Exponent Inc (EXPO) Surpasses First Quarter Earnings and Revenue Estimates

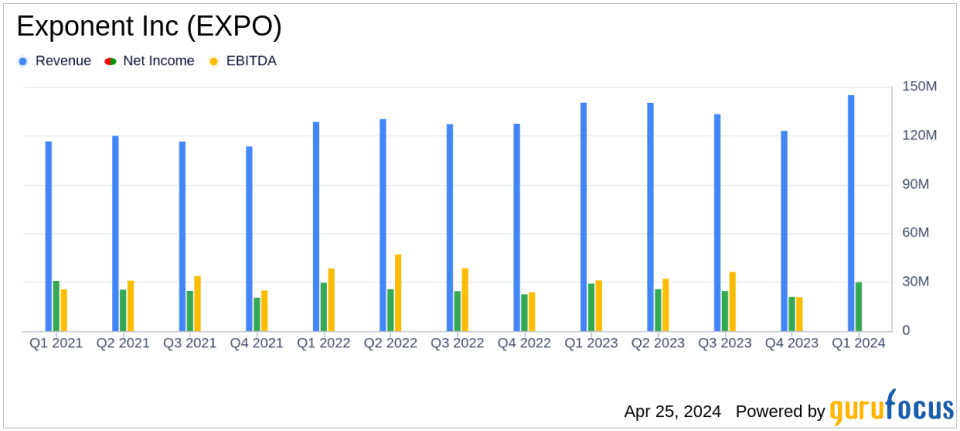

Revenue: $144.9M, up 3.3% year-over-year, surpassing estimates of $125.98M.

Net Income: $30.1M, up 3.5% from $29.1M in Q1 2023, exceeding estimates of $23.82M.

Earnings Per Share (EPS): $0.59, up from $0.56 in the same period last year, surpassing estimates of $0.47.

EBITDA: Increased to $40.1M, or 29.2% of net revenues, up from $35.8M, or 27.8% of net revenues in Q1 2023.

Dividends: Quarterly cash dividend announced at $0.28 per share, payable on June 21, 2024.

Cash Position: Ended the quarter with $168.7M in cash and cash equivalents, down from $187.15M at the end of the previous quarter.

Revenue Guidance: Increased for FY 2024, with revenues before reimbursements expected to grow in the low-single digits.

On April 25, 2024, Exponent Inc (NASDAQ:EXPO), a leader in engineering and scientific consulting, announced its financial results for the first quarter of the fiscal year 2024, which ended on March 29, 2024. The company reported a robust performance, exceeding analyst expectations with significant growth in both revenues and earnings per share. For a detailed view of the filing, refer to Exponent Inc's 8-K filing.

Exponent Inc provides specialized engineering and scientific consulting services across two main segments: engineering and other scientific services, and environmental and health services. The company has built a reputation for its deep analytical capabilities applied to complex issues ranging from failure analysis to regulatory compliance.

Fiscal Performance Highlights

In Q1 2024, Exponent saw its revenues before reimbursements rise by 6.6% to $137.2 million from $128.7 million in the first quarter of 2023. Total revenues increased by 3.3% to $144.9 million. This growth was driven by a surge in demand for the company's reactive services, particularly in the fields of energy, vehicles, and medical devices. The company also reported a net income of $30.1 million, or $0.59 per diluted share, up from $29.1 million, or $0.56 per diluted share in the same period last year.

The company's EBITDA also saw a healthy increase, reaching $40.1 million, or 29.2% of net revenues, compared to $35.8 million, or 27.8% of net revenues in the first quarter of 2023. This improvement reflects Exponent's effective management and strategic alignment of resources to market demands.

Strategic Business Movements and Outlook

Exponent's proactive business segments, excluding consumer electronics, have shown resilience and growth due to strong performance in the transportation, utilities, and chemical sectors. The company's environmental and health segment, which represents 16% of revenues before reimbursements, also grew by 1% compared to the previous year.

Looking forward, Exponent has updated its fiscal year 2024 guidance, anticipating low-single-digit growth in revenues before reimbursements and an EBITDA margin between 26.25% and 27.0%. These projections reflect the company's confidence in its business model and its ability to adapt to dynamic market conditions.

Investor Considerations

Exponent's ability to exceed analyst expectations in terms of both revenue and earnings per share underscores its operational efficiency and market adaptability. The company's strategic focus on high-growth areas and its robust dividend policy, with a quarterly dividend of $0.28 per share announced for June 21, 2024, make it an attractive proposition for investors looking for stability and growth in the engineering and scientific consulting sectors.

Moreover, the company's strong financial position, evidenced by $168.7 million in cash and cash equivalents, provides it with the flexibility to navigate future challenges and capitalize on emerging opportunities. This financial health, combined with a clear strategic direction, positions Exponent to continue its trajectory of sustainable, long-term growth.

In conclusion, Exponent Inc's first-quarter results for 2024 reflect a company that is not only managing to navigate a complex global market landscape but is also thriving in it. The firm's expertise in critical, high-stakes areas of engineering and scientific consulting continues to drive demand across its diversified service portfolio, promising continued success in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Exponent Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance