Top Indian Dividend Stocks Yielding At Least 2.4% In February 2024

The past week saw impressive gains for the Sensex and the Nifty in particular, scaling a new peak, closing near 22,200. This recent surge comes amidst optimism from domestic investors, suggesting sustained confidence in the market even as global cues remain muted. Furthermore, the Indian rupee strengthened against the US dollar, adding another layer of support to the Indian market. Combined with analyst forecasts for an average of 18% earnings growth across the market over the next year, dividend stocks become especially compelling for investors seeking steady income streams and long-term value in a market brimming with growth potential.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

EPL (BSE:500135) | 2.20% | ★★★★★★ |

Narmada Gelatines (BSE:526739) | 2.44% | ★★★★★★ |

Vinyl Chemicals (India) (BSE:524129) | 2.52% | ★★★★★★ |

Swaraj Engines (NSEI:SWARAJENG) | 3.85% | ★★★★★☆ |

HCL Technologies (NSEI:HCLTECH) | 3.10% | ★★★★★☆ |

Castrol India (BSE:500870) | 3.53% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 2.65% | ★★★★★☆ |

Sun TV Network (NSEI:SUNTV) | 2.42% | ★★★★★☆ |

Ruchira Papers (NSEI:RUCHIRA) | 3.77% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 2.03% | ★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

Below, we're sharing a selection of stocks that have caught our attention through our screening process.

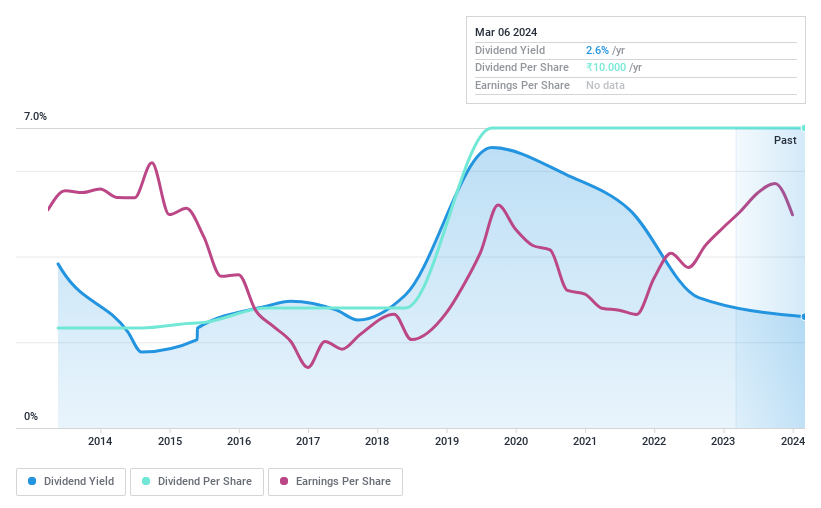

Narmada Gelatines (BSE:526739)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Narmada Gelatines Limited is a company engaged in the production and sale of gelatine and its by-products, serving both domestic and international markets, with a market capitalization of approximately ₹2.48 billion.

Operations: Narmada Gelatines Limited's operations focus on the manufacture and commercialization of gelatine and its derivatives, catering to a diverse client base across global markets.

Dividend Yield: 2.4%

Narmada Gelatines (BSE:526739) stands out as a company with no debt, enhancing its appeal to dividend-seeking investors. Over the past five years, the company has consistently grown its earnings by 7.3% annually, with recent profit margins improving to 8.3%. Although there was a slight dip in earnings growth compared to the five-year average, Narmada Gelatines maintains a sustainable dividend policy with low payout ratios—46.8% from earnings and 35.8% from cash flow—indicating dividends are well-covered. The company seems to have an impressive track record of making reliable and stable dividend payments over the past decade, therefore positioning its yield attractively within the top quartile of Indian market payers at 2.44%.

Discovering a possibly undervalued opportunity can be exciting, but ensuring it fits well within your investment goals is essential. Do so seamlessly using the analytical power of Simply Wall St's portfolio tool.

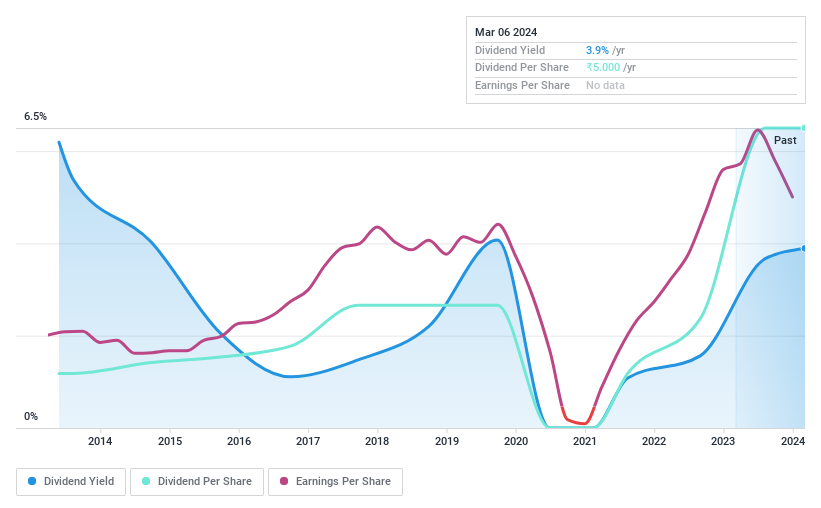

Ruchira Papers (NSEI:RUCHIRA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ruchira Papers Limited is an India-based company engaged in the manufacturing and international sale of paper and paper products, with a market capitalization of approximately ₹3.95 billion.

Operations: Ruchira Papers Limited generates its revenue primarily through the manufacturing of paper, with a reported segment revenue of ₹6.78 billion.

Dividend Yield: 3.8%

Ruchira Papers has made significant strides in reducing its debt, managing to slash its debt to equity ratio from 29.9% to just 7% over the span of five years, reflecting a strengthened balance sheet. Additionally, Ruchira Papers has experienced impressive earnings growth, averaging 21.5% annually during the same period. However, the company faced a setback with negative earnings growth over the last year. Despite this, Its dividends appear sustainable with low payout ratios and are supported by both earnings and operating cash flow, ensuring shareholder returns are well-protected. However, investors should note the volatility in dividend payments over the past decade despite recent increases. This aspect may raise concerns about the stock's attractivenesson as a consistent income stock amidst India's top dividend payers.

Take a closer look at Ruchira Papers' potential here in our dividend report.

Our valuation report here indicates Ruchira Papers may be overvalued.

You might want to monitor its performance and wait for a better entry point by using Simply Wall St's watchlist.

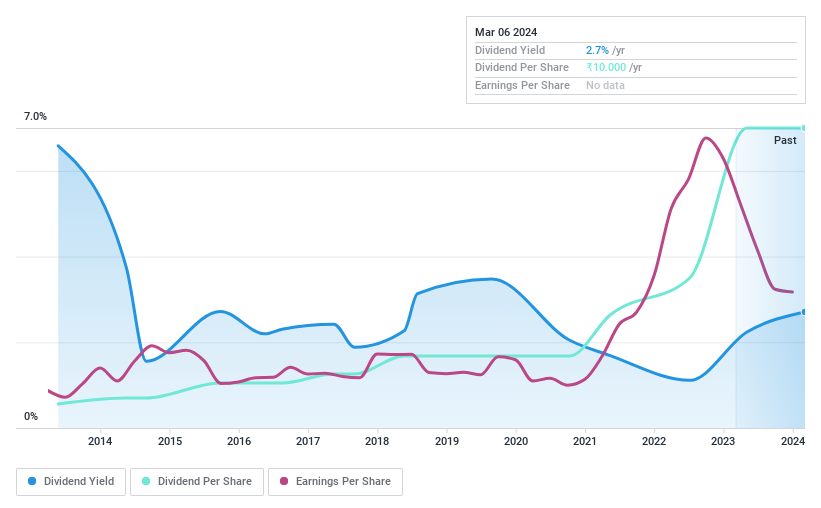

Vinyl Chemicals (India) (BSE:524129)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vinyl Chemicals (India) Limited is a company engaged in the trading of a diverse range of chemicals within the Indian market, with a market capitalization of approximately ₹7.29 billion.

Operations: Vinyl Chemicals (India) Limited generates its revenue primarily through the trading of chemicals, with a reported segment revenue of ₹5.36 billion.

Dividend Yield: 2.5%

Vinyl Chemicals is another interesting option for dividend investors, with its debt profile showing great improvements. The debt to equity ratio is now half of what it was compared to five years ago, while its cash reserves now surpass total debt. While historically the company's earnings have seen impressive growth, recent negative earnings growth contrasts this trend. Despite this, Dividend sustainability is a bright spot, with low payout ratios from both earnings and cash flow underpinning consistent payouts that have grown over the past decade. Yet, investors should be mindful of the current lower net profit margins compared to last year and lack of data on expected future profit and revenue growth. These factors introduce an element of caution in assessing Vinyl Chemicals' long-term dividend prospects amidst India's diverse market offerings.

Dive into the specifics of Vinyl Chemicals (India) here with our thorough dividend report.

You can save this company for future evaluation in a Simply Wall St watchlist should market dynamics shift favorably.

Where To Now?

Ready to harness the power of insightful data analysis? Explore top-performing dividend stocks in India using the Simply Wall St screener. With 55 gems waiting to be discovered , there's plenty of opportunities to find your next investment!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance