Exploring Three Swedish Growth Companies With High Insider Ownership On The Swedish Exchange

As global markets show signs of resilience and growth, with indices like the S&P 500 approaching record highs, Sweden's own economic landscape presents unique opportunities. In this context, exploring Swedish growth companies with high insider ownership could offer insightful perspectives on commitment and confidence from those closely tied to these enterprises.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.4% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Yubico (OM:YUBICO) | 37.5% | 43% |

We're going to check out a few of the best picks from our screener tool.

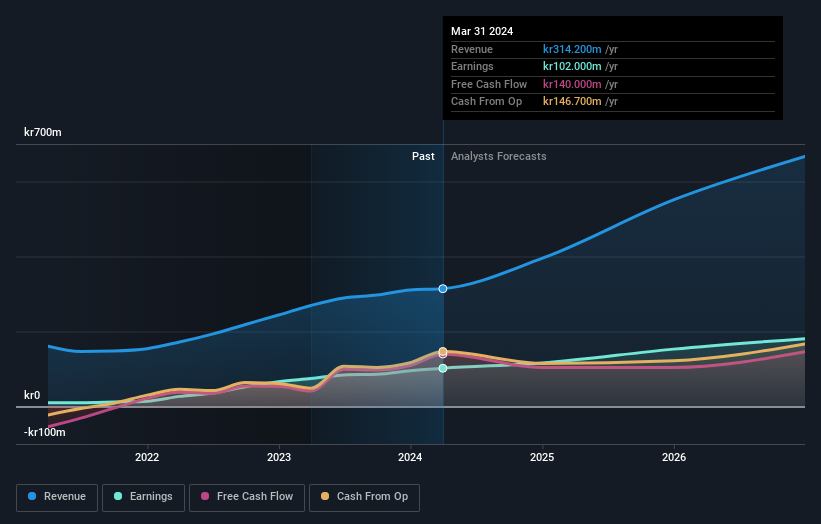

CTT Systems

Simply Wall St Growth Rating: ★★★★★★

Overview: CTT Systems AB, based in Sweden, specializes in designing, manufacturing, and selling aircraft humidity control systems globally, with a market capitalization of approximately SEK 4.10 billion.

Operations: The company generates its revenue from the design, manufacture, and sale of aircraft humidity control systems across Sweden, Denmark, France, the United States, and other international markets.

Insider Ownership: 16.9%

CTT Systems, a Swedish company with high insider ownership, shows promising growth prospects with earnings and revenue expected to significantly outpace market averages. The firm recently increased dividends and introduced new board members, signaling strong governance. Despite an unstable dividend track record, the company's financial performance is robust, with substantial year-over-year improvements in net income and sales forecasts indicating continued upward momentum. Trading below its estimated fair value suggests potential for appreciation.

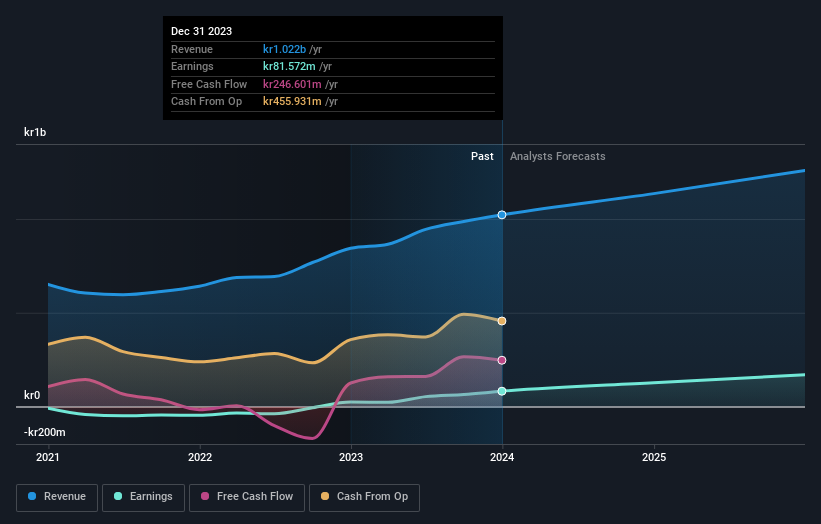

RaySearch Laboratories

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RaySearch Laboratories AB, a medical technology company based in Sweden, specializes in developing software solutions for cancer treatment and has a market capitalization of approximately SEK 4.23 billion.

Operations: The company generates its revenue primarily from healthcare software, achieving SEK 1.02 billion in sales.

Insider Ownership: 24.1%

RaySearch Laboratories, a Swedish company specializing in advanced radiation therapy technology, demonstrates strong growth potential with earnings expected to increase significantly. Recent strategic alliances and product innovations, such as the collaboration with C-RAD to enhance treatment planning systems and showcasing new technologies at industry events, underscore its commitment to advancing cancer treatment. Despite trading below its estimated fair value and a forecasted low return on equity in three years, the company's revenue growth is projected to outperform the Swedish market.

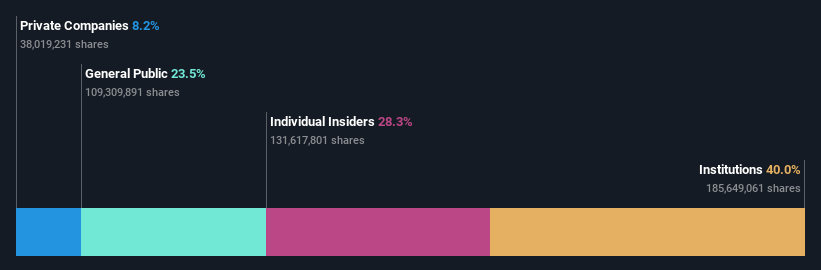

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 104.74 billion.

Operations: The company generates its revenue primarily through real estate rentals, amounting to SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish real estate company, has shown notable financial dynamics with a significant recovery in the first quarter of 2024, posting SEK 1.08 billion in net income after a loss the previous year. Despite this rebound, annual figures for 2023 reflect volatility with an overall net loss. The company's earnings are expected to grow by 33.92% annually over the next three years, outpacing the Swedish market's growth. However, revenue growth projections remain modest at 9.3% per year and recent shareholder dilution raises concerns about equity value retention despite high insider ownership which typically signals confidence in long-term prospects.

Where To Now?

Click this link to deep-dive into the 81 companies within our Fast Growing Swedish Companies With High Insider Ownership screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:CTT OM:RAY B and OM:SAGA A

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance