Exploring Three TSX Growth Companies With High Insider Ownership

The Canadian market has experienced a slight decline of 1.4% over the last week, yet it maintains a robust annual growth of 11%, with earnings expected to increase by 15% annually. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate that those who know the company best are confident in its future prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Payfare (TSX:PAY) | 15% | 57.7% |

Aritzia (TSX:ATZ) | 19.1% | 51.6% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

ROK Resources (TSXV:ROK) | 16.6% | 159.6% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Magna Mining (TSXV:NICU) | 10.5% | 95.1% |

Ivanhoe Mines (TSX:IVN) | 13.2% | 65.8% |

Almonty Industries (TSX:AII) | 12.4% | 82.1% |

Let's review some notable picks from our screened stocks.

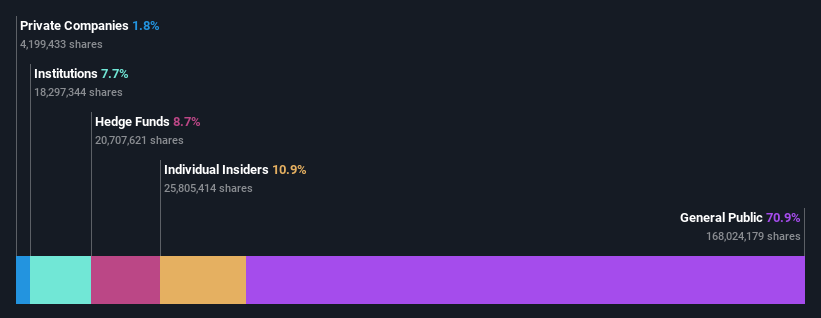

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult use, with a market capitalization of approximately CA$3.68 billion.

Operations: The company generates revenue primarily through its retail operations, which brought in CA$806.38 million, and its consumer packaged goods segment, which accounted for CA$583.78 million.

Insider Ownership: 10.9%

Earnings Growth Forecast: 23.5% p.a.

Green Thumb Industries, a growth-oriented company with significant insider ownership, reported robust first-quarter earnings with a substantial increase in sales and net income. The company's revenue is expected to grow by 10.3% annually, outpacing the Canadian market average. Although insider transactions were not voluminous, more shares were bought than sold recently. Additionally, Green Thumb continues its expansion with new dispensary openings in Florida, enhancing its market presence and community engagement through charitable initiatives.

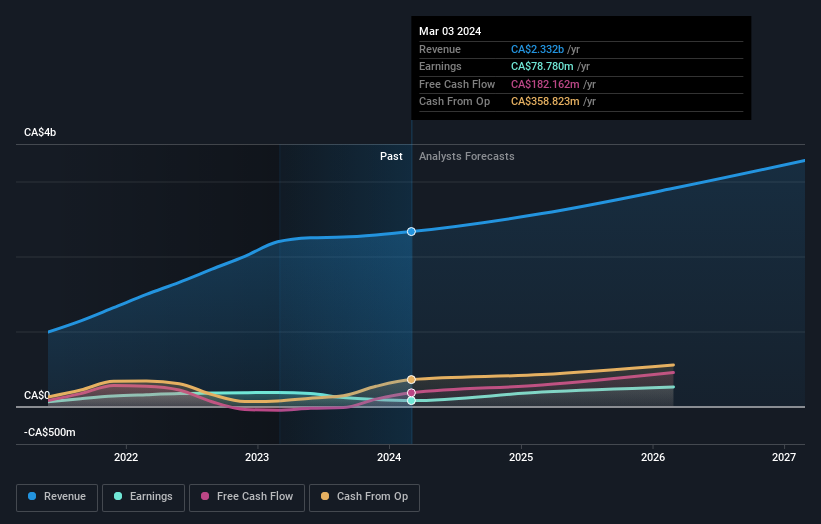

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. is a company that designs, develops, and sells women's apparel and accessories in the United States and Canada, with a market capitalization of approximately CA$3.79 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel and accessories segment.

Insider Ownership: 19.1%

Earnings Growth Forecast: 51.6% p.a.

Aritzia, a Canadian retailer, reported a decline in net income to CA$78.78 million from CA$187.59 million year-over-year, despite a slight increase in sales to CA$2.33 billion. The company forecasts revenue growth of 8% to 12% for fiscal 2025, aiming for up to CA$2.62 billion. Analysts predict substantial earnings growth of 51.6% annually over the next three years and see the stock trading significantly below its fair value, indicating potential upside despite current profit margin challenges at 3.4%.

Get an in-depth perspective on Aritzia's performance by reading our analyst estimates report here.

Our valuation report unveils the possibility Aritzia's shares may be trading at a discount.

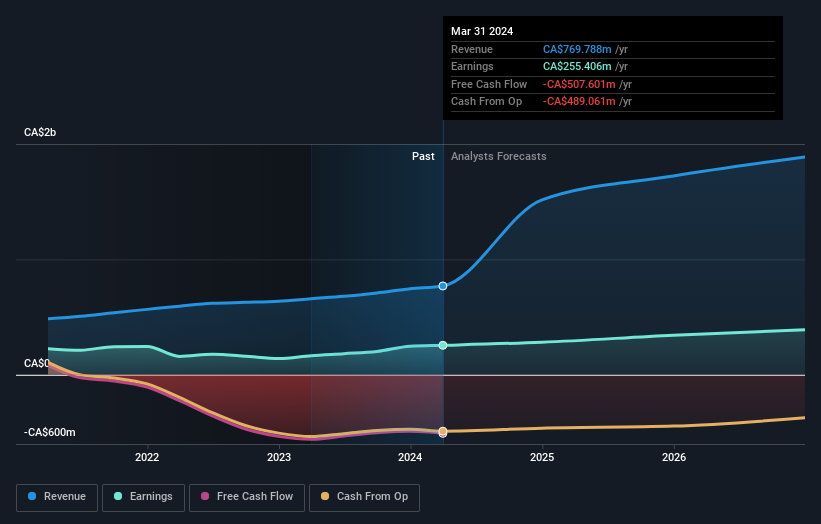

goeasy

Simply Wall St Growth Rating: ★★★★★☆

Overview: goeasy Ltd. operates in Canada, offering non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands with a market cap of CA$3.05 billion.

Operations: The company generates revenue through its easyhome and easyfinancial segments, totaling CA$153.99 million and CA$1.17 billion respectively.

Insider Ownership: 21.7%

Earnings Growth Forecast: 15.9% p.a.

goeasy Ltd., a Canadian company, is poised for notable growth with its revenue expected to increase by 32.7% annually, outpacing the national average of 7.2%. Despite this, earnings are set to rise at a slower pace of 15.95% per year. The firm's debt is poorly covered by operating cash flow, and dividends are not well supported by cash flows either. However, the stock trades at a significant discount to its estimated fair value and has seen robust earnings growth over the past year (54.3%). Recent executive appointments aim to strengthen leadership in key financial services sectors.

Seize The Opportunity

Discover the full array of 32 Fast Growing TSX Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTII TSX:ATZ and TSX:GSY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance