Factors Influencing Five Below's (FIVE) Fate in Q3 Earnings

Five Below, Inc. FIVE is likely to register an increase in the top line when it reports third-quarter fiscal 2020 numbers on Dec 2, after the market closes. The Zacks Consensus Estimate for revenues is pegged at $443.8 million, suggesting an improvement of 17.6% from the prior-year reported figure.

Meanwhile, the Zacks Consensus Estimate for earnings for the quarter under review has been stable at 19 cents over the past 30 days. The figure indicates growth of 5.6% from the prior-year quarter.

Notably, this specialty value retailer has a trailing four-quarter earnings surprise of 26%, on average. In the last reported quarter, this Philadelphia, PA-based company’s bottom line surpassed the Zacks Consensus Estimate by a significant margin.

Factors to Note

Five Below’s third-quarter performance is likely to have benefited from the company’s digital strategy, expansion of supply chain network, enhancement of overall distribution capabilities and focus on merchandise assortment. As customers consolidate trips and prioritize health, safety and convenience, the company has been adding more essential households and wellness products at compelling prices. On its last earnings call management informed that in the third quarter through Sep 2, total comparable sales are tracking up approximately 6%.

Clearly, aforementioned factors raise optimism about the outcome of the results. However, margins still remain an area to watch. Impact of costs associated with digital fulfilment and supply chain cannot be ruled out. Management on the call had projected a marginal decline in operating margin during the third quarter owing to the restoration of some expenses such as marketing and payroll.

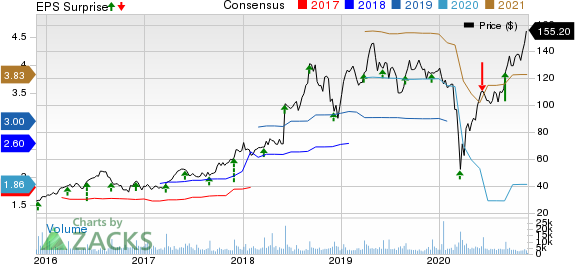

Five Below, Inc. Price, Consensus and EPS Surprise

Five Below, Inc. price-consensus-eps-surprise-chart | Five Below, Inc. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Five Below this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Although Five Below carries a Zacks Rank #3, it has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks With Favorable Combination

Here are companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

Signet SIG presently has an Earnings ESP of +13.95% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kroger KR has an Earnings ESP of +0.38% and a Zacks Rank #3 at present.

Ollies Bargain Outlet OLLI currently has an Earnings ESP of +0.58% and a Zacks Rank #3.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Signet Jewelers Limited (SIG) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

Five Below, Inc. (FIVE) : Free Stock Analysis Report

Ollies Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance