Exploring Three SGX Stocks With Intrinsic Value Discounts Ranging From 43% To 47.2%

Amidst a landscape of heightened vigilance against financial fraud, as highlighted by initiatives from major banks like National Australia Bank, investors in the Singapore market may find reassurance in focusing on fundamentally sound investments. In this context, identifying stocks trading below their intrinsic value can offer a prudent strategy, especially when market conditions underscore the need for careful investment choices.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

Name | Current Price | Fair Value (Est) | Discount (Est) |

Singapore Technologies Engineering (SGX:S63) | SGD4.28 | SGD8.10 | 47.2% |

LHN (SGX:41O) | SGD0.33 | SGD0.37 | 11.8% |

Hongkong Land Holdings (SGX:H78) | US$3.20 | US$5.79 | 44.7% |

Seatrium (SGX:5E2) | SGD1.41 | SGD2.58 | 45.3% |

Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD0.935 | SGD1.65 | 43.3% |

Digital Core REIT (SGX:DCRU) | US$0.61 | US$1.11 | 45.2% |

Nanofilm Technologies International (SGX:MZH) | SGD0.825 | SGD1.45 | 43% |

Let's review some notable picks from our screened stocks

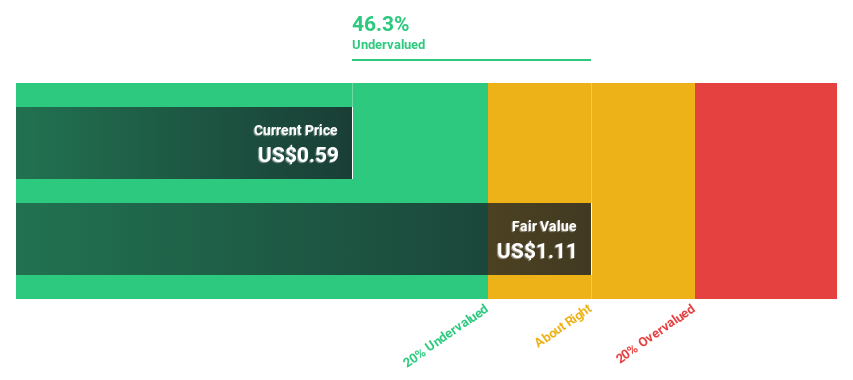

Digital Core REIT

Overview: Digital Core REIT (SGX: DCRU) operates as a pure-play data centre real estate investment trust in Singapore, sponsored by Digital Realty, and has a market capitalization of approximately S$756.40 million.

Operations: The company generates its revenue primarily from the commercial real estate investment trust (REIT) segment, which amounted to S$71.10 million.

Estimated Discount To Fair Value: 45.2%

Digital Core REIT is perceived as undervalued based on discounted cash flow analysis, trading at S$0.61 against an estimated fair value of S$1.11. Despite recent operational challenges, including a drop from the S&P Global BMI Index and a slight decline in quarterly sales to US$24.58 million from US$26.78 million year-over-year, the REIT has initiated share repurchases signaling confidence in its valuation. Forecasted revenue growth at 9.7% annually outpaces the Singapore market's 3.6%, with profitability expected to improve significantly within three years. However, its dividend reliability remains uncertain due to an unstable track record.

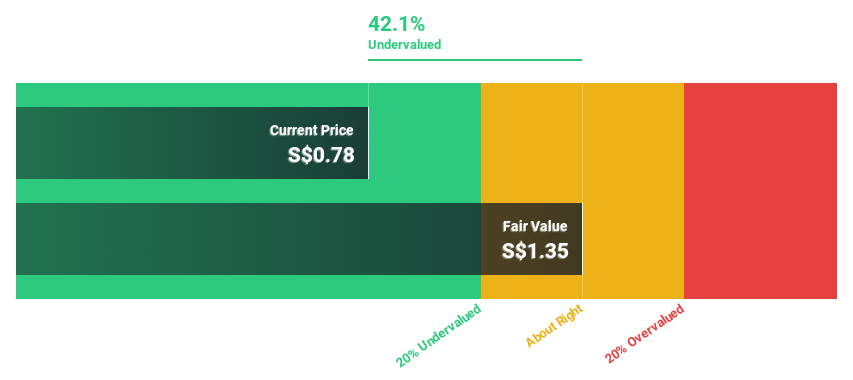

Nanofilm Technologies International

Overview: Nanofilm Technologies International Limited offers nanotechnology solutions across Singapore, China, Japan, and Vietnam with a market capitalization of approximately SGD 537.08 million.

Operations: The company generates revenue through four primary segments: Sydrogen (SGD 1.05 million), Nanofabrication (SGD 16.05 million), Advanced Materials (SGD 141.54 million), and Industrial Equipment (SGD 37.17 million).

Estimated Discount To Fair Value: 43%

Nanofilm Technologies International is currently priced at SGD0.83, significantly below the estimated fair value of SGD1.45, reflecting a potential undervaluation based on cash flows. The company's earnings are projected to grow by 50.7% annually, outpacing the Singapore market forecast of 8.9%. Despite this robust growth projection, its return on equity is expected to remain modest at around 9% in three years, and recent profit margins have decreased sharply from last year's levels.

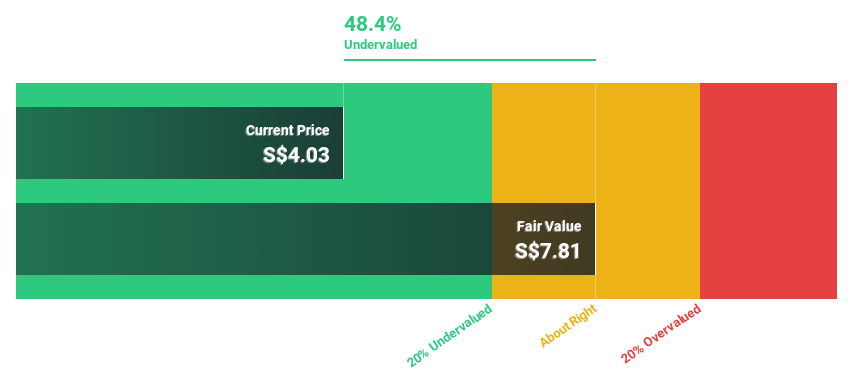

Singapore Technologies Engineering

Overview: Singapore Technologies Engineering Ltd is a global technology, defense, and engineering group with a market capitalization of SGD 13.35 billion.

Operations: The company's revenue is divided among three primary segments: Commercial Aerospace (SGD 3.97 billion), Urban Solutions & Satcom (SGD 1.98 billion), and Defence & Public Security (SGD 4.29 billion).

Estimated Discount To Fair Value: 47.2%

Singapore Technologies Engineering, trading at S$4.28, is significantly undervalued with an estimated fair value of S$8.10 based on discounted cash flows. Its earnings are expected to grow by 11.6% annually, surpassing the Singapore market's average of 8.9%. However, it carries a high level of debt and has an unstable dividend record. Recent share buybacks and consistent dividends reflect proactive capital management despite slower revenue growth projections at 6.9% annually compared to the market's 3.6%.

Taking Advantage

Get an in-depth perspective on all 7 Undervalued SGX Stocks Based On Cash Flows by using our screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:DCRU SGX:MZH and SGX:S63.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance