Exploring Three SIX Swiss Exchange Stocks With Intrinsic Value Discounts Ranging From 22.5% to 44.9%

The Switzerland market concluded on a robust note this Thursday, buoyed by broader European market optimism and expectations of an interest rate cut by the U.S. Federal Reserve. The benchmark SMI index reflected this positive sentiment, advancing notably. In such a market environment, identifying stocks that appear undervalued relative to their intrinsic value could offer interesting opportunities for investors looking to potentially enhance their portfolios.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

Sulzer (SWX:SUN) | CHF133.80 | CHF221.68 | 39.6% |

COLTENE Holding (SWX:CLTN) | CHF48.20 | CHF77.58 | 37.9% |

Burckhardt Compression Holding (SWX:BCHN) | CHF609.00 | CHF858.74 | 29.1% |

Temenos (SWX:TEMN) | CHF64.50 | CHF85.02 | 24.1% |

Barry Callebaut (SWX:BARN) | CHF1408.00 | CHF1827.66 | 23% |

Julius Bär Gruppe (SWX:BAER) | CHF52.54 | CHF95.20 | 44.8% |

Sonova Holding (SWX:SOON) | CHF276.80 | CHF468.87 | 41% |

SGS (SWX:SGSN) | CHF81.70 | CHF125.69 | 35% |

Comet Holding (SWX:COTN) | CHF380.50 | CHF589.01 | 35.4% |

Medartis Holding (SWX:MED) | CHF72.40 | CHF131.43 | 44.9% |

Let's uncover some gems from our specialized screener.

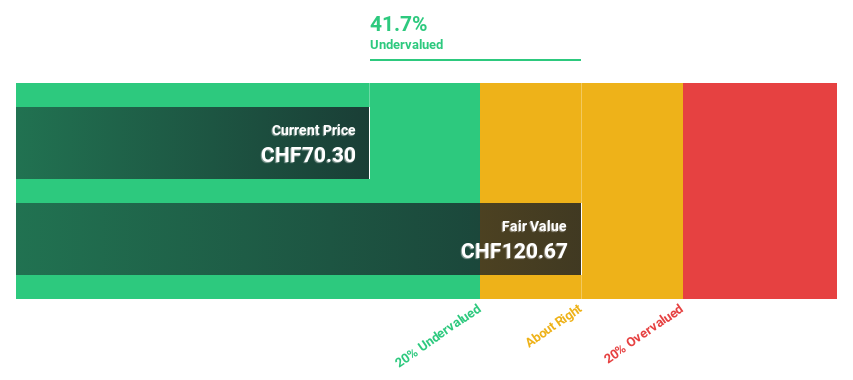

Medartis Holding

Overview: Medartis Holding AG is a global medical device company that specializes in developing, manufacturing, and selling implant solutions with a market capitalization of approximately CHF 983.24 million.

Operations: The company generates CHF 212.01 million from its medical products segment.

Estimated Discount To Fair Value: 44.9%

Medartis Holding is currently trading at CHF72.4, significantly below the estimated fair value of CHF131.43, marking a 44.9% undervaluation based on discounted cash flow analysis. Despite recent shareholder dilution and low forecasted return on equity at 7%, Medartis shows promising financial prospects with earnings expected to grow by 60.4% annually, outpacing the Swiss market's average of 8.3%. This growth is supported by revenue projections that exceed market trends, although impacted by large one-off items in its financial results.

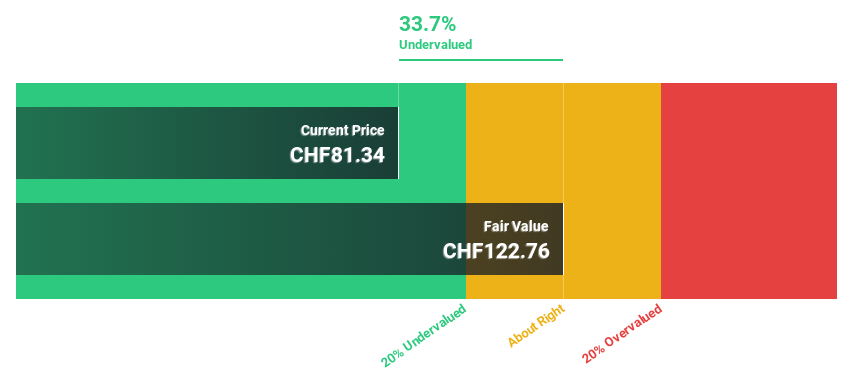

SGS

Overview: SGS SA is a company that offers inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 15.46 billion.

Operations: SGS's revenue is generated from five key segments: Business Assurance (CHF 746 million), Natural Resources (CHF 1.58 billion), Health & Nutrition (CHF 857 million), Connectivity & Products (CHF 1.25 billion), and Industries & Environment (CHF 2.19 billion).

Estimated Discount To Fair Value: 35%

SGS, priced at CHF81.7, appears undervalued with a discount of around 35% against a fair value of CHF125.69 based on cash flow analysis. Despite high debt levels and dividends not well-covered by earnings, SGS's earnings are expected to grow by 9.8% annually, outperforming the Swiss market's 8.3%. Recent corporate guidance confirms mid to high single-digit organic growth for 2024, with first-quarter sales showing strong organic growth despite negative currency impacts.

The analysis detailed in our SGS growth report hints at robust future financial performance.

Click here and access our complete balance sheet health report to understand the dynamics of SGS.

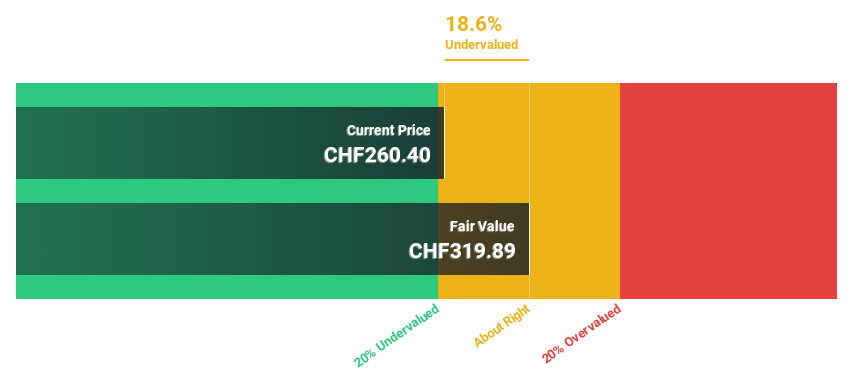

Sika

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the building sector and automotive industry globally, with a market capitalization of approximately CHF 42.08 billion.

Operations: The company generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 22.5%

Sika, trading at CHF 262.30, is perceived as undervalued by more than 20%, with a fair value estimated at CHF 338.61 based on discounted cash flows. Despite a high debt load, Sika's revenue growth forecast of 6.1% annually outpaces the Swiss market's 4.5%, and its earnings are expected to increase by 12.7% per year—higher than the market average of 8.3%. Recent expansions in China and Peru should bolster its position in key markets, supporting this growth trajectory.

According our earnings growth report, there's an indication that Sika might be ready to expand.

Dive into the specifics of Sika here with our thorough financial health report.

Turning Ideas Into Actions

Click this link to deep-dive into the 14 companies within our Undervalued SIX Swiss Exchange Stocks Based On Cash Flows screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:MED SWX:SGSN and SWX:SIKA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance