Exploring Three Growth Companies With High Insider Ownership On The KRX

The South Korean stock market has shown resilience, with the KOSPI recently ticking higher and resting just above the 2,705-points plateau. Amidst this modest uptrend and mixed global cues, investors might find particular interest in growth companies with high insider ownership, as these firms often demonstrate alignment of interests between shareholders and management—a reassuring factor in uncertain times.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

SamyoungLtd (KOSE:A003720) | 25% | 30.4% |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

HANA Micron (KOSDAQ:A067310) | 19.8% | 76.8% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here we highlight a subset of our preferred stocks from the screener.

Advanced Nano Products

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Advanced Nano Products Co., Ltd. is a South Korean company engaged in the manufacture and sale of high-tech materials for applications including displays, semiconductors, secondary batteries, and solar cells, with a market capitalization of approximately ₩1.44 billion.

Operations: The company generates revenue through the production and sale of high-tech materials for displays, semiconductors, secondary batteries, and solar cells.

Insider Ownership: 23.9%

Advanced Nano Products, a South Korean growth company with significant insider ownership, is navigating mixed financial waters. While its revenue growth is robust at 54.2% annually, outpacing the local market's 10.3%, its profit margins have declined from 25.1% to 15.3% over the past year. Earnings are expected to grow by 22.24% annually, though this lags behind the broader Korean market forecast of 29.1%. Recent earnings reports reflect a downturn in net income and basic earnings per share as of Q1 2024 compared to the previous year.

ALTEOGEN

Simply Wall St Growth Rating: ★★★★★★

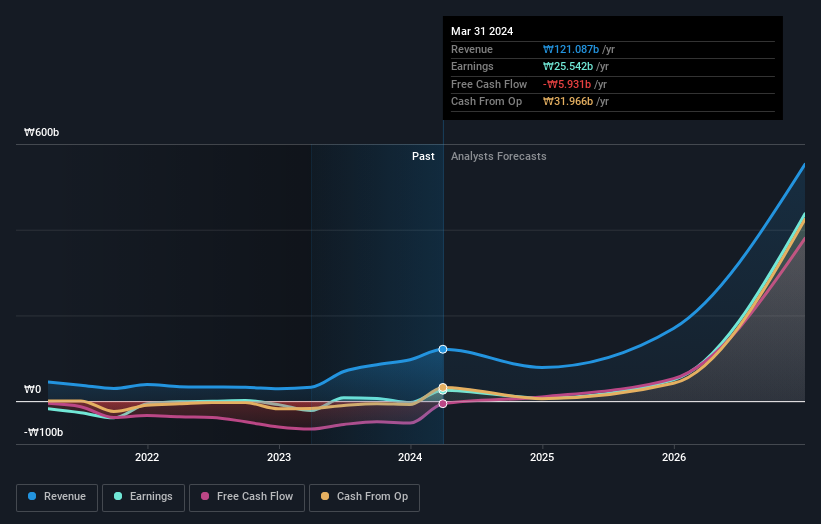

Overview: ALTEOGEN Inc. is a biotechnology firm specializing in the development of long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market capitalization of approximately ₩13.44 billion.

Operations: The company generates revenue through the development of long-acting biobetters, proprietary antibody-drug conjugates, and biosimilars.

Insider Ownership: 26.6%

ALTEOGEN, a South Korean growth company with high insider ownership, showcases promising financial prospects despite some challenges. Its earnings are expected to surge by 73.06% annually, significantly outpacing the local market forecast of 29.1%. Additionally, revenue is projected to grow at 48.3% per year, well above the market average of 10.3%. However, shareholder dilution occurred over the past year and its share price has been highly volatile recently. Trading at 68.1% below its estimated fair value suggests potential undervaluation.

APR

Simply Wall St Growth Rating: ★★★★★☆

Overview: APR Co., Ltd. is a company based in South Korea that specializes in manufacturing and selling cosmetic products for both men and women, with a market capitalization of approximately ₩2.55 billion.

Operations: The business primarily generates revenue through the sale of cosmetic products tailored for both male and female consumers.

Insider Ownership: 34.2%

APR Co., Ltd. in South Korea, characterized by high insider ownership, presents a mixed financial outlook. The company's earnings are set to grow by 26.21% annually, slightly underperforming the broader Korean market growth rate of 29.1%. However, its revenue growth forecast at 23.2% annually exceeds the market average significantly. Despite trading 20.5% below its estimated fair value and expectations of a substantial rise in stock price by 20.4%, APR faces challenges with high share price volatility recently observed.

Dive into the specifics of APR here with our thorough growth forecast report.

Our expertly prepared valuation report APR implies its share price may be lower than expected.

Make It Happen

Access the full spectrum of 82 Fast Growing KRX Companies With High Insider Ownership by clicking on this link.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A121600 KOSDAQ:A196170 and KOSE:A278470.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance