Exploring Undervalued Stock Opportunities on the SIX Swiss Exchange in June 2024

The Swiss stock market recently experienced a downturn, closing lower in a trend mirrored across Europe as investors awaited crucial economic data from the U.S. that could influence future interest rate decisions by the Federal Reserve. In such uncertain times, identifying undervalued stocks on the SIX Swiss Exchange can offer potential opportunities for informed investment choices.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF47.50 | CHF76.09 | 37.6% |

Burckhardt Compression Holding (SWX:BCHN) | CHF584.00 | CHF822.88 | 29.0% |

Julius Bär Gruppe (SWX:BAER) | CHF51.26 | CHF96.65 | 47% |

Sonova Holding (SWX:SOON) | CHF271.50 | CHF449.64 | 39.6% |

Temenos (SWX:TEMN) | CHF61.90 | CHF84.31 | 26.6% |

SGS (SWX:SGSN) | CHF80.58 | CHF122.30 | 34.1% |

Comet Holding (SWX:COTN) | CHF362.50 | CHF546.71 | 33.7% |

Medartis Holding (SWX:MED) | CHF69.90 | CHF120.85 | 42.2% |

Kudelski (SWX:KUD) | CHF1.44 | CHF1.86 | 22.6% |

Galderma Group (SWX:GALD) | CHF76.30 | CHF149.69 | 49% |

Let's review some notable picks from our screened stocks

Sika

Overview: Sika AG is a specialty chemicals company that offers solutions for bonding, sealing, damping, reinforcing, and protecting in the building and automotive industries globally, with a market capitalization of CHF 41.25 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

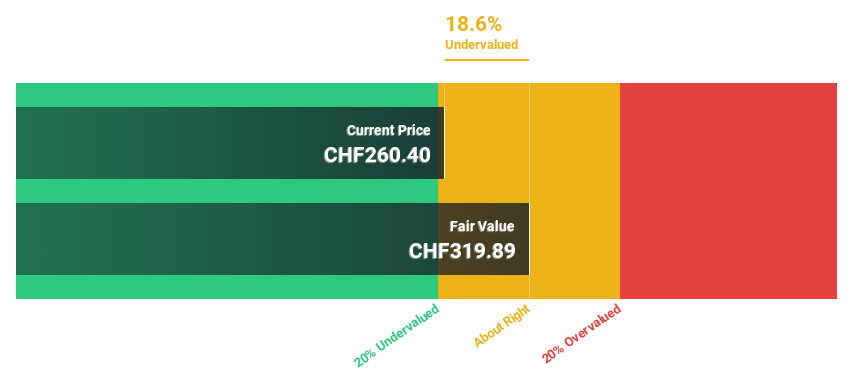

Estimated Discount To Fair Value: 19.6%

Sika, priced at CHF257.1, is trading below the estimated fair value of CHF319.71, reflecting a potential undervaluation based on discounted cash flows. Despite this, the company faces challenges such as high debt levels and shareholder dilution over the past year. However, Sika's earnings are expected to grow by 12.53% annually, outpacing the Swiss market's 8.3%, with revenue growth also forecasted to exceed local market trends at 6.2% per year compared to 4.4%. Recent expansions in China and Peru underline its strategic efforts to enhance global manufacturing capabilities and meet increasing product demand efficiently.

Sonova Holding

Overview: Sonova Holding AG is a company that specializes in manufacturing and selling hearing care solutions for adults and children across regions including the United States, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of CHF 16.18 billion.

Operations: The company's revenue is primarily generated from two segments: Cochlear Implants, which brought in CHF 282.40 million, and Hearing Instruments, which contributed CHF 3.36 billion.

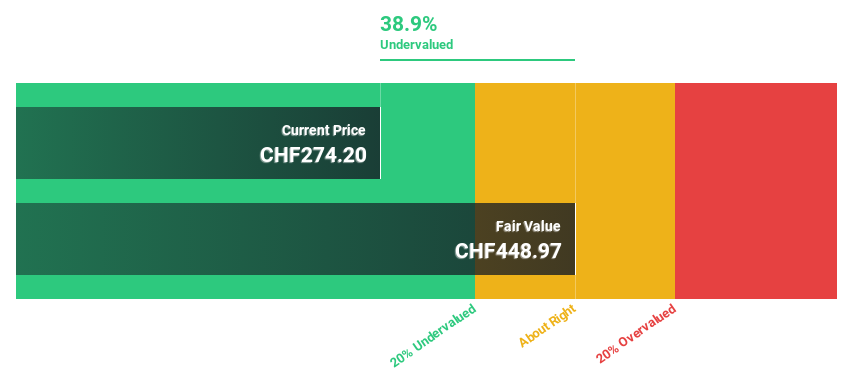

Estimated Discount To Fair Value: 39.6%

Sonova Holding, with a current price of CHF271.5, is identified as trading significantly below its calculated fair value of CHF449.64. This suggests a substantial undervaluation based on discounted cash flows. The company's recent financials show robust performance with sales reaching CHF3.63 billion and net income at CHF609.5 million for the fiscal year ending March 2024. Despite this strong financial position, Sonova's debt level is high which could pose risks to its future stability and growth prospects.

Temenos

Overview: Temenos AG is a global provider of integrated banking software systems to financial institutions, with a market capitalization of approximately CHF 4.49 billion.

Operations: The company generates its revenue by providing integrated banking software solutions to financial institutions globally.

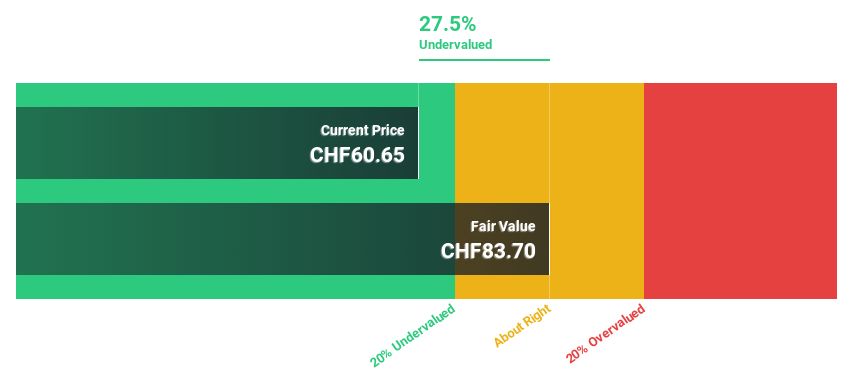

Estimated Discount To Fair Value: 26.6%

Temenos, priced at CHF61.9, is considered undervalued with a fair value estimate of CHF84.31, reflecting a 26.6% discount. While the company's revenue growth at 7.6% per year surpasses the Swiss market average of 4.4%, its earnings growth projection of 14.7% also outstrips the market's 8.3%. However, high debt levels and a volatile share price temper these positives. Recent initiatives include a CHF200 million share buyback and advancements in sustainable cloud solutions which may bolster future performance despite current financial leverage concerns.

The growth report we've compiled suggests that Temenos' future prospects could be on the up.

Unlock comprehensive insights into our analysis of Temenos stock in this financial health report.

Where To Now?

Dive into all 13 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:SIKA SWX:SOON and SWX:TEMN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance