Exploring Smartsens Technology (Shanghai) And Two Other Growth Leaders With High Insider Ownership

As global markets show signs of stabilization and growth, particularly with easing inflation in major economies, China's market presents a unique landscape. The recent government measures to bolster the property sector and mixed economic signals underline the complexities of investing in this region. In such an environment, identifying growth companies with high insider ownership can offer investors potential resilience and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

YanKer shop FoodLtd (SZSE:002847) | 29.2% | 23.9% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.5% |

Jiangsu Cnano Technology (SHSE:688116) | 18.5% | 33.9% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 69.2% |

Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's uncover some gems from our specialized screener.

Smartsens Technology (Shanghai)

Simply Wall St Growth Rating: ★★★★★☆

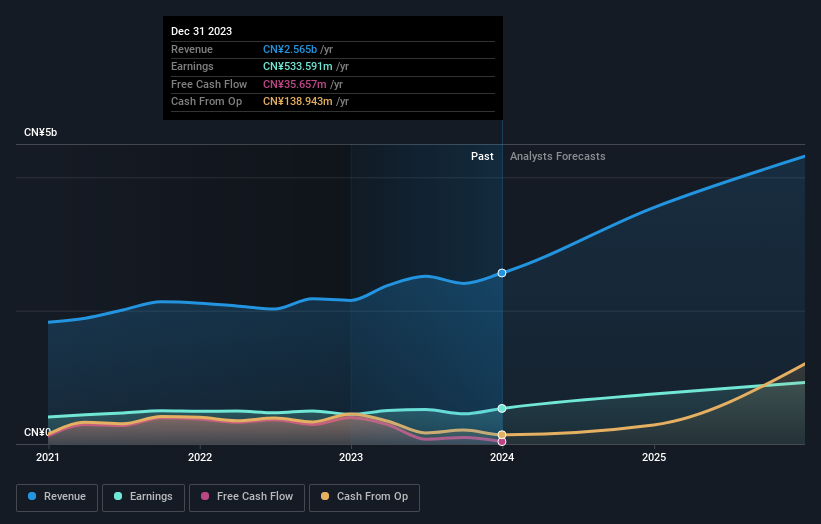

Overview: Smartsens Technology (Shanghai) Co., Ltd. is a company specializing in the development and manufacturing of advanced sensor technologies, with a market capitalization of approximately CN¥18.91 billion.

Operations: The company generates its revenue primarily from the sale of semiconductor integrated circuit chips, totaling approximately CN¥3.24 billion.

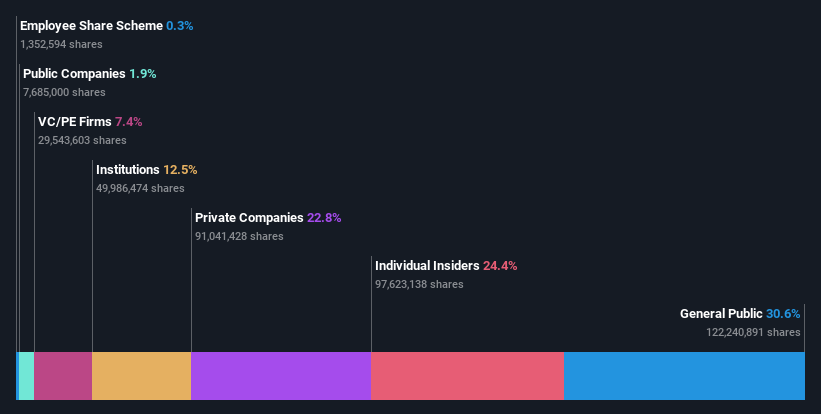

Insider Ownership: 24.4%

Smartsens Technology (Shanghai) has demonstrated a robust turnaround, reporting substantial year-over-year revenue growth from CNY 454.34 million to CNY 837.4 million in Q1 2024 and shifting from a net loss to a net income of CNY 14.03 million. This performance aligns with forecasts predicting revenue growth at nearly double the Chinese market rate and earnings expected to surge by approximately 61.8% annually. However, its projected Return on Equity remains modest at around 12.1% in three years, indicating potential challenges in sustaining high profitability levels relative to capital employed.

Harbin Boshi Automation

Simply Wall St Growth Rating: ★★★★★☆

Overview: Harbin Boshi Automation Co., Ltd. specializes in the research, development, production, and sale of intelligent manufacturing equipment and industrial robots in China, with a market capitalization of approximately CN¥15.91 billion.

Operations: The company generates revenue primarily through the sale of intelligent manufacturing equipment and industrial robots.

Insider Ownership: 36.4%

Harbin Boshi Automation, despite a recent dip in quarterly revenue from CNY 729.71 million to CNY 661.56 million and halved net income of CNY 105.61 million, is positioned for recovery with forecasted earnings growth of 26.49% per year. The company's revenue growth is expected to surpass the Chinese market average at 25.2% annually, supported by a competitive price-to-earnings ratio of 29.8x against the market's 32.4x. However, its modest dividend coverage and low projected return on equity suggest cautious optimism for long-term profitability.

Guangdong Create Century Intelligent Equipment Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Create Century Intelligent Equipment Group Corporation Limited focuses on the research, development, production, and sale of high-end intelligent equipment in China, with a market capitalization of approximately CN¥11.05 billion.

Operations: The company generates its revenue primarily through the research, development, production, and sale of high-end intelligent equipment in China.

Insider Ownership: 18.6%

Guangdong Create Century Intelligent Equipment Group is experiencing significant challenges, with recent quarterly and annual reports showing substantial declines in revenue and net income. Despite these setbacks, the company's earnings are expected to grow by 44.5% per year, outpacing the Chinese market prediction of 23.3%. However, this growth comes amidst a backdrop of lower profit margins compared to the previous year and ongoing high share price volatility. These factors present a mixed outlook for its status as a growth company with high insider ownership in China.

Next Steps

Navigate through the entire inventory of 410 Fast Growing Chinese Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688213SZSE:002698SZSE:300083 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance