Exploring Three TSX Stocks With Estimated Discounts Ranging From 14.1% To 42.8%

As central banks like the Bank of Canada initiate rate cuts in response to softening economic indicators, investors might find opportunities in sectors less tied to rapid economic growth. In this context, identifying undervalued stocks on the TSX could be particularly compelling, as these assets may offer potential for appreciation when broader market conditions stabilize and improve.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$176.71 | CA$313.76 | 43.7% |

Trisura Group (TSX:TSU) | CA$40.53 | CA$80.18 | 49.4% |

Kinaxis (TSX:KXS) | CA$157.09 | CA$262.87 | 40.2% |

Kraken Robotics (TSXV:PNG) | CA$1.14 | CA$2.24 | 49.2% |

Endeavour Mining (TSX:EDV) | CA$30.50 | CA$53.35 | 42.8% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

Jamieson Wellness (TSX:JWEL) | CA$30.12 | CA$48.98 | 38.5% |

Green Thumb Industries (CNSX:GTII) | CA$15.61 | CA$28.18 | 44.6% |

Kits Eyecare (TSX:KITS) | CA$9.05 | CA$15.43 | 41.4% |

Capstone Copper (TSX:CS) | CA$10.23 | CA$16.76 | 39% |

Let's dive into some prime choices out of from the screener.

Alamos Gold

Overview: Alamos Gold Inc. is a company involved in acquiring, exploring, developing, and extracting precious metals primarily in Canada and Mexico, with a market capitalization of approximately CA$9.10 billion.

Operations: The company generates revenue from three primary segments: Mulatos (CA$442.80 million), Island Gold (CA$254.90 million), and Young-Davidson (CA$351.70 million).

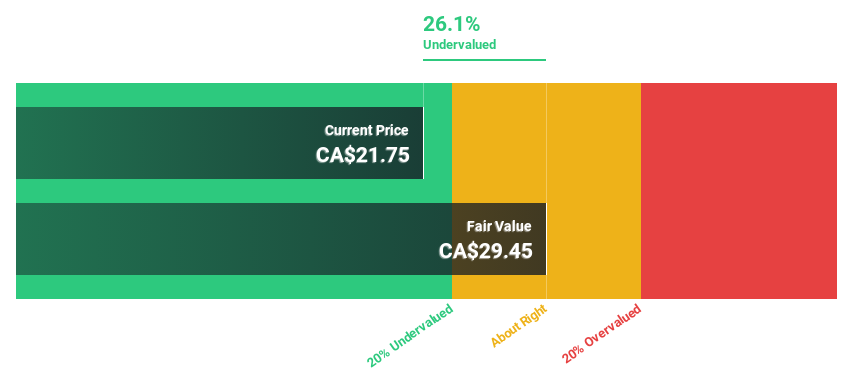

Estimated Discount To Fair Value: 14.1%

Alamos Gold, priced at CA$22.8, is trading 14.1% below its estimated fair value of CA$26.54, reflecting potential undervaluation based on cash flows. The company's earnings have surged by 116.7% over the past year and are projected to grow at a robust annual rate of 36.87%. Despite this strong growth trajectory, Alamos Gold's forecasted Return on Equity in three years is considered low at 15.3%, which may raise concerns about long-term profitability relative to equity levels.

Constellation Software

Overview: Constellation Software Inc. operates globally, focusing on acquiring, building, and managing vertical market software businesses primarily in Canada, the United States, and Europe, with a market capitalization of approximately CA$85.80 billion.

Operations: The company generates CA$8.84 billion from its software and programming segment.

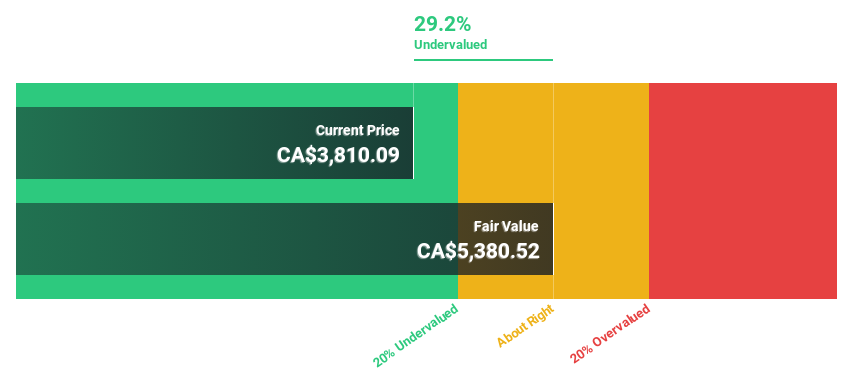

Estimated Discount To Fair Value: 27.3%

Constellation Software, valued at CA$4050, is currently trading well below its fair value of CA$5574.3, indicating significant undervaluation based on discounted cash flows. With a robust earnings growth forecast of 24.43% annually and revenue growth expected at 16.1% per year—both outpacing market averages—its financial outlook appears strong. However, the company carries a high level of debt and has seen considerable insider selling recently, which could be points of concern for potential investors.

Endeavour Mining

Overview: Endeavour Mining plc, along with its subsidiaries, is a gold mining company operating in West Africa with a market capitalization of CA$7.47 billion.

Operations: The company generates its revenue from four primary gold mines in West Africa: Ity Mine ($653.70 million), Mana Mine ($292.70 million), Houndé Mine ($611.30 million), and Sabodala Massawa Mine ($548.40 million).

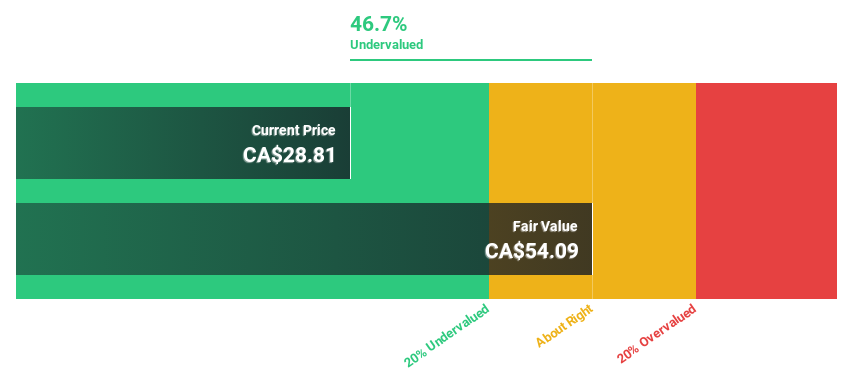

Estimated Discount To Fair Value: 42.8%

Endeavour Mining, priced at CA$30.5, trades significantly below its calculated fair value of CA$53.35, reflecting a deep discount and potential undervaluation based on cash flows. Despite this, the dividend coverage by earnings and free cash flows is weak. The company's revenue growth forecast of 10.1% annually outpaces the Canadian market average but remains below some industry peers' faster rates. Analyst consensus suggests a substantial upside in stock price expectations with anticipated profitability improvements within three years, aligning with above-average market growth predictions for earnings.

Turning Ideas Into Actions

Get an in-depth perspective on all 25 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:AGI TSX:EDV and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance