Exploring Top Dividend Stocks In Hong Kong For April 2024

As of April 2024, the Hong Kong market faces challenges amidst a backdrop of geopolitical tensions and economic uncertainties that have influenced global markets. Despite these headwinds, dividend stocks remain a focal point for investors seeking potential stability and income generation in turbulent times. In this context, understanding the fundamentals of robust dividend-paying companies becomes crucial. These firms typically exhibit strong financial health and consistent earnings, qualities that are particularly valuable in the current economic environment.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 9.34% | ★★★★★★ |

China Construction Bank (SEHK:939) | 8.81% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.88% | ★★★★★★ |

S.A.S. Dragon Holdings (SEHK:1184) | 9.04% | ★★★★★☆ |

Xingfa Aluminium Holdings (SEHK:98) | 8.39% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.50% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.91% | ★★★★★☆ |

Zhejiang Expressway (SEHK:576) | 6.85% | ★★★★★☆ |

Bank of China (SEHK:3988) | 7.43% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.48% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Lion Rock Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lion Rock Group Limited, an investment holding company based in Hong Kong, offers printing services to a diverse range of clients including international book publishers and print media companies, with a market capitalization of approximately HK$0.99 billion.

Operations: Lion Rock Group Limited generates revenue primarily through its printing and publishing segments, with HK$1.77 billion from printing services and HK$0.95 billion from publishing activities.

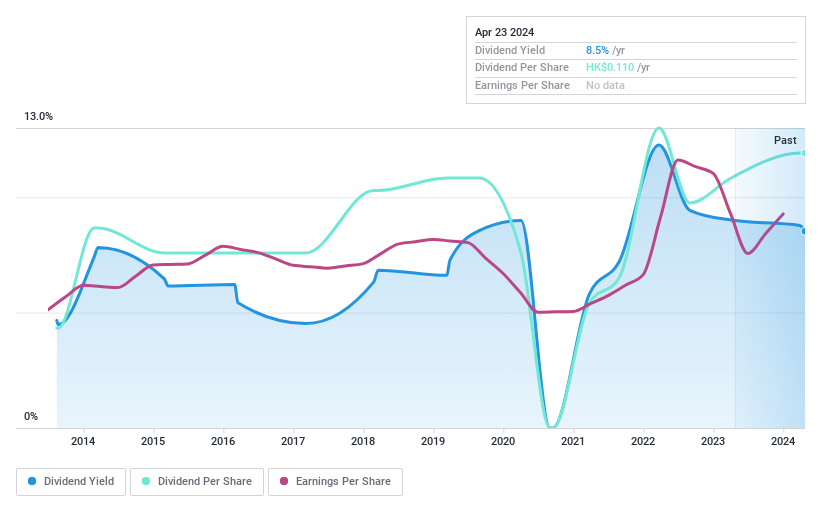

Dividend Yield: 8.5%

Lion Rock Group Limited, despite trading at 39.1% below its estimated fair value, presents a mixed scenario for dividend investors. The company's dividend yield of 8.53% ranks in the top 25% in Hong Kong's market, supported by a reasonable payout ratio of 44.1%, suggesting earnings sufficiently cover the dividends. However, its dividend track record over the past decade has been volatile with no consistent growth pattern, reflecting potential risks in sustainability and stability moving forward. Recently, Lion Rock proposed a final dividend of HK$0.08 per share for the year ended December 31, 2023.

Tsingtao Brewery

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsingtao Brewery Company Limited operates globally, focusing on the production, distribution, wholesale, and retail sale of beer products with a market capitalization of approximately HK$96.26 billion.

Operations: Tsingtao Brewery Company Limited generates revenue primarily from various Chinese regions including CN¥24.39 billion from Shandong Area, CN¥8.10 billion from North China, CN¥3.71 billion from South China, CN¥2.85 billion from East China, and smaller amounts of CN¥899.27 million and CN¥988.10 million from South-East China Region and Hong Kong, Macau and other overseas markets respectively.

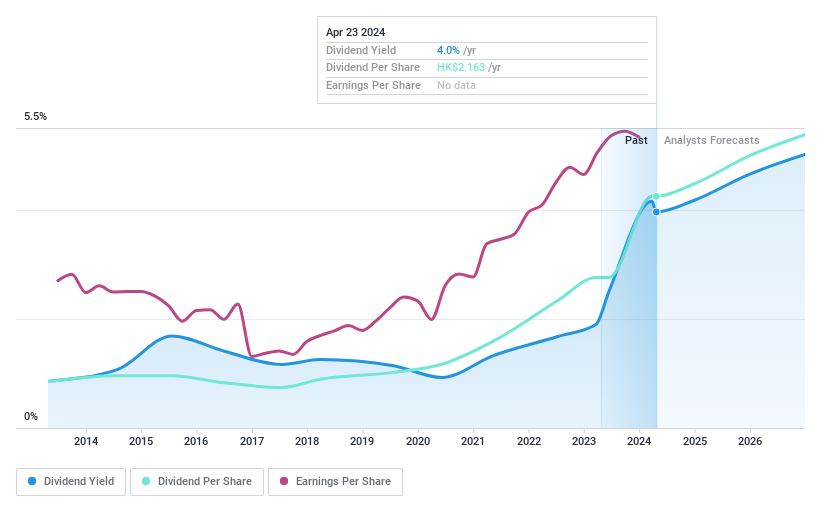

Dividend Yield: 4%

Tsingtao Brewery has demonstrated a stable dividend history over the past decade, with recent increases, including a proposed final dividend of RMB 2 per share for 2023. Despite its dividends being covered by earnings with a payout ratio of 63.7%, they are not well supported by cash flows due to a high cash payout ratio of 235.2%. While the company's earnings have grown significantly and are expected to continue growing, its current dividend yield of 3.96% remains low compared to Hong Kong's top dividend payers.

Click here to discover the nuances of Tsingtao Brewery with our detailed analytical dividend report.

Xingfa Aluminium Holdings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Xingfa Aluminium Holdings Limited operates as an investment holding company that manufactures and sells construction and industrial aluminium profiles in the People's Republic of China, with a market capitalization of approximately HK$3.20 billion.

Operations: Xingfa Aluminium Holdings generates CN¥14.12 billion from construction aluminium profiles and CN¥2.64 billion from industrial aluminium profiles.

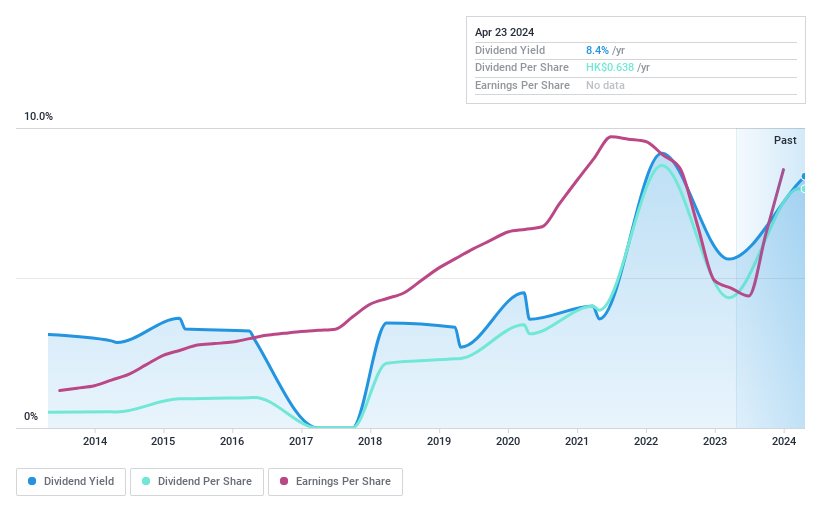

Dividend Yield: 8.4%

Xingfa Aluminium Holdings Limited has proposed a final dividend of HKD 0.64 per share for 2023, reflecting a positive shift in its financial stance with reported sales of CNY 17.35 billion and net income of CNY 804.17 million, both showing an uptick from the previous year. Despite this growth and a reasonable payout ratio of 30.4%, the company's dividend history over the last decade has been marked by volatility and inconsistency in payments, challenging its reliability as a steady dividend payer in Hong Kong's competitive market.

Click to explore a detailed breakdown of our findings in Xingfa Aluminium Holdings' dividend report.

Key Takeaways

Embark on your investment journey to our 74 Top Dividend Stocks selection here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1127 SEHK:168SEHK:98 and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance