Farmers National Banc (NASDAQ:FMNB) Has Affirmed Its Dividend Of $0.17

The board of Farmers National Banc Corp. (NASDAQ:FMNB) has announced that it will pay a dividend of $0.17 per share on the 29th of March. This makes the dividend yield 5.1%, which will augment investor returns quite nicely.

Check out our latest analysis for Farmers National Banc

Farmers National Banc's Dividend Forecasted To Be Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

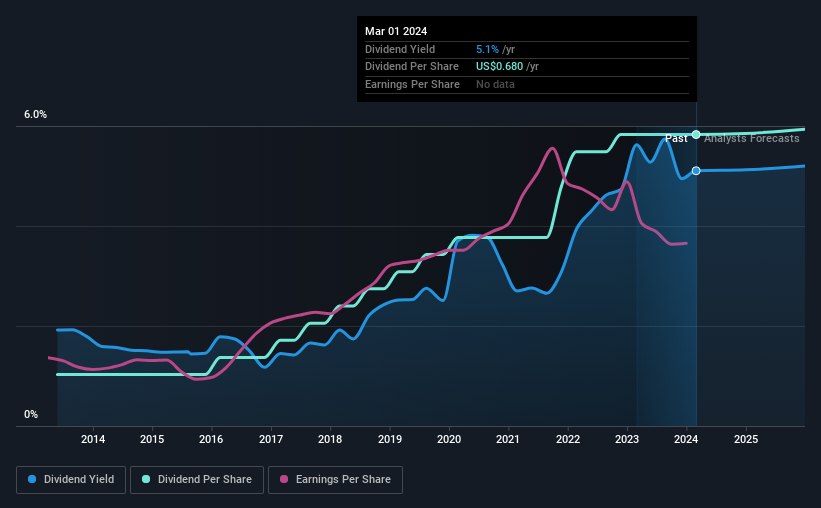

Farmers National Banc has a long history of paying out dividends, with its current track record at a minimum of 10 years. Past distributions do not necessarily guarantee future ones, but Farmers National Banc's payout ratio of 51% is a good sign as this means that earnings decently cover dividends.

Over the next 3 years, EPS is forecast to fall by 1.1%. However, as estimated by analysts, the future payout ratio could be 52% over the same time period, which we think the company can easily maintain.

Farmers National Banc Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. The annual payment during the last 10 years was $0.12 in 2014, and the most recent fiscal year payment was $0.68. This implies that the company grew its distributions at a yearly rate of about 19% over that duration. Rapidly growing dividends for a long time is a very valuable feature for an income stock.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Farmers National Banc has only grown its earnings per share at 2.5% per annum over the past five years. Growth of 2.5% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

An additional note is that the company has been raising capital by issuing stock equal to 10% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

We Really Like Farmers National Banc's Dividend

Overall, we like to see the dividend staying consistent, and we think Farmers National Banc might even raise payments in the future. The company is generating plenty of cash, and the earnings also quite easily cover the distributions. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Farmers National Banc (1 makes us a bit uncomfortable!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance