Exploring Three US Stocks With Intrinsic Value Discounts Ranging From 12.8% To 37.3%

Amidst a buoyant U.S. stock market where indices like the Nasdaq and S&P 500 are hitting record highs, investors continue to seek value in undervalued stocks that may not yet reflect their intrinsic worth. In this context, identifying stocks trading below their fundamental value can offer attractive opportunities for those looking to invest in potential growth at a discount.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

Name | Current Price | Fair Value (Est) | Discount (Est) |

SouthState (NYSE:SSB) | $77.16 | $151.58 | 49.1% |

Hanover Bancorp (NasdaqGS:HNVR) | $16.21 | $31.99 | 49.3% |

AppLovin (NasdaqGS:APP) | $83.68 | $166.27 | 49.7% |

Fluence Energy (NasdaqGS:FLNC) | $15.88 | $31.52 | 49.6% |

Duckhorn Portfolio (NYSE:NAPA) | $7.18 | $14.23 | 49.6% |

USCB Financial Holdings (NasdaqGM:USCB) | $12.12 | $23.73 | 48.9% |

Vasta Platform (NasdaqGS:VSTA) | $3.00 | $5.86 | 48.8% |

HealthEquity (NasdaqGS:HQY) | $85.76 | $165.65 | 48.2% |

APi Group (NYSE:APG) | $36.52 | $70.70 | 48.3% |

Alnylam Pharmaceuticals (NasdaqGS:ALNY) | $247.61 | $494.74 | 50% |

We're going to check out a few of the best picks from our screener tool

Credit Acceptance

Overview: Credit Acceptance Corporation specializes in offering financing programs, along with related products and services across the United States, with a market capitalization of approximately $6.26 billion.

Operations: The company generates revenue primarily through financing programs and related products and services, totaling approximately $866.70 million.

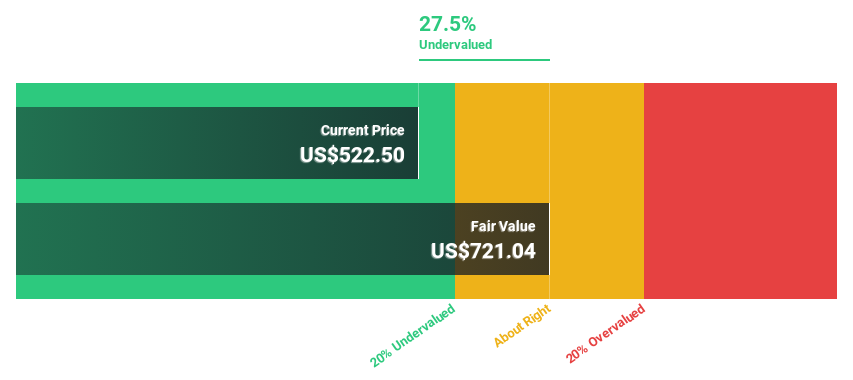

Estimated Discount To Fair Value: 27.5%

Credit Acceptance, with a current trading price of US$522.5, appears undervalued based on discounted cash flow analysis, suggesting a fair value of US$721.04—a significant discrepancy highlighting potential upside. Despite high debt levels, the company's revenue and earnings growth projections are robust, outpacing general market expectations significantly. Recent financial maneuvers include extending their credit facility's maturity and adjusting interest terms, alongside an active share buyback program demonstrating confidence in their financial health and stock value stability.

Datadog

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market capitalization of approximately $43.65 billion.

Operations: The company generates revenue primarily from its IT infrastructure segment, totaling approximately $2.26 billion.

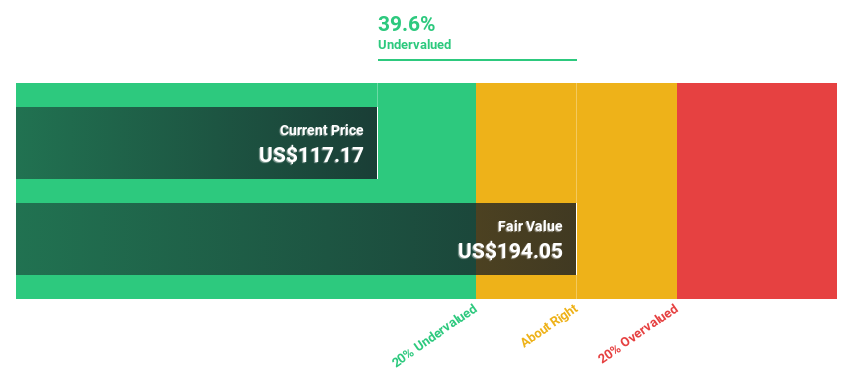

Estimated Discount To Fair Value: 37.3%

Datadog, currently priced at US$131.75, is trading significantly below its estimated fair value of US$209.98, suggesting it may be undervalued based on cash flows. Despite a revenue growth forecast of 19% per year—slightly under the 20% benchmark—it outpaces the US market average of 8.6%. Earnings are expected to grow by 24.56% annually, surpassing market expectations significantly. However, shareholder dilution over the past year and substantial insider selling in recent months could raise concerns about its valuation sustainability.

Arthur J. Gallagher

Overview: Arthur J. Gallagher & Co., operating globally, offers insurance and reinsurance brokerage, consulting, and third-party claims services in property and casualty, with a market capitalization of approximately $56.64 billion.

Operations: The company generates revenue primarily through its brokerage and risk management segments, with figures reported at $8.77 billion and $1.31 billion respectively.

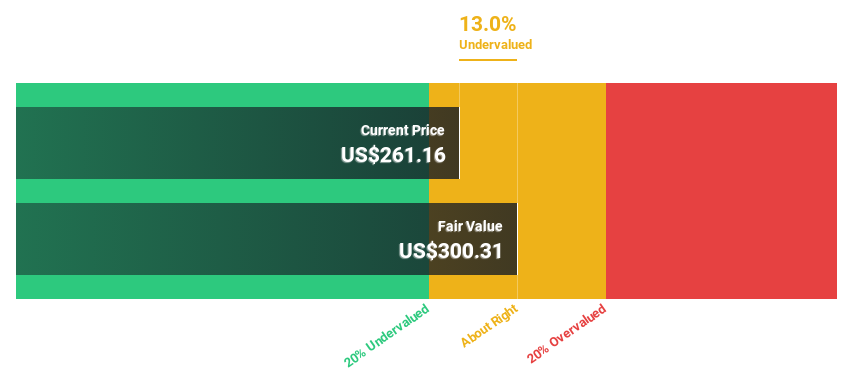

Estimated Discount To Fair Value: 12.8%

Arthur J. Gallagher, valued at US$262, is trading below its fair value of US$300.31, indicating potential undervaluation based on discounted cash flow analysis. Expected to grow earnings by 22.4% annually—outpacing the US market's 14.7%—AJG also shows promise with a high forecast Return on Equity of 22.7%. However, concerns arise from significant insider selling and a high debt level which may impact financial stability despite strong anticipated free cash flows earmarked for aggressive M&A activities outlined recently by CFO Douglas Howell.

Make It Happen

Unlock more gems! Our Undervalued US Stocks Based On Cash Flows screener has unearthed 182 more companies for you to explore.Click here to unveil our expertly curated list of 185 Undervalued US Stocks Based On Cash Flows.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqGS:CACC NasdaqGS:DDOG and NYSE:AJG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance