missed in Jackson Hole

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance