Exploring Undervalued Opportunities On Euronext Paris With Discounts Ranging From 14.6% To 33.4%

As global markets respond to shifting economic indicators, France's CAC 40 Index has shown resilience, rising by 0.63% this past week amid broader European gains fueled by encouraging U.S. inflation data. In such a climate, identifying undervalued stocks on Euronext Paris could present opportunities for investors seeking value in a market responsive to international economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In France

Name | Current Price | Fair Value (Est) | Discount (Est) |

Wavestone (ENXTPA:WAVE) | €57.00 | €93.26 | 38.9% |

Lectra (ENXTPA:LSS) | €28.85 | €44.04 | 34.5% |

Thales (ENXTPA:HO) | €154.20 | €266.60 | 42.2% |

Tikehau Capital (ENXTPA:TKO) | €23.25 | €33.00 | 29.5% |

ENENSYS Technologies (ENXTPA:ALNN6) | €0.60 | €1.09 | 44.7% |

Vivendi (ENXTPA:VIV) | €10.985 | €16.50 | 33.4% |

Figeac Aero Société Anonyme (ENXTPA:FGA) | €5.72 | €9.96 | 42.6% |

Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €3.88 | €6.20 | 37.4% |

Esker (ENXTPA:ALESK) | €186.60 | €259.28 | 28.0% |

OVH Groupe (ENXTPA:OVH) | €5.65 | €7.54 | 25.1% |

Here's a peek at a few of the choices from the screener.

Edenred

Overview: Edenred SE operates a global digital platform offering services and payments solutions for companies, employees, and merchants, with a market capitalization of approximately €10.15 billion.

Operations: The company generates revenue primarily through its Business Services segment, which brought in €2.31 billion.

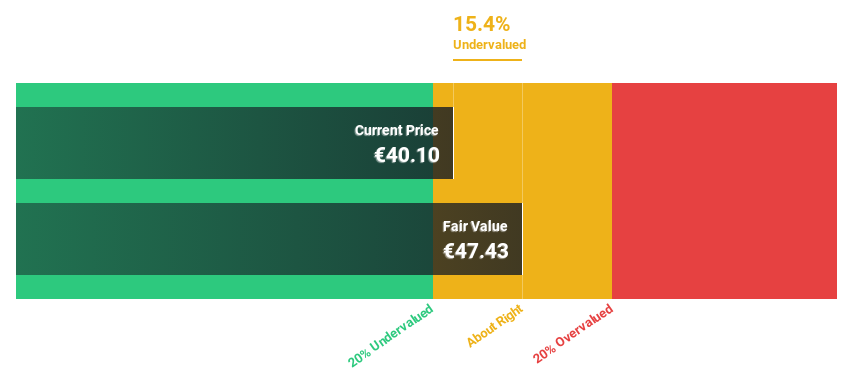

Estimated Discount To Fair Value: 14.6%

Edenred, priced at €40.79, trades below its estimated fair value of €47.76, suggesting undervaluation based on cash flows. Despite a high forecasted return on equity and earnings growth expected at 20.3% annually, challenges include a high debt level and dividends not well covered by earnings. Analysts predict the stock could rise by 50.8%, outpacing the French market's revenue growth forecast of 5.7% with Edenred's own at 10.9% per year.

The growth report we've compiled suggests that Edenred's future prospects could be on the up.

Dive into the specifics of Edenred here with our thorough financial health report.

Tikehau Capital

Overview: Tikehau Capital is a private equity and venture capital firm that specializes in a diverse range of financing products such as senior secured loans, equity, and mezzanine financing, with a market capitalization of approximately €4.02 billion.

Operations: The firm generates revenue primarily through two segments: Investment Activities, which brought in €179.19 million, and Asset Management Activities, contributing €322.32 million.

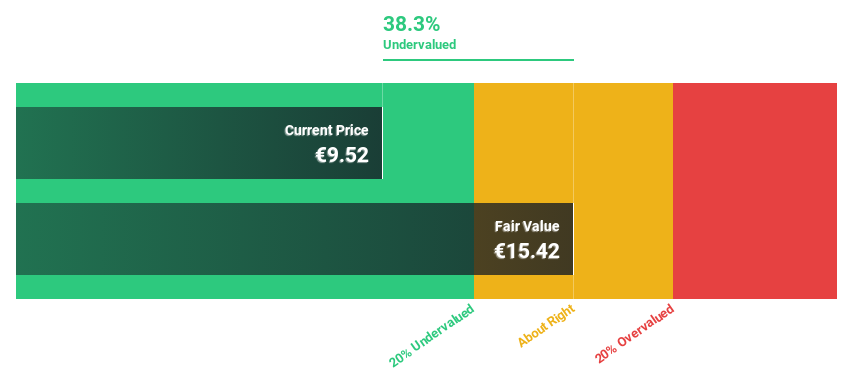

Estimated Discount To Fair Value: 29.5%

Tikehau Capital, valued at €23.25, is seen as undervalued with a fair value of €33. The company's earnings are expected to increase by 31.26% annually, surpassing the French market's 10.9%. Despite this robust growth and a significant undervaluation based on discounted cash flows, its return on equity is projected to be modest at 12.6% in three years. Additionally, its dividend coverage by free cash flows is weak, reflecting potential concerns about sustainability in payouts amidst its financial strategies and recent strategic partnership aimed at expanding Asian market presence through joint ventures and distribution agreements with Nikko Asset Management.

Vivendi

Overview: Vivendi SE is a France-based entertainment, media, and communication company with operations spanning Europe, the Americas, Asia/Oceania, and Africa, boasting a market capitalization of €11.26 billion.

Operations: Vivendi's revenue is primarily generated from its Canal + Group at €6.06 billion, followed by Havas Group at €2.87 billion, Lagardère at €0.67 billion, Gameloft at €0.31 billion, Prisma Media also contributing €0.31 billion, Vivendi Village at €0.18 billion, and New Initiatives adding €0.15 billion.

Estimated Discount To Fair Value: 33.4%

Vivendi, priced at €10.99, is significantly undervalued based on discounted cash flow analysis, with an estimated fair value of €16.50. Its earnings are expected to grow by 29.27% annually over the next three years, outpacing the French market's average of 10.9%. Despite this potential for substantial growth and trading at 33.4% below its fair value, Vivendi's return on equity is forecasted to remain low at 5.9%. Recent strategic moves include settling longstanding litigation and planning a spinoff of Canal+ to streamline operations.

Seize The Opportunity

Unlock more gems! Our Undervalued Euronext Paris Stocks Based On Cash Flows screener has unearthed 13 more companies for you to explore.Click here to unveil our expertly curated list of 16 Undervalued Euronext Paris Stocks Based On Cash Flows.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:EDEN ENXTPA:TKO and ENXTPA:VIV.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance