Exploring Sebo Manufacturing Engineering & Construction And Two More Top Dividend Stocks On KRX

The South Korean market has experienced a slight downturn in the past week with a 1.4% drop, yet it maintains a positive trajectory over the last year, showing a 4.3% increase. In this context of expected earnings growth and current market dynamics, dividend stocks like Sebo Manufacturing Engineering & Construction can offer investors potential stability and steady income streams.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.57% | ★★★★★★ |

Shinhan Financial Group (KOSE:A055550) | 4.47% | ★★★★★☆ |

KT (KOSE:A030200) | 5.46% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 4.01% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.02% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.16% | ★★★★★☆ |

Snt DynamicsLtd (KOSE:A003570) | 3.95% | ★★★★☆☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.07% | ★★★★☆☆ |

Samyang (KOSE:A145990) | 3.38% | ★★★★☆☆ |

Hansae Yes24 Holdings (KOSE:A016450) | 5.27% | ★★★★☆☆ |

Click here to see the full list of 70 stocks from our Top KRX Dividend Stocks screener.

We'll examine a selection from our screener results.

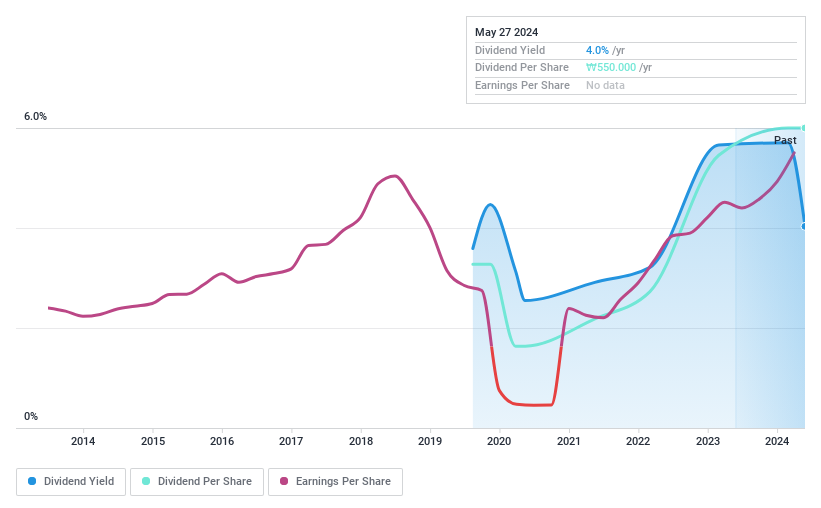

Sebo Manufacturing Engineering & Construction

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sebo Manufacturing Engineering & Construction Corp. operates in the construction and engineering sector with a market capitalization of approximately ₩136.46 billion.

Operations: Sebo Manufacturing Engineering & Construction Corp. does not have detailed revenue segment information available.

Dividend Yield: 4%

Sebo Manufacturing Engineering & Construction has a strong coverage of dividends by both earnings and cash flows, with payout ratios of 15.5% and 5.5% respectively, indicating a solid financial capacity to maintain its dividend payments. Despite this, the dividend history is marked by volatility and unreliability over its short 10-year distribution period. The firm's recent share repurchase program, valued at KRW 3 billion, aims to enhance shareholder value and stabilize the stock price, reflecting proactive management actions in favor of investors. Additionally, Sebo's price-to-earnings ratio stands at an attractive 3.9x compared to the broader Korean market average of 13x.

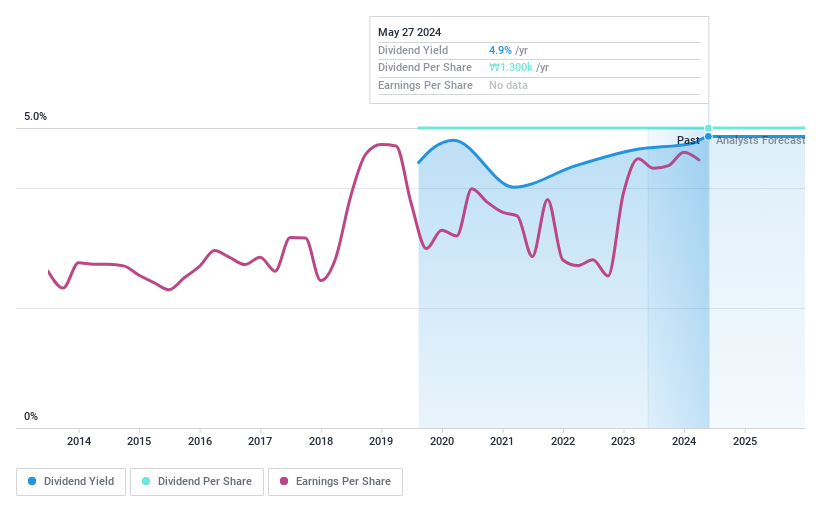

Geumhwa Plant Service & Construction

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Geumhwa Plant Service & Construction Co., Ltd. specializes in plant maintenance and construction services, with a market capitalization of approximately ₩157.98 billion.

Operations: Geumhwa Plant Service & Construction Co., Ltd. does not have detailed revenue segment information available.

Dividend Yield: 4.9%

Geumhwa Plant Service & Construction maintains a conservative dividend approach with a payout ratio of 20.8% and a cash payout ratio of 36.7%, ensuring dividends are well-covered by both earnings and cash flows. Despite its attractive dividend yield of 4.86%, which ranks in the top quartile of Korean dividend payers, the company's dividend history is marred by instability, with no growth over its five-year payment period. Additionally, earnings are projected to decline annually by 10.2% over the next three years, posing potential challenges for future dividend sustainability.

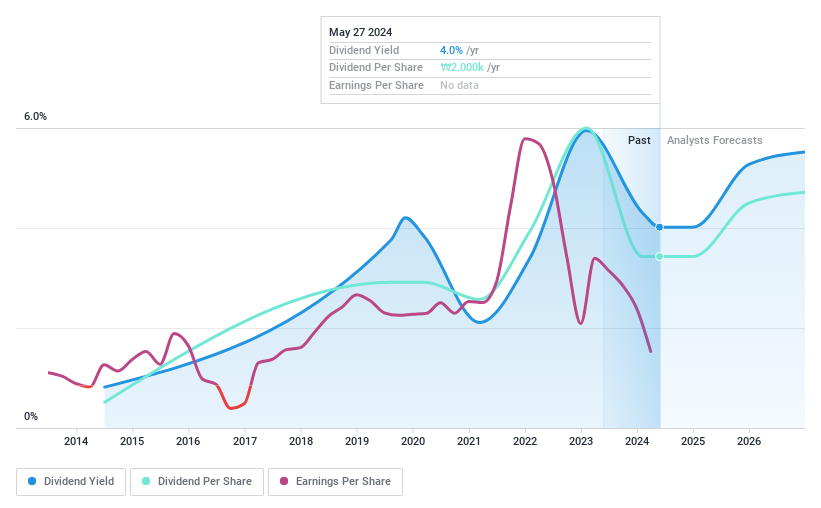

LOTTE Fine Chemical

Simply Wall St Dividend Rating: ★★★★★☆

Overview: LOTTE Fine Chemical Co., Ltd. specializes in the production and distribution of chemical products in Korea, with a market capitalization of approximately ₩1.27 trillion.

Operations: LOTTE Fine Chemical Co., Ltd. generates its revenue primarily from the production and distribution of chemical products in Korea.

Dividend Yield: 4%

LOTTE Fine Chemical has exhibited a mixed performance with its dividends, marked by volatility over the past decade. Despite this inconsistency, the company maintains a reasonable payout ratio of 63.6%, ensuring that dividends are adequately covered by earnings. Additionally, with a cash payout ratio of 85.7%, its dividend payments are also supported by cash flows. However, recent financial results show a decline in net income and basic earnings per share year-over-year as of Q1 2024, coupled with lower profit margins compared to the previous year, which could raise concerns about future dividend reliability and growth prospects.

Seize The Opportunity

Discover the full array of 70 Top KRX Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A011560 KOSDAQ:A036190 and KOSE:A004000.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance