Exploring Three SEHK Growth Companies With High Insider Ownership

As global markets navigate through mixed economic signals and fluctuating indices, the Hong Kong market has shown resilience with the Hang Seng Index recently experiencing an uplift. This context sets a compelling stage for examining growth companies in Hong Kong, particularly those with high insider ownership which can indicate strong confidence in the company's future from those who know it best.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.2% | 43% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 75.4% |

Beijing Airdoc Technology (SEHK:2251) | 27.7% | 83.9% |

Lianlian DigiTech (SEHK:2598) | 19.4% | 84.2% |

Underneath we present a selection of stocks filtered out by our screen.

DPC Dash

Simply Wall St Growth Rating: ★★★★★☆

Overview: DPC Dash Ltd operates a chain of fast-food restaurants across the People's Republic of China, with a market capitalization of approximately HK$7.66 billion.

Operations: The company generates revenue primarily from its fast-food restaurant operations, totaling CN¥3.05 billion.

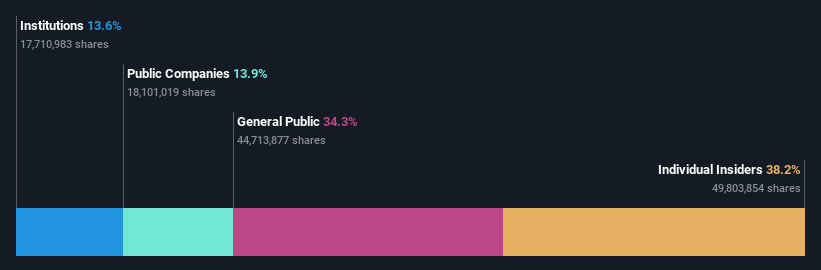

Insider Ownership: 38.2%

DPC Dash, a Hong Kong-based company, is experiencing a significant phase of growth with high insider ownership. In the past three months, insiders have notably increased their holdings, reflecting confidence in the company's trajectory. DPC Dash has shown robust revenue growth at 24.4% annually and is projected to continue this trend above market expectations. Despite recent financial challenges resulting in a net loss of CNY 26.6 million for 2023, improvements are evident compared to the previous year's larger losses. The firm is on track to become profitable within three years, supported by an anticipated earnings growth rate of 89.74% per year.

IGG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across regions including Asia, North America, and Europe, with a market capitalization of approximately HK$3.42 billion.

Operations: The company generates revenue primarily from the development and operation of online games, totaling approximately HK$5.27 billion.

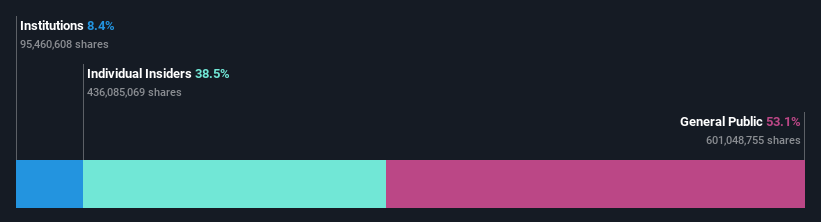

Insider Ownership: 38.5%

IGG Inc, a Hong Kong-based company, recently turned profitable with its latest annual earnings reporting significant recovery to HK$73.05 million in net income from a previous loss. Analysts project robust earnings growth of 51.2% annually over the next three years, outpacing the local market's average. Despite slower revenue growth at 4.2% yearly, IGG is considered undervalued by analysts, trading 24.3% below estimated fair value. Recent corporate governance enhancements and leadership appointments signal a strengthening of oversight and strategic direction.

Delve into the full analysis future growth report here for a deeper understanding of IGG.

Our expertly prepared valuation report IGG implies its share price may be lower than expected.

Linklogis

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Linklogis Inc. is an investment holding company specializing in supply chain finance technology and data-driven solutions in Mainland China, with a market capitalization of HK$4.33 billion.

Operations: The company generates revenue primarily through its supply chain finance technology solutions, including FI Cloud and Anchor Cloud which together brought in CN¥823.55 million, and its emerging solutions like Cross-Border Cloud and SME Credit Tech Solutions totaling CN¥44.22 million.

Insider Ownership: 26.7%

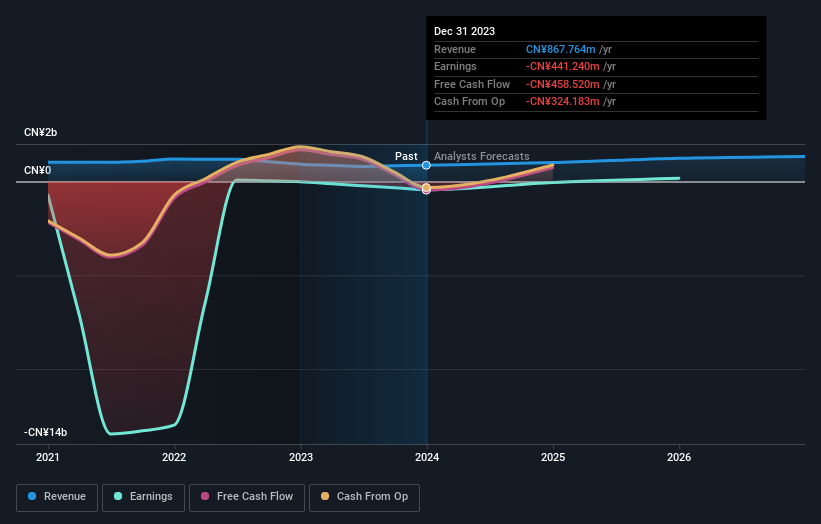

Linklogis Inc., despite a challenging financial year with a substantial net loss of CNY 441.24 million, is anticipated to pivot towards profitability within three years, showcasing potential growth above market expectations. The company's revenue growth forecast at 15.2% annually surpasses the Hong Kong market average of 7.8%. Additionally, Linklogis has initiated a significant share repurchase program valued at $100 million and proposed a special dividend, indicating confidence in future financial health and commitment to shareholder value.

Where To Now?

Unlock more gems! Our Fast Growing SEHK Companies With High Insider Ownership screener has unearthed 48 more companies for you to explore.Click here to unveil our expertly curated list of 51 Fast Growing SEHK Companies With High Insider Ownership.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1405 SEHK:799 and SEHK:9959.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance