ExxonMobil (XOM) Beats Q3 Earnings Estimates, Hikes Dividend

Exxon Mobil Corporation’s XOM third-quarter 2022 earnings per share of $4.45, excluding identified items, have beat the Zacks Consensus Estimate of $3.88 and improved from the year-ago profit of $1.58.

Total quarterly revenues of $112,070 million missed the Zacks Consensus Estimate of $115,188 million but jumped from the year-ago quarter’s $73,786 million.

The strong earnings have resulted from higher realized commodity prices and oil-equivalent production, and strong refining margins.

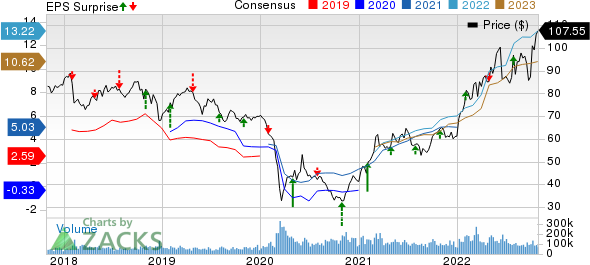

Exxon Mobil Corporation Price, Consensus and EPS Surprise

Exxon Mobil Corporation price-consensus-eps-surprise-chart | Exxon Mobil Corporation Quote

Dividend Hike

ExxonMobil has announced a fourth-quarter dividend of 91 cents per share, indicating an increase of 3.4% from the last paid dividend of 88 cents. The dividend is payable on Dec 9.

Operational Performance

Upstream

The segment of ExxonMobil has reported quarterly earnings of $12,419 million, improving from $3,951 million in the year-ago quarter. Higher commodity prices primarily drove the upside.

Operations in the United States recorded a profit of $3,110 million, skyrocketing from $869 million in the September-end quarter of 2021. The company reported a profit of $9,309 million from non-U.S. operations, improving from $3,082 million in the year-ago quarter.

Production: ExxonMobil’s total production averaged 3,716 thousand barrels of oil equivalent per day (MBoe/d), higher than 3,665 MBoe/d a year ago.

Liquid production increased to 2,389 thousand barrels per day (MBbls/d) from 2,313 MBbls/d in the prior-year quarter. The outperformance was owing to higher production, primarily in the United States and Canada. Yet, natural gas production was 7,963 million cubic feet per day (Mmcf/d), down from 8,110 Mmcf/d a year ago primarily due to lower output from the United States and Canada.

Price Realization: In the United States, ExxonMobil recorded crude price realization of $91.69 per barrel, significantly higher than the year-ago quarter’s $67.62. The same metric for non-U.S. operations rose to $91.42 per barrel from $64.89.

Natural gas prices in the United States were $8.38 per thousand cubic feet (Mcf), higher than the year-ago quarter’s $3.33. Also, in the non-U.S. section, the metric improved to $22.92 per Mcf from $9.03.

Energy Products

The segment of ExxonMobil has recorded a profit of $5,819 million, up from $529 million a year ago due to strong industry refining margins. Higher aromatics, marketing and trading margins also aided the segment.

Chemical Products

This unit of ExxonMobil has recorded an $812-million profit, down from $2,027 million in the year-ago quarter on lower volumes and margins from bottom-of-cycle conditions in the Asia Pacific, and weaker demand in Europe and North America.

Specialty Products

This unit of ExxonMobil has recorded a $762-million profit, down from earnings of $839 million in the year-ago quarter primarily due to the higher feed cost environment.

Financials

In the quarter under review, ExxonMobil generated a cash flow of $27,107 million from operations and asset divestments. The company’s capital and exploration spending were $5,728 million.

At the end of third-quarter 2022, ExxonMobil’s total cash and cash equivalents were $30,407 million, and long-term debt amounted to $39,246 million.

Zacks Rank & Other Stocks to Consider

ExxonMobil currently carries a Zacks Rank #2 (Buy).

Investors interested in the energy sector might look at the following companies that presently flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Comstock Resources, Inc. CRK is an independent energy company that acquires, develops, produces and explores oil and natural gas properties. CRK has a Zacks Style Score of A for Growth and B for Value.

Comstock Resources is scheduled to release third-quarter results on Nov 1. The Zacks Consensus Estimate for CRK’s earnings is pegged at $1.15 per share, suggesting an increase from the prior-year reported figure.

The Williams Companies, Inc. WMB is a premier energy infrastructure provider in North America. WMB’s board recently approved a share repurchase program worth $1.5 billion, highlighting its commitment to shareholders.

Williams is scheduled to report third-quarter results on Oct 31. The Zacks Consensus Estimate for WMB’s earnings is pegged at 44 cents per share, suggesting a significant increase from the prior-year reported figure.

SilverBow Resources SBOW engages in the exploration, development and production of oil and natural gas properties. CRK has a Zacks Style Score of A for Value.

SilverBow is scheduled to release third-quarter earnings on Nov 2. The Zacks Consensus Estimate for SBOW’s earnings is pegged at $2.74 per share, suggesting an increase from the prior-year reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. The (WMB) : Free Stock Analysis Report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

SilverBow Resources (SBOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance