Exploring Three Undervalued Small Caps With Insider Action In The United Kingdom

The United Kingdom market has shown robust performance, climbing by 1.7% over the past week and achieving an 8.9% increase over the past 12 months, with earnings expected to grow by 13% annually. In such a thriving environment, identifying undervalued small-cap stocks with recent insider buying can signal potential opportunities for informed investors.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Norcros | 7.5x | 0.5x | 42.73% | ★★★★★☆ |

THG | NA | 0.4x | 33.73% | ★★★★★☆ |

Ultimate Products | 9.6x | 0.7x | 18.15% | ★★★★☆☆ |

Bytes Technology Group | 29.5x | 6.7x | 9.75% | ★★★★☆☆ |

Tracsis | 50.6x | 3.0x | 20.02% | ★★★★☆☆ |

Eurocell | 14.2x | 0.4x | 26.12% | ★★★★☆☆ |

Robert Walters | 20.8x | 0.3x | 34.81% | ★★★☆☆☆ |

Savills | 36.8x | 0.7x | 24.34% | ★★★☆☆☆ |

J D Wetherspoon | 21.6x | 0.4x | -64.07% | ★★★☆☆☆ |

Hochschild Mining | NA | 1.7x | 37.19% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

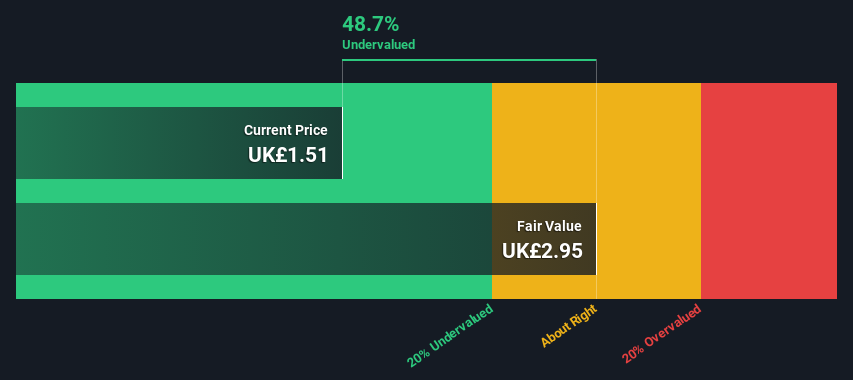

Aston Martin Lagonda Global Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for its high-performance vehicles, with a market capitalization of approximately £1.23 billion.

Operations: The Automotive segment generated £1.60 billion in revenue, with a gross profit of £637 million, reflecting a gross profit margin of 39.70%.

PE: -4.3x

Aston Martin Lagonda, a notable player in the UK's automotive sector, recently reported a decline in Q1 sales to £267.7 million and an increased net loss of £138.9 million. Despite these challenges, insider confidence remains as evidenced by recent board re-elections and executive appointments at their AGM on May 8, 2024. This move may signal potential for reversal from its current undervalued position as earnings are expected to grow significantly. Their funding strategy involves high-risk external borrowing, avoiding customer deposit dilution over the past year.

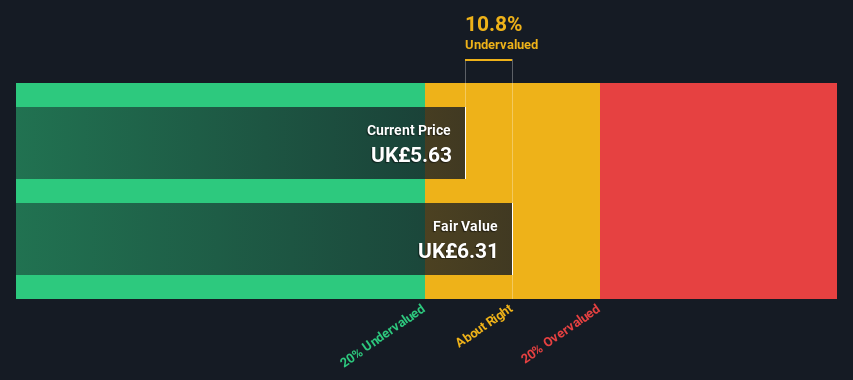

Bytes Technology Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a market capitalization of approximately £1.20 billion.

Operations: The IT Solutions Provider segment generated £207.02 million in revenue, with a gross profit margin of 70.42%. This reflects the cost efficiency in their business operations, despite increasing operating expenses over recent periods.

PE: 29.5x

Bytes Technology Group, a noteworthy player in the technology sector, recently showcased a robust financial performance with annual sales climbing to £207 million and net income reaching £47 million. This improvement reflects a strategic uptick in earnings per share from both basic and diluted perspectives. Complementing this financial growth, the company declared an increased special dividend of 8.7 pence per share, signaling strong profit after tax adjustments. With insider confidence demonstrated through recent purchases of shares by executives, this move underlines their belief in the company's ongoing value and potential for growth. Additionally, leadership stability is anticipated following the appointment of Sam Mudd as CEO, who is expected to drive further organic expansion based on her successful tenure at Phoenix Software Limited.

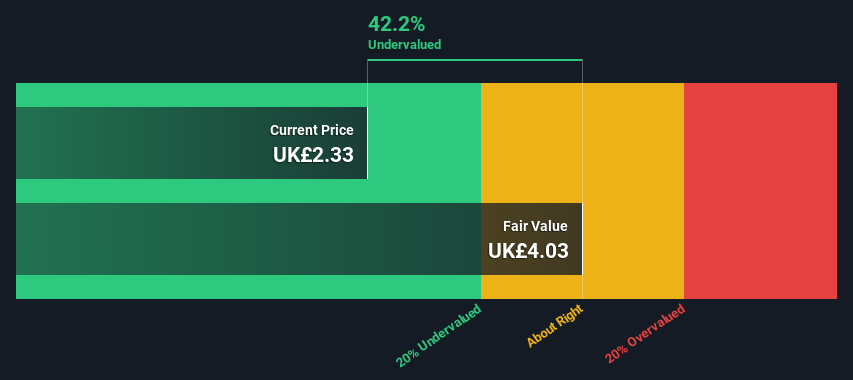

MONY Group

Simply Wall St Value Rating: ★★★★★★

Overview: MONY Group operates in various sectors including money, travel, cashback, insurance, and home services, with a market capitalization of approximately £1.2 billion.

Operations: The company generates revenue from multiple segments including Money (£100.20 million), Travel (£20.60 million), Cashback (£59.80 million), Insurance (£220 million), and Home Services (£39 million). Gross profit margins have shown a general upward trend, reaching approximately 0.68% by the end of the last reported period, reflecting an efficient control over cost of goods sold relative to revenue generated across its diverse service offerings.

PE: 16.8x

MONY Group, formerly known as Moneysupermarket.com, recently showcased a revenue increase to £115 million in Q1 2024 from £106 million the previous year. With earnings expected to rise by over 10% annually, this reflects a solid trajectory for the company. Notably, insiders have shown confidence through recent share purchases, signaling strong belief in the firm’s prospects. Despite relying solely on external borrowing—a higher risk funding method—the insider activity suggests an optimistic outlook for this evolving entity.

Dive into the specifics of MONY Group here with our thorough valuation report.

Understand MONY Group's track record by examining our Past report.

Taking Advantage

Take a closer look at our Undervalued Small Caps With Insider Buying list of 35 companies by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:AML LSE:BYIT and LSE:MONY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance