Exploring Three Undervalued Small Caps With Insider Action In Canada

In the past year, Canada's market has shown resilience with an 11% increase, despite a flat performance over the last seven days. In this context of promising annual earnings growth forecasted at 15%, identifying undervalued small caps with insider buying can be particularly compelling for investors looking for potential opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 8.7x | 3.0x | 46.51% | ★★★★★★ |

First National Financial | 8.6x | 2.9x | 49.35% | ★★★★★☆ |

Calfrac Well Services | 2.3x | 0.2x | 27.60% | ★★★★★☆ |

Nexus Industrial REIT | 2.8x | 3.4x | 14.41% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 30.97% | ★★★★☆☆ |

Bragg Gaming Group | NA | 1.4x | 21.69% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -88.73% | ★★★★☆☆ |

Primaris Real Estate Investment Trust | 11.9x | 3.1x | 32.81% | ★★★★☆☆ |

Russel Metals | 9.4x | 0.5x | -9.74% | ★★★☆☆☆ |

AutoCanada | 11.4x | 0.1x | -99.44% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

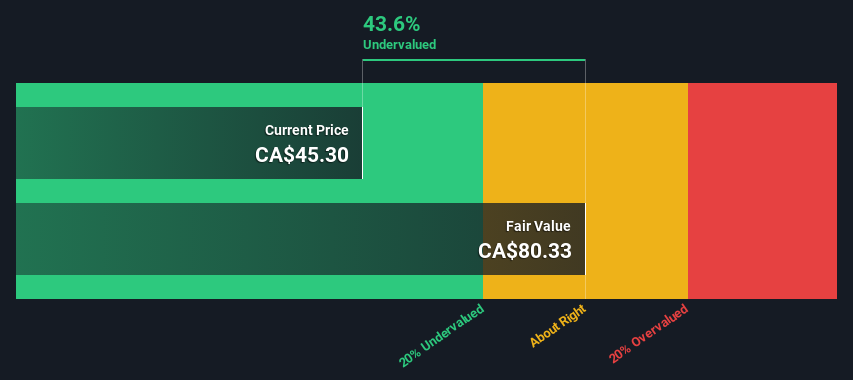

Exchange Income

Simply Wall St Value Rating: ★★★★☆☆

Overview: Exchange Income is a diversified company operating primarily in the manufacturing and aerospace & aviation sectors, with a market capitalization of approximately CA$1.57 billion.

Operations: Manufacturing and Aerospace & Aviation are the primary revenue contributors, generating CA$1.03 billion and CA$1.54 billion respectively. Gross profit margin has shown a variation, with recent figures around 34.45% as of the latest reporting period in 2024.

PE: 19.2x

Despite a challenging funding environment, Exchange Income's commitment to shareholder returns is evident through consistent dividend payments, recently affirming a $0.22 per share for July 2024. This aligns with their financial strategy even as net income dipped to CAD 4.53 million in Q1 2024 from CAD 6.86 million the previous year. Insider confidence is reflected in recent share purchases, underscoring belief in the company’s potential amidst external borrowing risks and a lack of customer deposit buffers. This paints a picture of cautious optimism for future growth within this sector player.

Click here to discover the nuances of Exchange Income with our detailed analytical valuation report.

Examine Exchange Income's past performance report to understand how it has performed in the past.

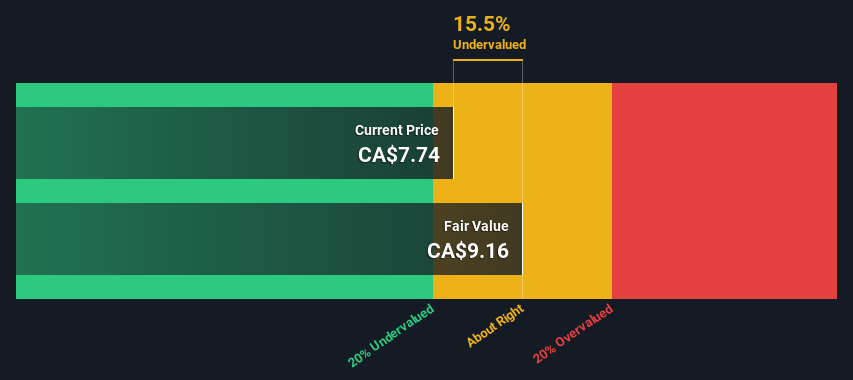

Nexus Industrial REIT

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nexus Industrial REIT is a real estate investment trust specializing in industrial properties, with a market capitalization of approximately CA$161.97 million.

Operations: The entity generates revenue from investment properties, totaling CA$161.97 million. It has observed a net income margin increase to 1.23% and a gross profit margin of 71.61%.

PE: 2.8x

Nexus Industrial REIT, a player in the Canadian industrial real estate sector, recently showcased strong Q1 earnings with sales hitting CA$41.6 million, up from CA$37.48 million year-over-year, and net income soaring to CA$43.67 million from CA$3.72 million. Despite this performance, forecasts suggest a potential earnings decline over the next three years. The company is also reshaping its portfolio by divesting non-core assets aimed at reducing debt—a move funded by expected sales of around $200 million in H2 2024. Amidst these strategic shifts, Nexus continues to affirm monthly dividends and has maintained consistent payouts recently set at $0.05333 per unit monthly—indicative of stable cash flow generation amidst operational transitions.

Russel Metals

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Russel Metals is a Canadian company specializing in metal distribution and services, including steel distribution and energy products, with a market capitalization of approximately CA$1.54 billion.

Operations: The company's revenue is primarily derived from its Metals Service Centers, contributing CA$2.95 billion, with additional significant income from Energy Field Stores and Steel Distributors totaling CA$982.20 million and CA$429 million respectively. Its gross profit margin has shown a notable increase over the years, reaching 0.213% by mid-2024, reflecting efficiency in managing the cost of goods sold relative to revenue generated.

PE: 9.4x

Russel Metals, reflecting a blend of financial resilience and strategic growth, recently expanded through an acquisition set to close in Q3 2024, enhancing its service center locations. Amidst fluctuating earnings with a Q1 net income drop to CAD 49.7 million from CAD 73.9 million year-over-year, the firm still boosted its quarterly dividend by 5%, signaling confidence in its financial health. Notably, insider confidence shone through as they recently purchased shares, underscoring belief in the company’s prospects despite external funding risks highlighted by reliance on borrowing over deposits. This move aligns with the company's active share repurchase program, where 300,000 shares were bought back for CAD 15 million within the first quarter of this year.

Turning Ideas Into Actions

Unlock more gems! Our Undervalued TSX Small Caps With Insider Buying screener has unearthed 26 more companies for you to explore.Click here to unveil our expertly curated list of 29 Undervalued TSX Small Caps With Insider Buying.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:EIF TSX:NXR.UN and TSX:RUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance