Exploring Undervalued Small Caps With Insider Buying In The United Kingdom July 2024

As the United Kingdom's FTSE 100 index shows signs of subdued activity ahead of significant global financial events, investors may find potential opportunities in smaller cap stocks that are often less influenced by broad market movements. In this context, identifying undervalued small caps with insider buying can be a strategic approach, especially when larger indices and economic indicators present mixed signals.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Stelrad Group | 9.5x | 0.5x | 43.89% | ★★★★★★ |

Norcros | 7.8x | 0.5x | 43.78% | ★★★★★☆ |

Ultimate Products | 9.6x | 0.7x | 19.03% | ★★★★★☆ |

GB Group | NA | 3.2x | 21.69% | ★★★★★☆ |

THG | NA | 0.4x | 41.34% | ★★★★★☆ |

CVS Group | 21.4x | 1.2x | 40.90% | ★★★★☆☆ |

M&C Saatchi | NA | 0.5x | 49.26% | ★★★★☆☆ |

Bytes Technology Group | 27.6x | 6.2x | -9.27% | ★★★☆☆☆ |

Robert Walters | 20.0x | 0.3x | 39.72% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.8x | 37.52% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

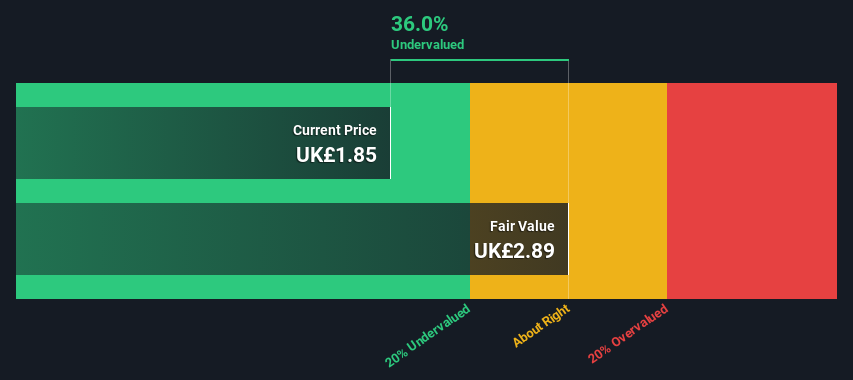

Hochschild Mining

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hochschild Mining is a precious metals company focused on the exploration, mining, and processing of silver and gold, primarily operating through its significant segments in Inmaculada, San Jose, and Pallancata.

Operations: Inmaculada, San Jose, and Pallancata are the primary revenue contributors for the entity, generating $396.64 million, $242.46 million, and $54.05 million respectively. The gross profit margin has shown variability over the periods observed but was recorded at 26.46% in the most recent data available from 2024-07-08.

PE: -22.7x

Recently, Eduardo Navarro demonstrated insider confidence in Hochschild Mining by acquiring 148,000 shares for £235,320, signaling a positive outlook. This move came alongside the company's announcement of expected production between 343,000 and 360,000 gold equivalent ounces for 2024. With earnings projected to grow by over 42% annually and reliance on external borrowing marking its funding strategy as higher risk, Hochschild presents a nuanced investment profile in the mining sector. Their recent operating results show a steady production with an increase in gold output compared to last year.

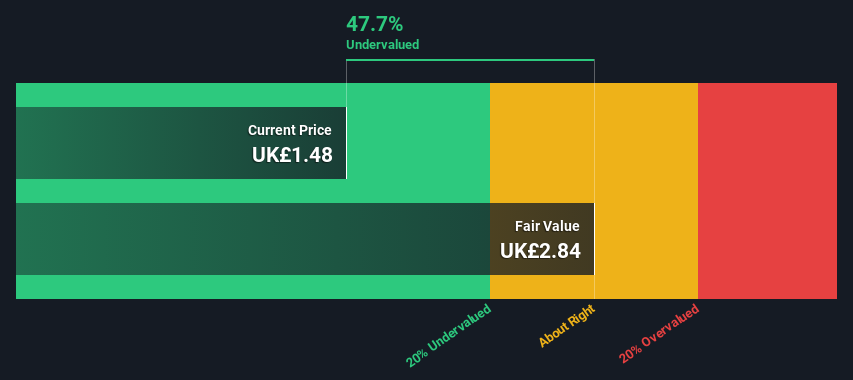

Kier Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kier Group is a construction and infrastructure services provider with operations spanning property development, corporate services, and infrastructure, boasting a market capitalization of approximately £241 million.

Operations: In analyzing the financial trends of Kier Group, it is evident that gross profit margins have shown variability over the observed periods, ranging from approximately 5.91% to 10.12%. The company's revenue has also experienced growth, escalating from £2.19 billion in late 2013 to approximately £3.72 billion by the end of 2024, reflecting an expansion in business scale and possibly efficiency improvements or market expansion strategies over time.

PE: 16.7x

Kier Group, reflecting a promising trajectory with earnings expected to climb by 23% annually, recently saw insiders bolster their stakes—a strong signal of confidence. Despite relying solely on external borrowing, which presents a higher risk profile, the company's financials are skewed by significant one-off items. This blend of insider activity and financial growth prospects paints Kier as an intriguing player among undervalued entities in the UK market.

Click to explore a detailed breakdown of our findings in Kier Group's valuation report.

Examine Kier Group's past performance report to understand how it has performed in the past.

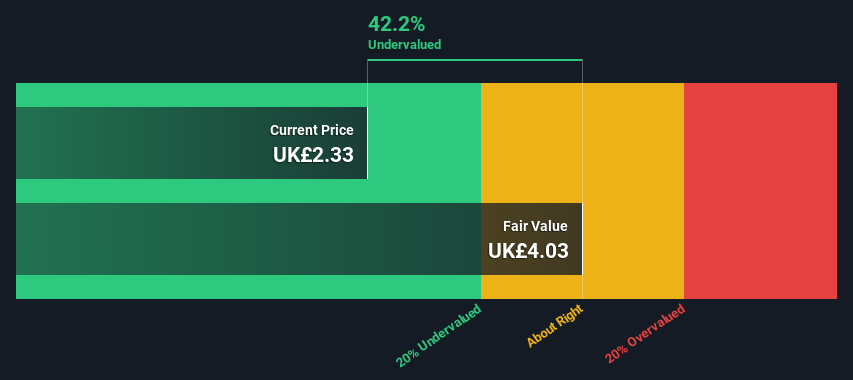

MONY Group

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group operates in various sectors including money, travel, cashback, insurance, and home services, with a diversified business model primarily focused on financial and consumer services.

Operations: The entity generates its highest revenue from the Insurance segment at £220 million, followed by Money services contributing £100.20 million. It has demonstrated a gross profit margin of approximately 67% to 68% over recent periods, indicating a significant proportion of revenue retained after accounting for the cost of goods sold.

PE: 17.2x

MONY Group, transitioning to its new name on May 20, 2024, has shown a promising trajectory with a first-quarter revenue jump to £114.6 million from £106.3 million the previous year. This growth of over 7% highlights its potential in an overlooked segment of the market. Despite relying solely on external borrowing—a higher risk funding method—insider confidence is evident as they recently purchased shares, signaling belief in the company’s future prospects. Forecasted annual earnings growth of over 10% further bolsters MONY Group’s appeal as a potentially underestimated investment opportunity within the UK sector.

Click here to discover the nuances of MONY Group with our detailed analytical valuation report.

Explore historical data to track MONY Group's performance over time in our Past section.

Where To Now?

Dive into all 33 of the Undervalued Small Caps With Insider Buying we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:HOC LSE:KIE and LSE:MONY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance