Exploring Three Indian Exchange Growth Companies With Substantial Insider Ownership

The Indian stock market is poised for a significant upswing, buoyed by the anticipation of continued governance under Prime Minister Narendra Modi, with exit polls predicting a strong electoral win. This optimism is reflected in the Sensex and Nifty 50 indices, which are expected to open at record highs. In such a buoyant market environment, companies with high insider ownership can be particularly compelling as these stakeholders often have a deep commitment to the company's long-term success and are likely aligned with broader investor interests amidst promising economic reforms.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 27.9% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Aether Industries (NSEI:AETHER) | 31.1% | 32% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 35% |

Here's a peek at a few of the choices from the screener.

AU Small Finance Bank

Simply Wall St Growth Rating: ★★★★★☆

Overview: AU Small Finance Bank Limited operates in India, offering a range of banking and financial services with a market capitalization of approximately ₹485.21 billion.

Operations: The bank generates revenue primarily through three segments: Treasury (₹17.04 billion), Retail Banking (₹91.18 billion), and Wholesale Banking (₹11.61 billion).

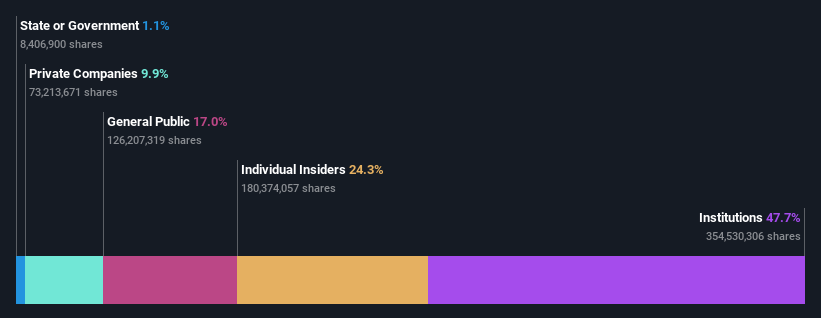

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.9% p.a.

AU Small Finance Bank has demonstrated robust growth with earnings increasing by 21.9% annually over the past five years, and both revenue and earnings are expected to grow by approximately 24% annually, outpacing the Indian market's average. However, recent regulatory penalties for procedural lapses highlight some operational challenges. Insider transactions have not been substantial in volume, suggesting cautious optimism from those closest to the company’s operations.

Jupiter Wagons

Simply Wall St Growth Rating: ★★★★★★

Overview: Jupiter Wagons Limited is a company based in India that manufactures and sells mobility solutions both domestically and internationally, with a market capitalization of approximately ₹24.83 billion.

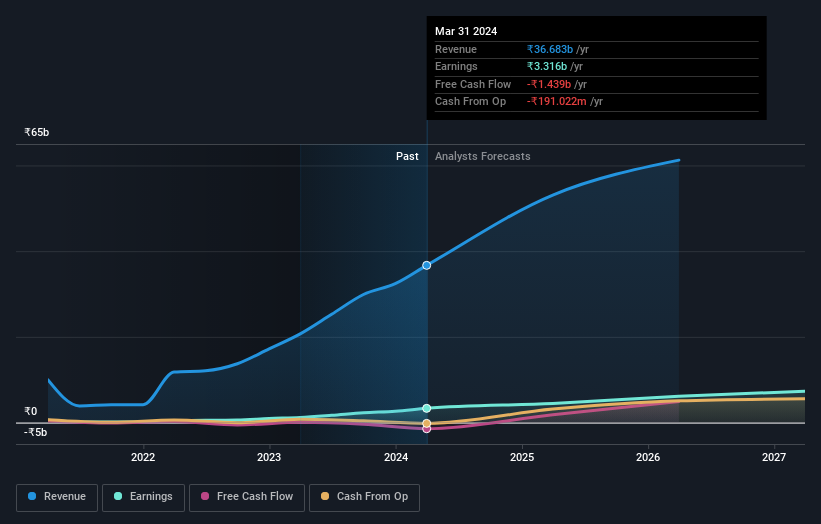

Operations: The company generates revenue primarily from the auto manufacturers segment, totaling ₹36.44 billion.

Insider Ownership: 11.1%

Revenue Growth Forecast: 21.6% p.a.

Jupiter Wagons Limited has shown a very high earnings growth of 174.5% over the past year with expectations to maintain a strong pace, projected at 27.21% annually. Revenue is also anticipated to grow at 21.6% per year, outstripping the Indian market's average. Despite this robust financial performance, the company's share price has been highly volatile recently. Additionally, there have been significant corporate actions including a substantial INR 1.35 billion private placement and strategic acquisitions aimed at expanding its market presence.

Titagarh Rail Systems

Simply Wall St Growth Rating: ★★★★★☆

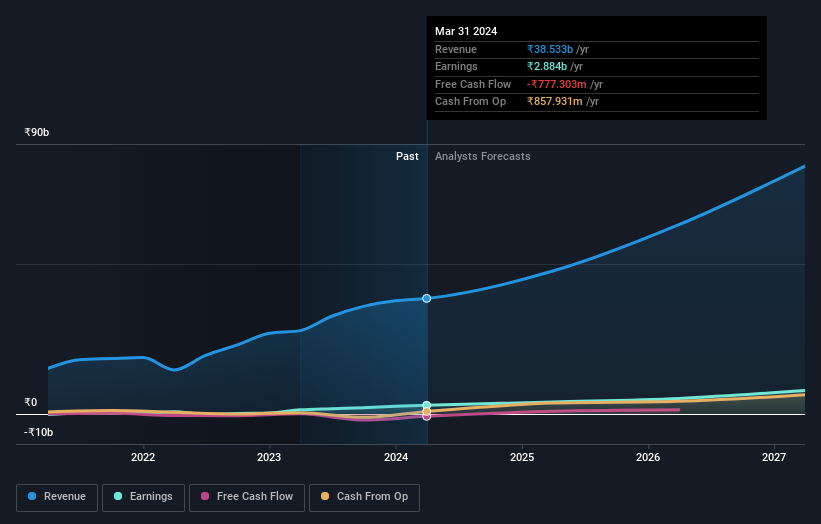

Overview: Titagarh Rail Systems Limited, operating both domestically and internationally, specializes in the manufacturing and sales of freight and passenger rail systems, with a market capitalization of approximately ₹190.66 billion.

Operations: The company's revenue is derived from two primary segments: Passenger Rail Systems generating ₹4.36 billion and Freight Rail Systems, which includes shipbuilding, bridges, and defense, contributing ₹34.18 billion.

Insider Ownership: 24.3%

Revenue Growth Forecast: 24.2% p.a.

Titagarh Rail Systems Limited has demonstrated robust growth with a 107.3% increase in earnings over the past year and is expected to continue this trend with forecasts suggesting a 28.83% annual growth in earnings and 24.2% in revenue, outpacing the Indian market average significantly. However, despite high insider purchases recently, volumes were not substantial, and shareholder dilution occurred over the past year. The recent elevation of Shri Prithish Chowdhary to Deputy Managing Director could further enhance strategic initiatives and client relationships within their rail systems vertical.

Key Takeaways

Navigate through the entire inventory of 79 Fast Growing Indian Companies With High Insider Ownership here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:AUBANKNSEI:JWL and NSEI:TITAGARH

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance