Exploring Undervalued Small Caps With Insider Action In Australia June 2024

Amidst a backdrop of fluctuating indices, the Australian market has shown mixed signals, with sectors like utilities and communications experiencing growth while materials lag behind. This nuanced landscape sets an intriguing stage for exploring undervalued small-cap companies that may offer unique opportunities in the current economic environment. A good stock in this context would ideally demonstrate resilience and potential for growth despite broader market volatility, making it an attractive consideration for those looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Corporate Travel Management | 17.8x | 2.7x | 44.66% | ★★★★★★ |

Tabcorp Holdings | NA | 0.6x | 24.96% | ★★★★★★ |

GUD Holdings | 14.3x | 1.4x | 5.31% | ★★★★★☆ |

Codan | 27.4x | 4.0x | 25.07% | ★★★★☆☆ |

Eagers Automotive | 9.7x | 0.3x | 28.73% | ★★★★☆☆ |

Tasmea | 13.6x | 0.9x | 16.99% | ★★★☆☆☆ |

Dicker Data | 21.7x | 0.8x | -2.53% | ★★★☆☆☆ |

Smartgroup | 17.9x | 4.4x | 47.00% | ★★★☆☆☆ |

Coventry Group | 268.4x | 0.4x | -23.36% | ★★★☆☆☆ |

Star Entertainment Group | NA | 0.8x | -10.13% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

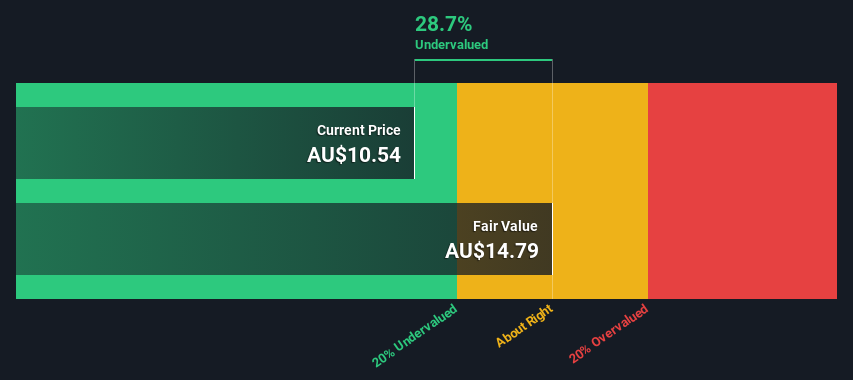

Eagers Automotive

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is an automotive retailer primarily engaged in car retailing, with a market capitalization of approximately A$3.82 billion.

Operations: Car Retailing is the primary revenue generator for the entity, achieving A$9.85 billion in sales. The gross profit margin has shown a slight increase over recent periods, reaching 0.19% as of the latest data point.

PE: 9.7x

Eagers Automotive, a notable player in the automotive sector, recently announced an ambitious share repurchase program, aiming to buy back 10% of its issued shares by June 2025. This move underscores insider confidence and aligns with their proactive Next100 strategy, emphasizing aggressive revenue growth and strategic mergers and acquisitions. Despite a forecasted slight decline in earnings by about 0.8% annually over the next three years, revenue is expected to rise by approximately 5.53% annually. Their approach combines financial agility with strategic foresight in the market.

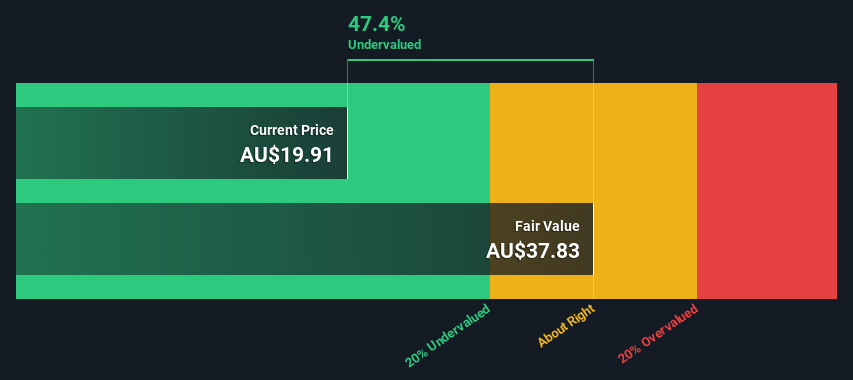

Neuren Pharmaceuticals

Simply Wall St Value Rating: ★★★★★☆

Overview: Neuren Pharmaceuticals is a company focused on the development of pharmaceutical products, with a market capitalization of approximately A$231.94 million.

Operations: Pharmaceutical Products generated A$231.94 million in revenue, with a gross profit margin of 88.47%, reflecting the cost efficiency in production relative to sales. The company's operating expenses were A$5.95 million for the period analyzed, indicating management of operational costs amidst revenue activities.

PE: 16.2x

Neuren Pharmaceuticals, an intriguing player in the biopharmaceutical sector, has recently demonstrated promising Phase 2 clinical trial results for NNZ-2591 in treating Pitt Hopkins syndrome, showcasing significant improvements across all primary efficacy measures. With no current approved treatments for this condition, their innovative approach could capture a niche market. Financially, Neuren is poised for growth with revenue expected to rise annually by 10.53%. Insider confidence is evident as they have recently purchased shares, signaling belief in the company's future prospects and stability derived from high-risk funding sources exclusively through external borrowing.

Dive into the specifics of Neuren Pharmaceuticals here with our thorough valuation report.

Evaluate Neuren Pharmaceuticals' historical performance by accessing our past performance report.

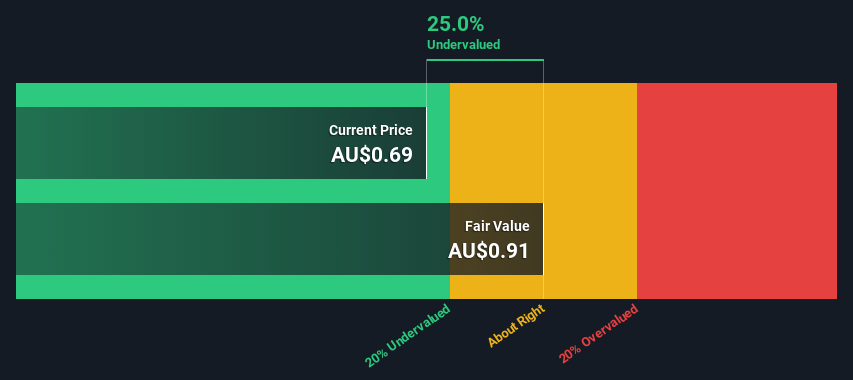

Tabcorp Holdings

Simply Wall St Value Rating: ★★★★★★

Overview: Tabcorp Holdings is a diversified entertainment group operating in gaming services and wagering and media, with a market capitalization of approximately A$11 billion.

Operations: The company has demonstrated a consistently high gross profit margin, nearly 1.0 across several periods, reflecting its ability to fully convert revenue into gross profit since COGS are absent. Net income has fluctuated significantly, with notable dips into negative territory in recent years, indicating challenges in managing operational or non-operational expenses effectively against its revenues.

PE: -2.5x

Tabcorp Holdings, recently buoyed by insider confidence with significant share purchases, underscores a promising outlook. Forecasting an 82% earnings growth annually, the company leverages external borrowing entirely for its financial needs, reflecting a strategic but higher risk approach. This blend of aggressive growth prospects and recent insider investments paints a picture of potential underappreciated by the market.

Where To Now?

Dive into all 25 of the Undervalued ASX Small Caps With Insider Buying we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:NEU and ASX:TAH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance