Exploring Primaris Real Estate Investment Trust And Two More Undervalued Small Caps With Insider Actions In Canada

In the first half of 2024, Canadian markets have shown resilience with notable gains in sectors like technology, while small-cap equities have faced challenges amidst low market volatility and shifting economic indicators. This mixed landscape underscores the importance of exploring undervalued opportunities within Canada's small-cap realm, where thorough analysis and strategic insight can uncover potential gems like Primaris Real Estate Investment Trust among others. In current conditions, a good stock often features solid fundamentals and insider confidence, which can signal strength in an otherwise overlooked segment.

Top 10 Undervalued Small Caps With Insider Buying In Canada

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Dundee Precious Metals | 8.0x | 2.8x | 47.09% | ★★★★★☆ |

Nexus Industrial REIT | 2.4x | 3.0x | 19.87% | ★★★★★☆ |

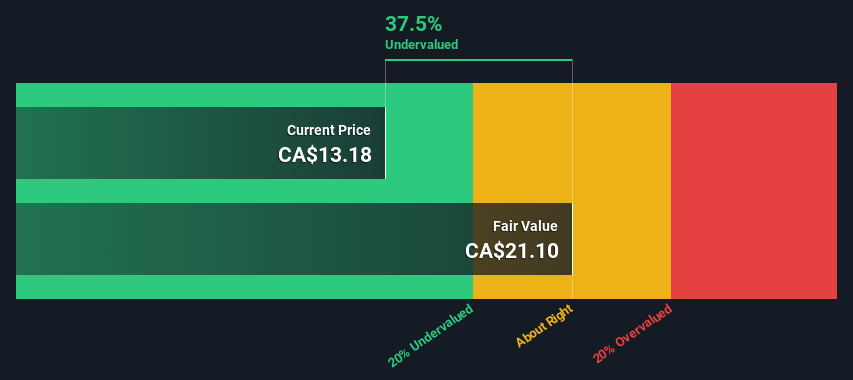

Primaris Real Estate Investment Trust | 11.3x | 2.9x | 37.54% | ★★★★★☆ |

Russel Metals | 9.1x | 0.5x | 15.77% | ★★★★☆☆ |

Guardian Capital Group | 10.4x | 4.0x | 32.02% | ★★★★☆☆ |

Calfrac Well Services | 2.3x | 0.2x | 7.67% | ★★★★☆☆ |

Sagicor Financial | 1.2x | 0.4x | -95.10% | ★★★★☆☆ |

Trican Well Service | 8.3x | 1.0x | -17.02% | ★★★☆☆☆ |

Westshore Terminals Investment | 14.3x | 3.8x | 2.01% | ★★★☆☆☆ |

Freehold Royalties | 15.4x | 6.6x | 48.55% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Primaris Real Estate Investment Trust

Simply Wall St Value Rating: ★★★★★☆

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of investment properties.

Operations: The entity generates revenue primarily through the ownership, management, and development of investment properties, with a recent reported revenue of CA$433.82 million. It has observed a gross profit margin of 56.72% as of the latest reporting period in 2024.

PE: 11.3x

Primaris Real Estate Investment Trust, reflecting a robust financial trajectory with a notable increase in sales to CAD 119 million and net income of CAD 46 million for Q1 2024, showcases its potential in the real estate sector. Recently purchased shares by insiders signal confidence in the company's prospects. With consistent monthly distributions, recently affirmed at $0.07 per unit, and a total share repurchase of 3.67% for CAD 47.44 million since last year, Primaris demonstrates both stability and strategic growth initiatives amidst market challenges.

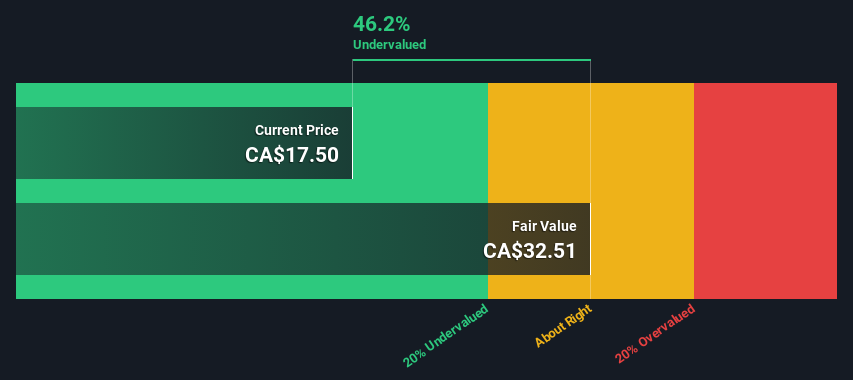

Softchoice

Simply Wall St Value Rating: ★★★★☆☆

Overview: Softchoice is a technology company specializing in IT solutions and services, with a market capitalization of approximately $1.24 billion CAD.

Operations: Direct Marketing generated $777.35 million in revenue, with a notable increase in gross profit margin to 41.82% by mid-2024, reflecting improved cost management relative to sales. The company's net income also showed positive growth, reaching $40.47 million during the same period.

PE: 19.3x

Softchoice, amid its recent financial turbulence with a Q1 net loss of US$1.03 million from sales of US$169.76 million, still demonstrates potential growth with earnings expected to rise by 17.66% annually. Insider confidence is reflected through their recent share purchases, emphasizing belief in the company's future despite current challenges. Additionally, an increased dividend payout in May suggests a commitment to shareholder value, further supported by leadership changes at the latest AGM aiming to rejuvenate strategy and governance.

Trican Well Service

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Trican Well Service is a Canadian company specializing in oil well equipment and services with a market capitalization of approximately CA$947.57 million.

Operations: In the most recent financial period, the company generated CA$947.57 million in revenue from its oil well equipment and services segment, with a gross profit of CA$265.95 million, reflecting a gross profit margin of 28.07%. This performance indicates a net income of CA$116.15 million, translating to a net income margin of approximately 12.26%.

PE: 8.3x

Trican Well Service, reflecting confidence in its trajectory, saw insiders recently bolster their stakes, a positive sign amidst a challenging backdrop where earnings are expected to dip by 3.7% annually over the next three years. Despite this forecasted decline and reliance on high-risk external borrowing, the firm's proactive management of capital through significant share repurchases—2.7% of its shares for CAD 23.47 million since January—underscores a strategic approach to enhancing shareholder value. Moreover, with sales at CAD 271.93 million and net income of CAD 41.18 million in the latest quarter, Trican demonstrates resilience and adaptability in navigating market dynamics.

Make It Happen

Dive into all 31 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:PMZ.UN TSX:SFTC and TSX:TCW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance