Exploring Undervalued Stocks On The German Exchange With Discounts Ranging From 11.9% To 34%

Amidst a generally positive week for European markets, with Germany's DAX index climbing by 1.48%, investors are keenly observing opportunities within this buoyant environment. In such a market, identifying undervalued stocks can be particularly compelling, as they may offer significant potential for appreciation when they converge with the broader market valuation.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

Name | Current Price | Fair Value (Est) | Discount (Est) |

Stabilus (XTRA:STM) | €44.45 | €80.07 | 44.5% |

technotrans (XTRA:TTR1) | €18.20 | €29.52 | 38.3% |

PSI Software (XTRA:PSAN) | €22.90 | €43.44 | 47.3% |

Stratec (XTRA:SBS) | €45.20 | €82.26 | 45.1% |

Wolftank-Adisa Holding (XTRA:WAH) | €11.40 | €22.46 | 49.2% |

SBF (DB:CY1K) | €2.96 | €5.73 | 48.3% |

CHAPTERS Group (XTRA:CHG) | €24.60 | €46.71 | 47.3% |

MTU Aero Engines (XTRA:MTX) | €251.60 | €419.25 | 40% |

Rubean (DB:R1B) | €5.90 | €10.83 | 45.5% |

Your Family Entertainment (DB:RTV) | €2.56 | €4.54 | 43.6% |

We're going to check out a few of the best picks from our screener tool.

adesso

Overview: Adesso SE operates as an IT services provider in Germany, Austria, Switzerland, and other international markets, with a market capitalization of approximately €597.26 million.

Operations: The company generates its revenue primarily from two segments: IT Services, which brought in €1.31 billion, and IT Solutions, contributing €119.88 million.

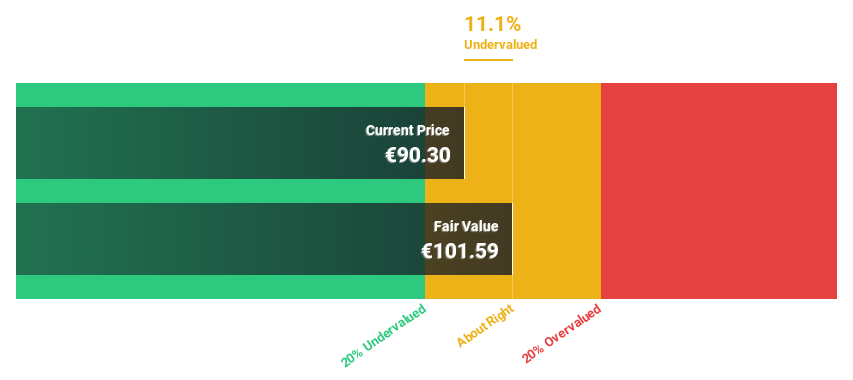

Estimated Discount To Fair Value: 11.9%

Adesso SE, priced at €91.6, is trading 11.9% below our estimated fair value of €104.02, suggesting undervaluation based on cash flows. While its revenue growth at 11.8% per year is robust compared to the German market's 5.2%, earnings are expected to grow significantly by approximately 38% annually. However, concerns include poor coverage of interest payments by earnings and a forecasted low return on equity of 13.6% in three years, indicating potential financial stress or underperformance in generating shareholder value from equity investments.

The growth report we've compiled suggests that adesso's future prospects could be on the up.

Take a closer look at adesso's balance sheet health here in our report.

adidas

Overview: Adidas AG operates globally, designing, developing, producing, and marketing athletic and sports lifestyle products across multiple regions, with a market capitalization of approximately €41.28 billion.

Operations: The company generates revenue primarily from three key regions: North America (€5.16 billion), Greater China (€3.20 billion), and Latin America (€2.31 billion).

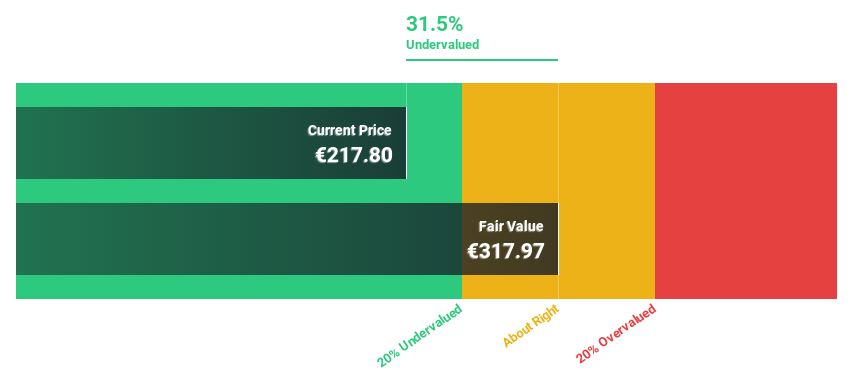

Estimated Discount To Fair Value: 32.1%

Adidas AG, with a current price of €231.2, is considered undervalued by 32.1%, as its fair value is estimated at €340.34. This valuation discrepancy is supported by a strong forecasted annual earnings growth of 41.3% over the next three years, significantly outpacing the German market's growth rate of 18.9%. Additionally, Adidas recently turned profitable with a notable increase in Q1 sales to €5.46 billion from €5.27 billion year-over-year and an operating profit guidance upgrade to approximately €700 million for 2024, reflecting operational improvements and market confidence.

The analysis detailed in our adidas growth report hints at robust future financial performance.

Dive into the specifics of adidas here with our thorough financial health report.

Kontron

Overview: Kontron AG is a company based in Austria that provides Internet of Things (IoT) solutions globally, with a market capitalization of approximately €1.25 billion.

Operations: The company generates its revenue primarily from Europe (€971.03 million), global markets (€269.17 million), and its software and solutions segment (€306.81 million).

Estimated Discount To Fair Value: 34%

Kontron AG, currently priced at €20.34, trades significantly below its fair value of €30.81, representing a 34% undervaluation. Despite a low forecasted Return on Equity at 17.2%, the company is expected to see robust earnings growth of 21.1% annually over the next three years, outpacing the German market's 18.9%. Recent initiatives include a share repurchase program and the launch of VX6096, enhancing its product line in high-performance computing sectors, which may positively influence future cash flows and market position.

Seize The Opportunity

Discover the full array of 29 Undervalued German Stocks Based On Cash Flows right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:ADN1XTRA:ADSXTRA:SANT and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance