Exploring Three KRX Stocks With Estimated Intrinsic Discounts Ranging From 16.2% To 36.7%

The South Korean market has shown positive momentum, rising 1.3% over the last week and achieving a 5.8% increase over the past twelve months with earnings projected to grow by 30% annually. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could be particularly compelling for investors looking for potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In South Korea

Name | Current Price | Fair Value (Est) | Discount (Est) |

Caregen (KOSDAQ:A214370) | ₩22450.00 | ₩44549.16 | 49.6% |

Anapass (KOSDAQ:A123860) | ₩25250.00 | ₩48486.62 | 47.9% |

KidariStudio (KOSE:A020120) | ₩4175.00 | ₩7430.73 | 43.8% |

Global Tax Free (KOSDAQ:A204620) | ₩3730.00 | ₩6225.56 | 40.1% |

Revu (KOSDAQ:A443250) | ₩11300.00 | ₩20993.58 | 46.2% |

Lutronic (KOSDAQ:A085370) | ₩36700.00 | ₩63217.94 | 41.9% |

SK Biopharmaceuticals (KOSE:A326030) | ₩78400.00 | ₩149728.31 | 47.6% |

Genomictree (KOSDAQ:A228760) | ₩23000.00 | ₩39815.34 | 42.2% |

NEXON Games (KOSDAQ:A225570) | ₩15650.00 | ₩28024.93 | 44.2% |

Ray (KOSDAQ:A228670) | ₩12010.00 | ₩20603.35 | 41.7% |

Below we spotlight a couple of our favorites from our exclusive screener

ISU Petasys

Overview: ISU Petasys Co., Ltd. is a global manufacturer and seller of printed circuit boards (PCBs), with a market capitalization of approximately ₩3.64 billion.

Operations: The company's revenue is primarily derived from the global manufacture and sale of printed circuit boards (PCBs).

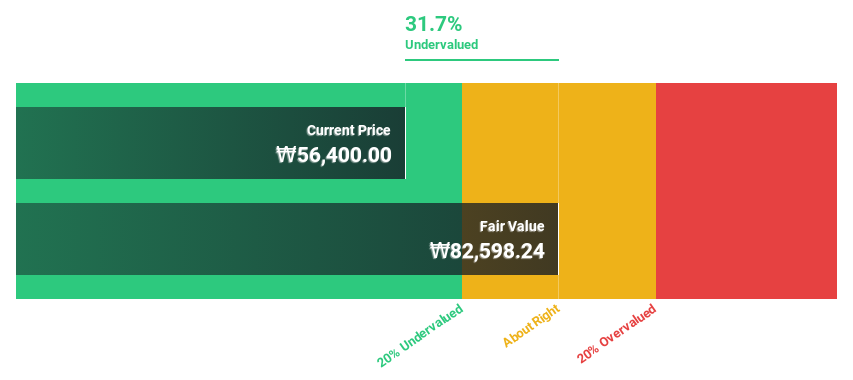

Estimated Discount To Fair Value: 36.7%

ISU Petasys, currently priced at ₩57600, appears undervalued with a fair value estimate of ₩91014.69. The company's revenue is expected to grow by 16.2% annually, surpassing the South Korean market average of 10.8%. Earnings are also projected to increase significantly at an annual rate of 41.48% over the next three years. However, its debt is not well covered by operating cash flows and profit margins have declined from 15.1% last year to 7%.

The analysis detailed in our ISU Petasys growth report hints at robust future financial performance.

HANMI Semiconductor

Overview: HANMI Semiconductor Co., Ltd. is a company based in South Korea that manufactures and sells semiconductor equipment both domestically and internationally, with a market capitalization of approximately ₩16.27 billion.

Operations: The company generates its revenue from the manufacture and sale of semiconductor equipment across domestic and international markets.

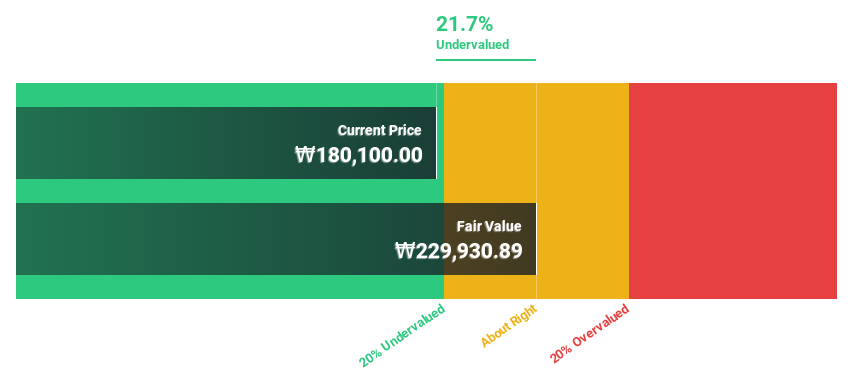

Estimated Discount To Fair Value: 34.1%

HANMI Semiconductor, trading at ₩168600, is valued below the estimated fair value of ₩255695.63, indicating potential undervaluation. The company's revenue and earnings are expected to grow by 53.1% and 33.54% annually, outpacing the Korean market projections of 10.8% and 29.6%, respectively. Despite recent negative sales results and a drop in net income as reported in Q1 2024, strategic share buybacks aim to stabilize its volatile stock price and enhance shareholder value.

APR

Overview: APR Co., Ltd, operating under the ticker KOSE:A278470, is a company that manufactures and sells cosmetic products for both men and women, with a market capitalization of approximately ₩2.88 billion.

Operations: The company generates its revenue from the manufacture and sale of cosmetic products targeted at both male and female consumers.

Estimated Discount To Fair Value: 16.2%

APR Co., Ltd., priced at ₩378,000, trades below its fair value of ₩451,118.9 and analyst targets suggest a potential increase. Recent buyback plans aim to stabilize its volatile stock price and boost shareholder value. Earnings are expected to grow by 25.3% annually over the next three years, outperforming the Korean market's growth forecast. Revenue growth also exceeds market expectations at 22.8% per year, supported by high-quality earnings and a robust return on equity forecast at 35.7%.

The growth report we've compiled suggests that APR's future prospects could be on the up.

Navigate through the intricacies of APR with our comprehensive financial health report here.

Next Steps

Click this link to deep-dive into the 36 companies within our Undervalued KRX Stocks Based On Cash Flows screener.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A007660KOSE:A042700 and KOSE:A278470.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance