Factors Likely to Shape Cheesecake's (CAKE) Earnings in Q2

The Cheesecake Factory Incorporated CAKE is scheduled to report second-quarter fiscal 2019 results on Jul 31. In the last reported quarter, the company’s bottom line surpassed the Zacks Consensus Estimate by 3.3%. It also delivered an earnings beat in two of the trailing four quarters.

How Are Estimates Faring?

The Zacks Consensus Estimate for second-quarter earnings is pegged at 81 cents, higher than 65 cents registered in the year-ago quarter. Notably, the company’s earnings estimate for the quarter has been stable over the past 30 days. For quarterly revenues, the consensus mark is pinned at nearly $610.4 million, suggesting a 2.9% increase from the prior-year quarter reported figure.

Let’s delve deeper to find out how the company’s top and bottom line will shape up in the upcoming quarterly release.

Factors at Play

Cheesecake Factory’s second-quarter results are likely to be driven by surge in restaurant revenues. The Zacks Consensus Estimate for restaurant revenues is pegged at $559 million, indicating 3.1% growth from the year-earlier reported figure.

The company’s efforts to improve guest experience have been stabilizing sales trend from the fourth quarter of 2017. In order to boost comps, it is focusing on improving the speed of service and training its servers so that they render a higher level of service.

Meanwhile, Cheesecake Factory’s technology-enabled initiatives have been quite successful with positive feedback on its mobile payment app, CakePay. Moreover, the company continues to improve its to-go business including online ordering capability. This is a major contributor to the company’s strong off-premise sales channels.

Cheesecake Factory has been expanding in domestic as well as international markets. Of late, it is foraying into lucrative markets like the Middle East, North Africa, Central and Eastern Europe, Russia, Turkey, Mexico, Kuwait, Lebanon and Chile. Overall, management believes that there is potential for 300 Cheesecake Factory locations in 2019, expecting to drive at least 3% unit growth. Moreover, the company’s costs savings initiatives are likely to drive margins higher.

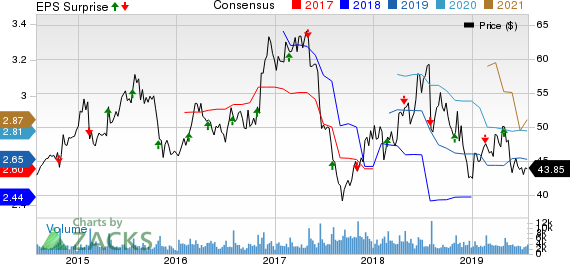

The Cheesecake Factory Incorporated Price, Consensus and EPS Surprise

The Cheesecake Factory Incorporated price-consensus-eps-surprise-chart | The Cheesecake Factory Incorporated Quote

What Does the Zacks Model Say?

Our proven model does not show that Cheesecake Factory is likely to beat earnings estimates in second-quarter fiscal 2019. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Cheesecake Factory has an Earnings ESP of -0.31% and a Zacks Rank #3, which make surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks With Favorable Combination

Here are a few other stocks from the Restaurant space that investors may consider as our model shows that they have the right combination of elements to post an earnings beat in the upcoming releases:

Dunkin' Brands Group, Inc. DNKN has a Zacks Rank #3 and an Earnings ESP of +1.02%. The company is scheduled to report quarterly numbers on Aug 1.

YUM! Brands, Inc. YUM has an Earnings ESP of +0.38% and a Zacks Rank #3. The company is scheduled to report quarterly numbers on Aug 1.

Yum China Holdings, Inc. YUMC has an Earnings ESP of +2.70% and a Zacks Rank #3. The company is scheduled to report quarterly numbers on Jul 30.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

The Cheesecake Factory Incorporated (CAKE) : Free Stock Analysis Report

Yum China Holdings Inc. (YUMC) : Free Stock Analysis Report

Dunkin' Brands Group, Inc. (DNKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance