Exxon Mobil: Not Worth the Risks Here

Exxon Mobil Corp. (NYSE:XOM) is one of the world's largest companies engaged in the exploration, production, and transportation of crude oil and natural gas. Moreover, for decades, the company has been one of the leaders in the global petrochemical market, ultimately contributing to successfully expanding its geographic presence, rapidly diversifying its product range, and attracting new customers.

Thesis

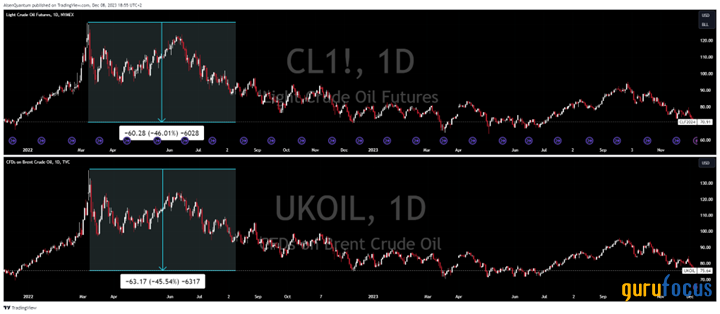

Since March 8, 2022, WTI and Brent crude oil futures have fallen by more than 40%, but Exxon Mobil's share price has risen by more than 17% over that period, creating a divergence between the two asset classes that historically ended in a unidirectional movement of their prices.

Source: TradingView

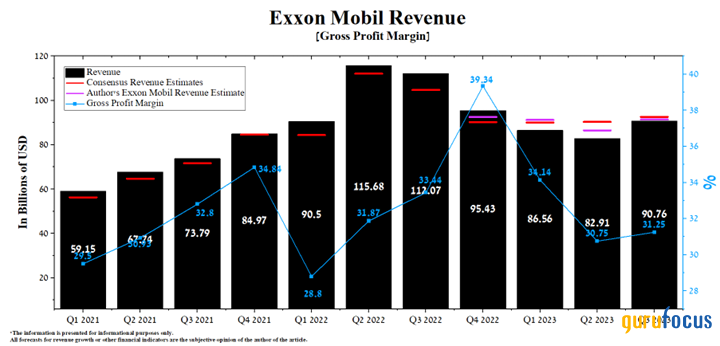

For most oil and gas companies, 2021-2022 was a period of significant prosperity. Exxon Mobil was no exception and was an asset, thanks to which many investors offset the rise in prices for products and services caused by the disruption of supply chains and the passage by the US government of multi-trillion-dollar stimulus packages aimed at combating the COVID-19 pandemic.

However, starting from the second half of 2022, Exxon Mobil's revenue and operating income began to decline, and we estimate that this trend will continue due to several factors.

Firstly, Hamas' war against Israel, which has been going on for more than two months, has not led to any decisive steps on the part of the Arab countries, as was the case during the Yom Kippur War, when OAPEC nations significantly reduced oil production and also imposed an embargo on oil exports to the United States.

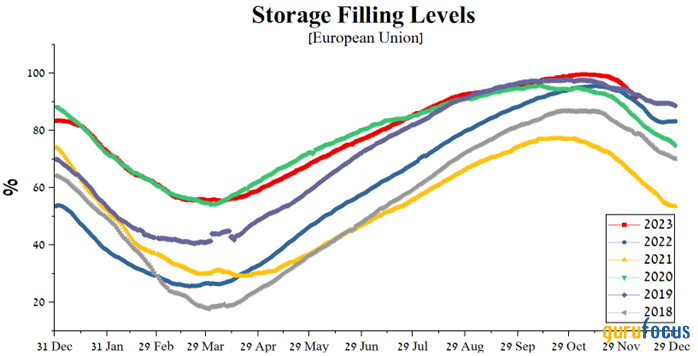

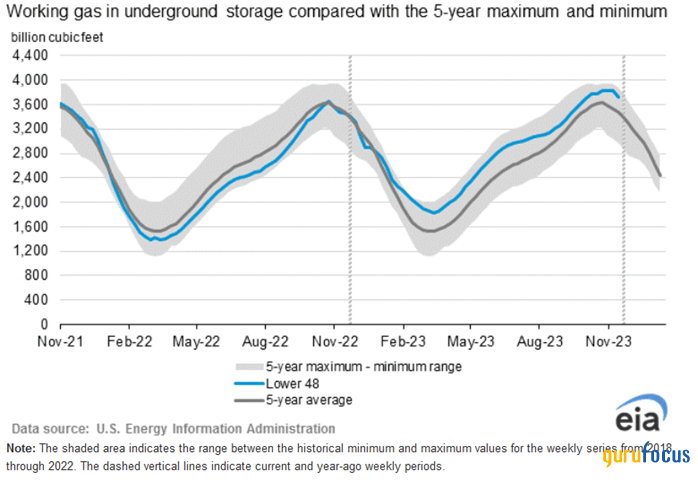

Secondly, natural gas reserves in the US and Europe remain at multi-month highs, while usage rates remain relatively low thanks to a warmer winter than in previous years. So, according to Gas Infrastructure Europe (GIE), as of December 7, 2023, natural gas storage facilities in Europe were more than 91% full, which significantly exceeds the levels of 2020 and 2022.

Author's elaboration, based on Gas Infrastructure Europe

As a result, this gives confidence that European Union leaders have been able to effectively deal with the consequences of Gazprom's destroyed Nord Stream pipelines and the ongoing war between Russia and Ukraine. Moreover, we estimate that European natural gas prices (TTF) will reach 24-25 euros per MWh in 2024, ultimately negatively impacting the Upstream segment's revenue.

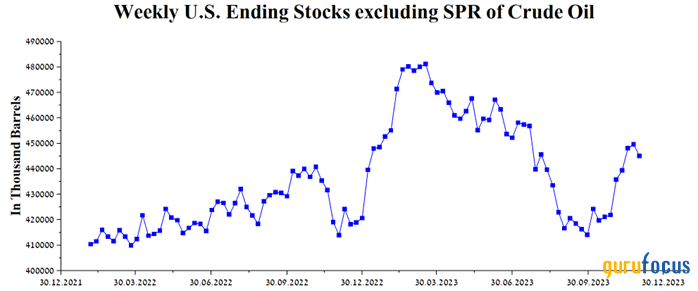

The third factor that we highlight is that the WTI and Brent crude oil prices will continue to remain under downward pressure in the coming months despite the attempts of Mohammed bin Salman and Vladimir Putin to persuade all OPEC+ countries to join the agreement on output cuts. US crude oil production continues to grow and has already reached a new record high of 13.2 million barrels per day in September 2023.

Moreover, according to the EIA report, US commercial crude oil inventories, excluding those in the SPR, were 445 million barrels, up 31.1 million from the previous year.

Author's elaboration, based on the EIA report

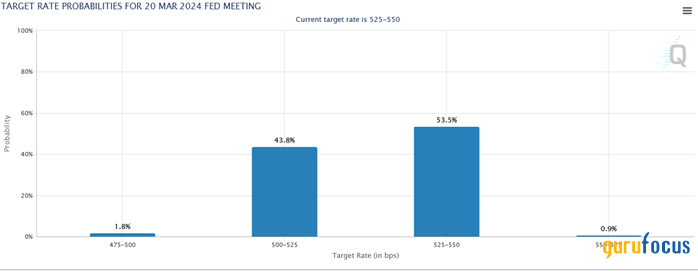

In conclusion, we would like to note one more factor that will have a negative impact on the attractiveness of assets in the energy sector, namely the cutting of the interest rates by the Federal Reserve as early as March 2024.

Source: CME Group

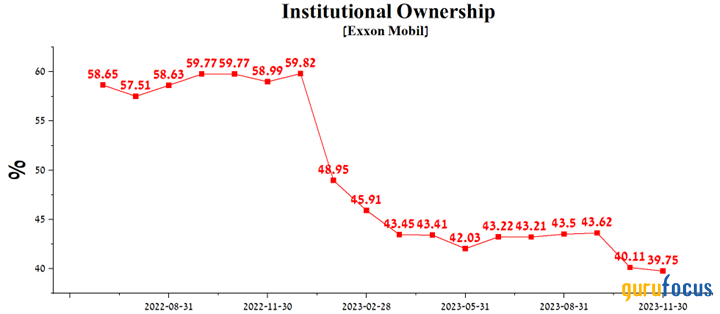

As a result, Exxon Mobil's institutional investors continue to sell its shares.

Author's elaboration, based on GuruFocus data.

At the same time, many Wall Street giants such as Vanguard Group, State Street, and Morgan Stanley are increasing stakes in technology and pharmaceutical companies, which could potentially provide greater returns as the Fed begins to pursue dovish monetary policy.

However, despite the factors discussed above that threaten Exxon Mobil's revenue and operating income growth rates in the coming quarters, its extremely high dividend yield of over 3.8%, relatively low total debt, and its share repurchase program are supporting the company's share price, which is currently above a strong support zone.

We initiate our coverage of Exxon Mobil with a "market perform" rating for the next 12 months.

The financial position of Exxon Mobil and its prospects

Exxon Mobil's revenue for the three months ended September 30, 2023, and amounted to $90.76 billion, which is 19% less than the previous year. On the other hand, the company's actual revenue beat analysts' consensus estimates in seven of the last ten quarters, which may indicate that financial market participants slightly underestimated the prospects of the US oil industry giant.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

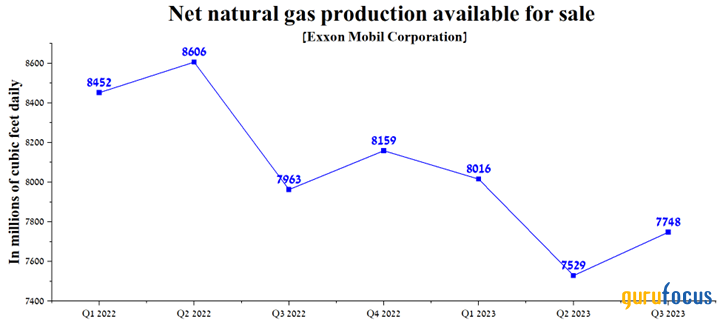

One of the reasons for the company's revenue decline, in addition to lower natural gas prices, is also a decline in its sales. So, Exxon Mobil's total natural gas sales were 7,748 million cubic feet per day in the third quarter of 2023, down 2.7% year-over-year, with a more significant decline occurring relative to the first three months of 2023.

Author's elaboration, based on quarterly securities reports.

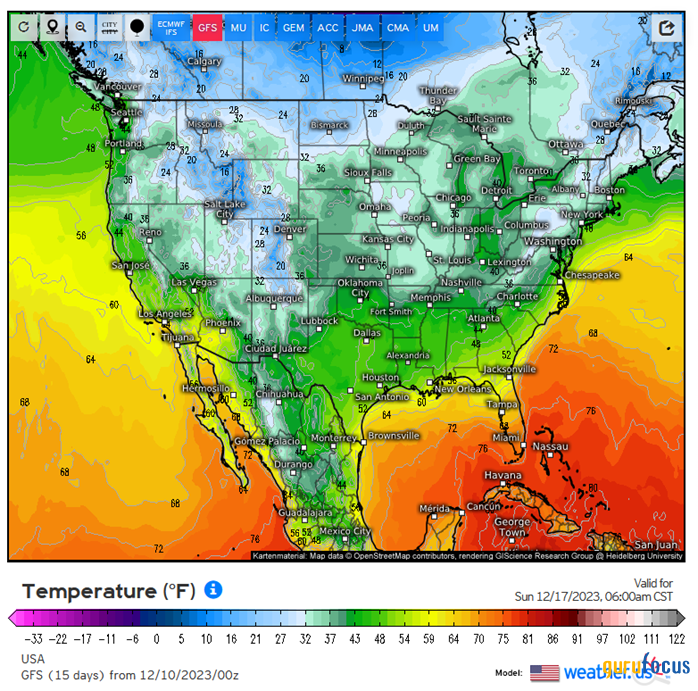

As of December 8, 2023, the U.S. natural gas price was $2,552 per MMBTU, and we expect it to continue to remain under downward pressure, including due to reduced risks of shortages in the coming quarters and also relatively high temperatures in most states.

Source: weather.us

Moreover, as of December 1, 2023, EIA estimates that the total volume of working natural gas in storage was 3.719 billion cubic feet, an increase of 254 billion cubic feet over December 1, 2022.

Source: U.S. Energy Information Administration

Exxon Mobil is expected to release financial results for the fourth quarter of 2023 on January 31, 2024. According to Seeking Alpha, the company's revenue for the quarter is anticipated to be $82.02 billion to $101.04 billion, down $2.16 billion from analysts' expectations for the previous quarter.

On the other hand, according to our model, Exxon Mobil's revenue will be below the median of this range and reach $88.5 billion, which is 7.3% less than in the fourth quarter of 2022. The year-on-year decline in this financial metric will occur mainly due to falling hydrocarbon prices, declining industry refining, and increased natural gas and crude oil supply from Russia to China and India.

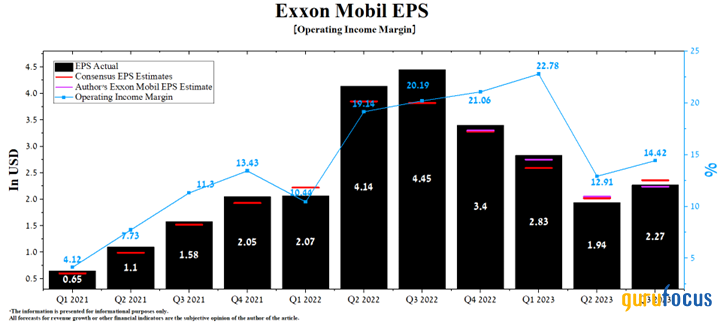

Exxon Mobil's operating income margin in the third quarter of 2023 was 14.42%, down 5.77% from the previous year. At the same time, we predict that this financial metric will reach 15.1%, and by 2024, this value will drop to 14.2%, mainly due to falling prices for gasoline in the US and the company's petrochemical products.

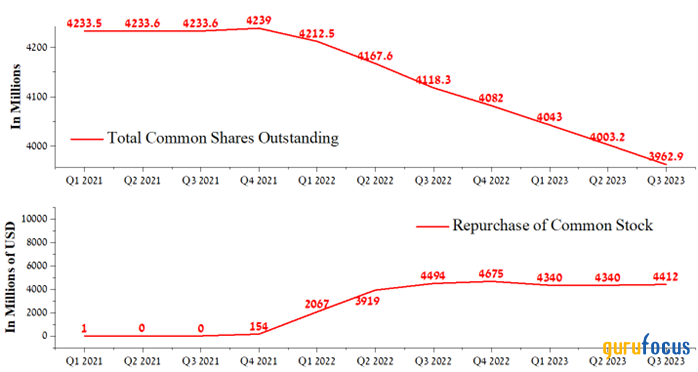

The company's Q3 Non-GAAP EPS was $2.27, missing analysts' consensus estimates by $0.09 and, more importantly, down 49% year-over-year despite the management's active use of the share buyback program.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

According to Seeking Alpha, Exxon Mobil's fourth-quarter EPS is expected to be $1.88-$2.52, down 9.7% from the consensus estimate for the third quarter of 2023. At the same time, we expect its EPS to be below the median of this range and reach $2.1.

Author's elaboration, based on GuruFocus and Seeking Alpha

Furthermore, Exxon Mobil's Non-GAAP P/E [TTM] is 9.54x, which is 10.83% higher than the sector average. Meanwhile, the Non-GAAP P/E [FWD] is 10.74x, which is one of the factors indicating that Mr. Market is objective about Exxon Mobil's prospects at a time when hydrocarbon prices remain under downward pressure, and it is pursuing an aggressive M&A policy to diversify its business.

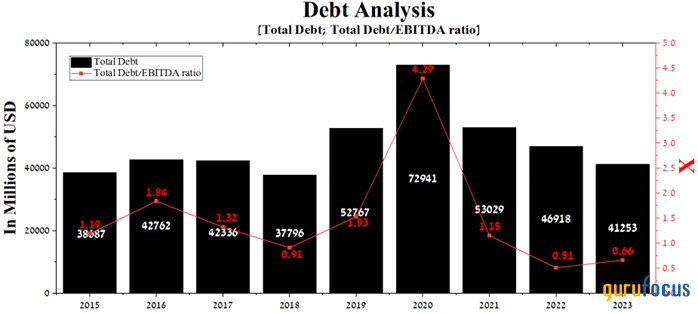

In addition to Exxon Mobil's high dividend yield, the decline in its total debt is an additional factor helping to keep its share price above its strong support zone, which ranges from $98.8 to $92.2. So, at the end of September 2023, the company's debt amounted to $41.25 billion, decreasing by 22.2% compared to 2021. Moreover, despite the EBITDA drop in recent quarters, Exxon Mobil's total debt/EBITDA ratio continues to decline year over year and stands at 0.66x.

Author's elaboration, based on GuruFocus and Seeking Alpha data.

Given continued cash flow stability and total cash and short-term investments over $32 billion, we do not expect the company to have difficulty repaying the senior notes maturing between 2024 and 2051.

Conclusion

Exxon Mobil is one of the world's largest companies engaged in the exploration, production, and transportation of crude oil and natural gas.

The period from 2021 to 2022 was a period of prosperity for Exxon Mobil, as rising hydrocarbon prices allowed its management to pursue aggressive policies to reduce its total debt and repurchase its shares by tens of billions of dollars.

However, due to the Fed's effective monetary policy to reduce inflation, China's weak economic recovery, the sale of Russian natural gas at a significant discount to market prices, and the growth of liquid hydrocarbon production in the United States have led to a continued decline in energy prices. As a result, not only has this led to the company's revenue and margins falling in recent quarters, but also many of its institutional investors have continued to reduce their stake in it.

We initiate our coverage of Exxon Mobil with a "market perform" rating for the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance