Fastenal's (FAST) Average Daily Sales Rise 3.6% in August

Fastenal Company FAST recently released its August sales report, wherein average daily sales grew 3.6% to $29.1 million, moderating sequentially. In July 2023, daily sales registered 3.7% growth, whereas the same had witnessed 16.1% growth in August 2022.

Net sales in August 2023 were $668.2 million, reflecting an increase of 3.6% year over year. August 2023 had 23 business days compared with 23 days a year ago.

Currency fluctuations had a negative impact of 0.2% on August’s daily sales growth. Last month, sales were up 1.3% month over month versus down 2.6% in July. The trend is worse than the historical August average daily sequential sales growth of 2.9% from 2017-2022 (excluding 2020).

End-Market Perspective, Product Lines & Customers

From an end-market perspective, heavy manufacturing sales improved 8.6% for the month and other manufacturing inched up 1.3% from a year ago. Total manufacturing registered 6.9% growth in July 2023. Non-residential construction dropped 6.2% compared with a 9.5% decrease reported in August 2022. The average daily sales growth rate in non-residential and manufacturing end markets improved in May from the prior month.

Fastenal derives sales from Fasteners, Safety and other product lines. Fasteners witnessed a 3.8% decline in sales last month against 19.8% growth in the year-ago period. Safety products grew 9.5% in August 2023 compared with a rise of 11.7% a year ago. In August 2023, Other categories improved 6.9% compared with a 14.5% increase a year ago.

Geographically, sales in the United States grew 3.2% (compared with 16.5% a year ago), while Canada/Mexico grew 9% (compared with 17.5% a year ago). Rest of World sales declined to 4.7% against 1.5% growth registered in the year-ago period.

In terms of customer/channel, National account daily sales growth advanced 8% in August from a year ago, given the fact that 63% of the top 100 accounts and 51.4% of public branches are expanding. Yet, non-national accounts showed a 3% decline year over year for the month. In the year-ago period, daily sales growth in non-national accounts was up 10% year over year.

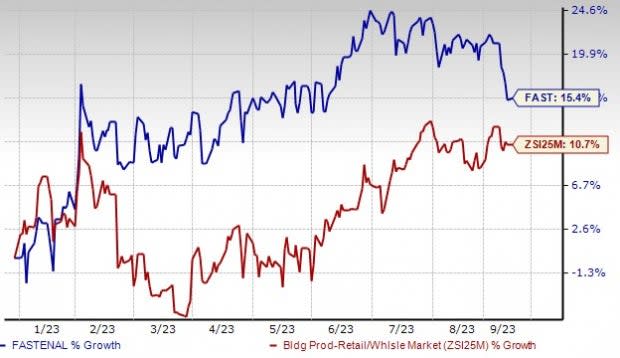

Image Source: Zacks Investment Research

Shares of the company have outperformed the industry this year so far. Although daily sales have moderated sequentially because of a potentially slower macro environment, we believe this Zacks Rank #3 (Hold) company is well-positioned to navigate these challenges, given cost-control efforts and focus on e-commerce business.

The company’s industrial markets have been slowing down broadly due to reduced customer spending. Despite tough year-ago comparisons, Fastenal’s decent large customers, its leverage in its digital strategy, onsite/offsite mix and market share gains across its product categories are expected to drive growth.

Better-Ranked Stocks From the Zacks Retail and Wholesale Sector are:

Builders FirstSource BLDR currently sports a Zacks Rank #1 (Strong Buy). The company has a trailing four-quarter earnings surprise of 52.2%, on average. Shares of BLDR rallied 118.7% this year so far. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BLDR’s 2023 earnings per share (EPS) has increased to $13.18 from $12.66 over the past 30 days.

Kura Sushi USA, Inc. KRUS sports a Zacks Rank #1. The company has a trailing four-quarter earnings surprise of 139.7% on average. Shares of KRUS gained 65.4% this year so far.

The Zacks Consensus Estimate for KRUS’s 2023 sales and EPS indicates 33.4% and 300% growth, respectively, from the year-ago period’s levels.

Arcos Dorados Holdings Inc. ARCO currently carries a Zacks Rank #2 (Buy). ARCO has a long-term earnings growth rate of 11.4%. The stock gained 16.5% this year so far.

The Zacks Consensus Estimate for Arcos Dorados’ 2023 sales and EPS indicates 19.2% and 13% growth, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO) : Free Stock Analysis Report

Kura Sushi USA, Inc. (KRUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance