Exploring Top Dividend Stocks In Hong Kong May 2024

As of May 2024, the Hong Kong market has shown resilience with the Hang Seng Index gaining 3.11%, reflecting a positive sentiment among investors despite broader economic challenges. This backdrop provides an interesting context for exploring dividend stocks, which are often considered for their potential to offer steady income and stability in varied market conditions. In selecting top dividend stocks, it's crucial to consider factors such as the sustainability of dividends, company fundamentals, and how these companies have navigated recent economic conditions.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.06% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.81% | ★★★★★★ |

Consun Pharmaceutical Group (SEHK:1681) | 8.74% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.37% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.54% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.52% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.12% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.36% | ★★★★★☆ |

China Overseas Grand Oceans Group (SEHK:81) | 7.43% | ★★★★★☆ |

Click here to see the full list of 90 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Shenhua Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shenhua Energy Company Limited operates in coal production and sales, power generation, and transportation services across China and globally, with a market capitalization of approximately HK$870.57 billion.

Operations: China Shenhua Energy Company Limited generates revenue primarily from coal production (CN¥273.67 billion), power generation (CN¥93.61 billion), and transportation services through railways (CN¥43.62 billion), ports (CN¥6.84 billion), shipping (CN¥4.92 billion), and coal chemical products (CN¥6.08 billion).

Dividend Yield: 6.7%

China Shenhua Energy's dividend yield of 6.65% is slightly lower than the top quartile of Hong Kong dividend stocks. Despite a recent dip in quarterly net income to CNY 17.76 billion, dividends are well-covered by earnings and cash flows, with payout ratios at 79.1% and 87%, respectively. However, the company's dividend history shows instability and volatility over the past decade, suggesting potential concerns for those seeking consistent income streams. The stock trades at a significant discount to estimated fair value, indicating possible undervaluation but also reflecting underlying risks such as fluctuating financial performance and operational challenges like decreased power generation year-over-year.

International Housewares Retail

Simply Wall St Dividend Rating: ★★★★★☆

Overview: International Housewares Retail Company Limited operates as an investment holding company, specializing in the retail sale and trading of housewares products, with a market capitalization of approximately HK$0.96 billion.

Operations: International Housewares Retail Company Limited generates revenue primarily through its retail operations, with HK$307.82 million from Singapore and HK$2.44 billion from Hong Kong and Macau.

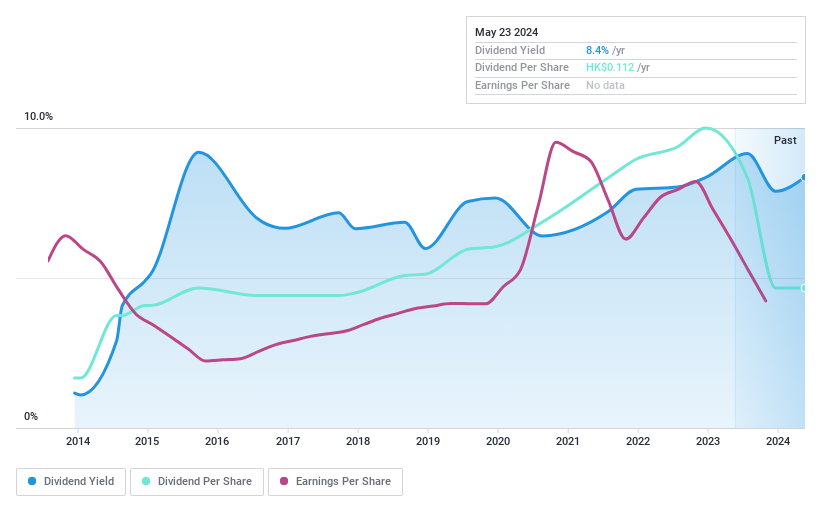

Dividend Yield: 8.4%

International Housewares Retail offers a dividend yield of 8.36%, ranking in the top 25% of Hong Kong dividend payers. Despite this, the company's dividends have shown volatility and unreliability over the past decade, with an unstable track record that includes significant annual fluctuations. The dividends are supported by earnings and cash flows, with payout ratios of 80.2% and 22.3%, respectively. However, profit margins have declined from last year's 7.9% to this year's 4.4%.

Carpenter Tan Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carpenter Tan Holdings Limited operates as an investment holding company that designs, manufactures, and distributes wooden handicrafts and accessories under the Carpenter Tan brand, with a market capitalization of approximately HK$1.39 billion.

Operations: Carpenter Tan Holdings generates revenue primarily through the manufacture and sale of wooden handicrafts and accessories, totaling CN¥499.69 million.

Dividend Yield: 6.7%

Carpenter Tan Holdings recently approved a final dividend of HK$0.3864 per share, indicating a commitment to returning value to shareholders. Despite a 62% earnings growth last year and dividends covered by both earnings (50.1%) and cash flows (51.6%), the company’s dividend history has been marked by volatility and unreliability over the past decade. Its dividend yield of 6.74% is below the top quartile in Hong Kong, reflecting potential concerns about sustainability amidst its fluctuating payout history.

Seize The Opportunity

Dive into all 90 of the Top Dividend Stocks we have identified here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1088 SEHK:1373 and SEHK:837.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance