Exploring Undervalued Gems on the Tokyo Stock Exchange in June 2024

Amid a backdrop of uncertainty regarding the Bank of Japan's monetary policy and a slight downturn in the Nikkei 225 and TOPIX indices, investors might find potential opportunities in undervalued stocks on the Tokyo Stock Exchange. In such an environment, identifying stocks that are priced below their intrinsic value could be particularly compelling, especially when broader market trends may not reflect individual stock potentials.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥452.00 | ¥891.21 | 49.3% |

Mimaki Engineering (TSE:6638) | ¥1900.00 | ¥3538.66 | 46.3% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1901.00 | ¥3563.34 | 46.7% |

Hibino (TSE:2469) | ¥2612.00 | ¥4889.55 | 46.6% |

OSAKA Titanium technologiesLtd (TSE:5726) | ¥2779.00 | ¥5531.93 | 49.8% |

Cyber Security Cloud (TSE:4493) | ¥2142.00 | ¥4106.05 | 47.8% |

S-Pool (TSE:2471) | ¥314.00 | ¥586.69 | 46.5% |

Macromill (TSE:3978) | ¥858.00 | ¥1671.55 | 48.7% |

NIHON CHOUZAILtd (TSE:3341) | ¥1448.00 | ¥2776.02 | 47.8% |

Members (TSE:2130) | ¥901.00 | ¥1718.12 | 47.6% |

Underneath we present a selection of stocks filtered out by our screen

Asahi Kasei

Overview: Asahi Kasei Corporation, with a market capitalization of ¥1.38 trillion, is engaged in the manufacturing and selling of chemicals.

Operations: The company's revenue is primarily generated from three segments: Material at ¥1.27 billion, Housing at ¥0.96 billion, and Healthcare at ¥0.55 billion.

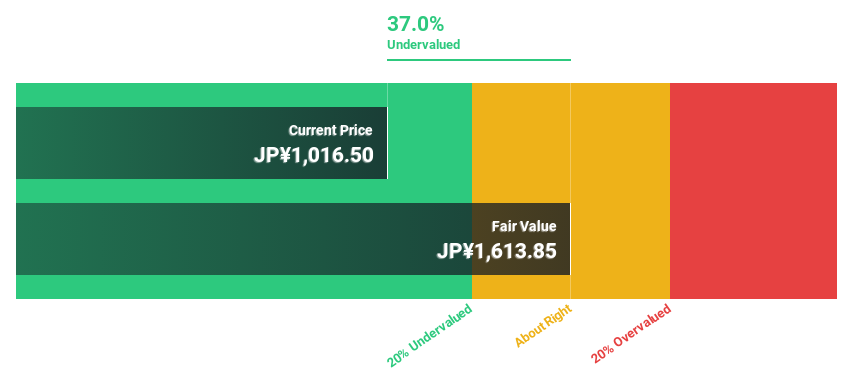

Estimated Discount To Fair Value: 37%

Asahi Kasei, trading at ¥1016.5, is perceived as undervalued based on a DCF valuation of ¥1613.85, suggesting potential unrecognized value in its stock price. Despite a modest revenue growth forecast of 4.4% per year, earnings are expected to surge by 22.65% annually, outpacing the Japanese market average significantly. However, its return on equity is projected to remain low at 7.2% in three years, and dividend coverage appears weak with ongoing large one-off items affecting financial stability. Recent strategic expansions into hydrogen production and battery technologies underscore a pivot towards high-demand sectors, potentially enhancing future profitability despite current financial ambiguities.

Tri Chemical Laboratories

Overview: Tri Chemical Laboratories Inc., operating in Japan, specializes in manufacturing chemical products used in various applications including semiconductors, coatings, optical fibers, solar cells, and compound semiconductors, with a market capitalization of ¥134.21 billion.

Operations: The company generates revenue from the production of chemical products utilized in semiconductors, coatings, optical fibers, solar cells, and compound semiconductors.

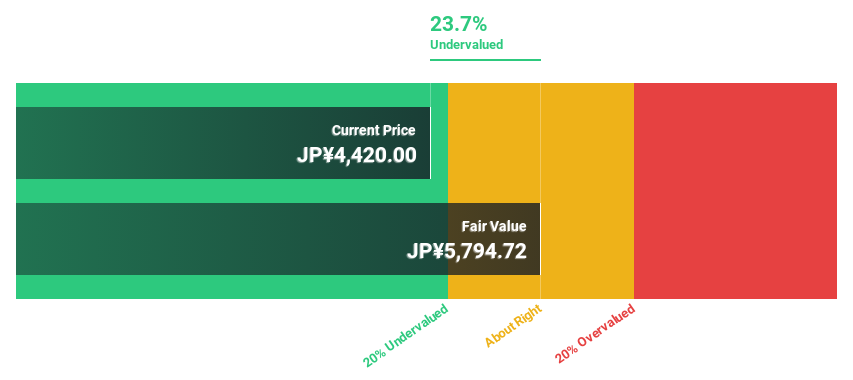

Estimated Discount To Fair Value: 23.7%

Tri Chemical Laboratories is trading at ¥4420, below the estimated fair value of ¥5794.72, indicating potential undervaluation. The company's earnings are expected to grow by 37.6% annually, significantly outpacing the Japanese market forecast of 8.9%. Despite a decrease in profit margins from 32.6% to 20.3%, revenue growth projections remain robust at 28.4% per year, well above the market average of 4.2%. However, its return on equity is anticipated to be low at 19.9% in three years, and the stock has experienced high volatility recently.

Dive into the specifics of Tri Chemical Laboratories here with our thorough financial health report.

AGC

Overview: AGC Inc., operating globally, is engaged in the manufacturing and sale of glass, automotive products, electronics, chemicals, and ceramics with a market capitalization of approximately ¥1.12 trillion.

Operations: The company's operations are segmented into glass, automotive products, electronics, chemicals, and ceramics.

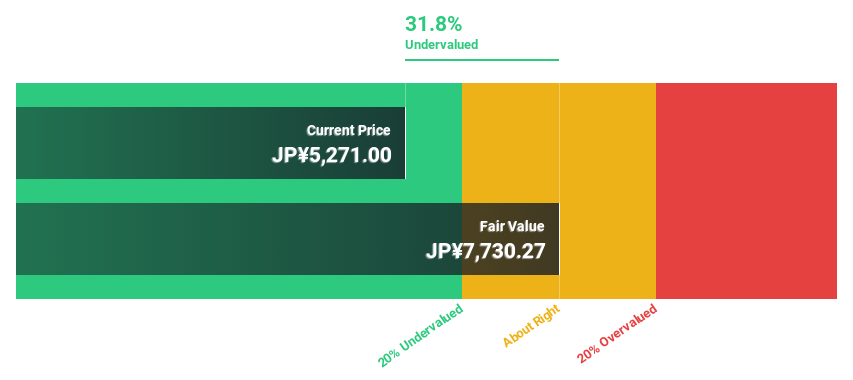

Estimated Discount To Fair Value: 31.8%

AGC Inc. is trading at ¥5271, significantly below its estimated fair value of ¥7730.27, suggesting it might be undervalued. The company's earnings are forecast to increase by 33.77% annually over the next three years, outperforming the Japanese market's growth expectation of 8.9% per year. However, its return on equity is expected to remain low at 8.2%. Recent executive changes could impact operations, with key leadership transitions in its Life Science division effective from July 2024.

Insights from our recent growth report point to a promising forecast for AGC's business outlook.

Unlock comprehensive insights into our analysis of AGC stock in this financial health report.

Seize The Opportunity

Navigate through the entire inventory of 99 Undervalued Japanese Stocks Based On Cash Flows here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:3407 TSE:4369 and TSE:5201.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance