Exploring Promising Value Investments On Chinese Exchanges In June 2024

As of June 2024, the Chinese stock market has shown mixed signals with sectors like real estate continuing to struggle, despite some positive movements in retail sales and industrial production. This complex environment presents a unique landscape for investors looking for undervalued stocks that may offer potential growth opportunities amidst current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥171.79 | CN¥309.51 | 44.5% |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥55.42 | CN¥110.58 | 49.9% |

Beijing Yuanliu Hongyuan Electronic Technology (SHSE:603267) | CN¥31.31 | CN¥56.80 | 44.9% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.25 | CN¥19.94 | 48.6% |

GemPharmatech (SHSE:688046) | CN¥10.75 | CN¥19.43 | 44.7% |

Chengdu Easton Biopharmaceuticals (SHSE:688513) | CN¥51.43 | CN¥91.34 | 43.7% |

China Film (SHSE:600977) | CN¥10.74 | CN¥20.17 | 46.7% |

Guoguang ElectricLtd.Chengdu (SHSE:688776) | CN¥55.39 | CN¥98.08 | 43.5% |

Quectel Wireless Solutions (SHSE:603236) | CN¥45.67 | CN¥89.68 | 49.1% |

Levima Advanced Materials (SZSE:003022) | CN¥13.97 | CN¥25.58 | 45.4% |

Let's take a closer look at a couple of our picks from the screened companies

Jinling Hotel Corporation

Overview: Jinling Hotel Corporation, Ltd. operates a chain of hotels in China and has a market capitalization of approximately CN¥2.44 billion.

Operations: The company generates its revenue through the operation of a chain of hotels across China.

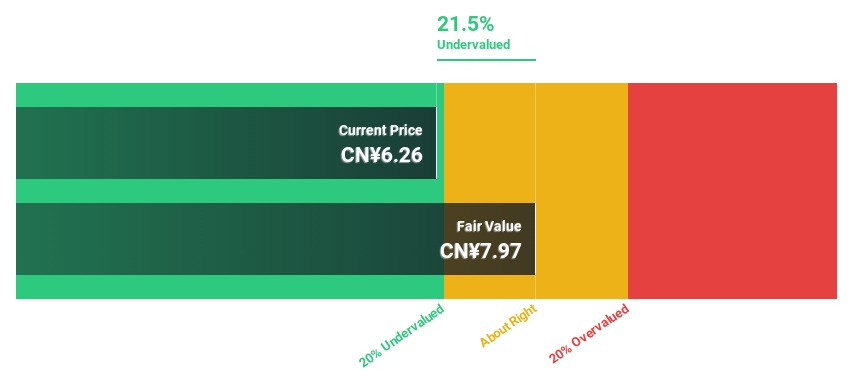

Estimated Discount To Fair Value: 21.5%

Jinling Hotel Corporation, trading at CN¥6.26, is considered undervalued by 21.5%, with a fair value estimate of CN¥7.97 based on discounted cash flows. Despite a low return on equity forecast at 7.5% over three years, the company’s earnings are expected to grow significantly by 26.69% annually during the same period, outpacing the Chinese market's average growth rate of 22.3%. Recent financial results show a year-over-year increase in revenue to CN¥1.81 billion and net income rising to CN¥59.54 million from last year's CN¥41.67 million, indicating improving profitability despite an unstable dividend track record and slower revenue growth projections compared to higher market benchmarks.

Proya CosmeticsLtd

Overview: Proya Cosmetics Co., Ltd. is a Chinese beauty and personal care company that focuses on researching, developing, producing, and selling cosmetics, with a market capitalization of approximately CN¥43.67 billion.

Operations: Proya Cosmetics Co., Ltd. generates its revenue primarily from the sale of beauty and personal care products within China.

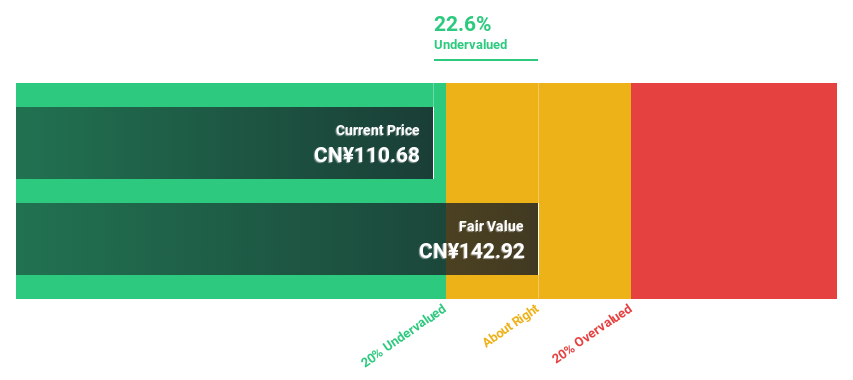

Estimated Discount To Fair Value: 22.6%

Proya Cosmetics Co., Ltd., with a current price of CN¥110.68, is assessed to be trading below its fair value estimated at CN¥142.92, indicating a potential undervaluation of 22.6%. The company's recent financials show robust growth, with Q1 earnings increasing significantly to CN¥302.85 million from CN¥208.03 million the previous year. Despite an unstable dividend history, Proya's earnings are expected to grow by 20% annually over the next three years, outpacing its revenue growth forecast of 19.4% per year but slightly underperforming against the broader Chinese market’s average earnings growth rate of 22.3%.

SWS Hemodialysis Care

Overview: SWS Hemodialysis Care Co., Ltd. specializes in offering integrated blood purification solutions for renal failure and critically ill patients globally, with a market capitalization of CN¥4.41 billion.

Operations: The company generates its revenue from providing integrated blood purification solutions for renal failure and critically ill patients across the globe.

Estimated Discount To Fair Value: 12.6%

SWS Hemodialysis Care Co., Ltd. is trading at CN¥20.58, below the estimated fair value of CN¥23.56, reflecting a modest undervaluation based on cash flows. Despite this, the company's recent performance shows a decline with Q1 net income dropping to CN¥34.23 million from CN¥74.59 million year-over-year and earnings per share also decreasing significantly. However, its future looks promising with expected annual revenue and earnings growth rates of 37.2% and 35.6%, respectively, both surpassing market averages.

Make It Happen

Unlock more gems! Our Undervalued Chinese Stocks Based On Cash Flows screener has unearthed 93 more companies for you to explore.Click here to unveil our expertly curated list of 96 Undervalued Chinese Stocks Based On Cash Flows.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:601007 SHSE:603605 and SHSE:688410.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance