Exploring Nick Scali And Two Additional Leading Dividend Stocks

Amidst a challenging day for the ASX200, which saw a decline of 1.1 percent across all sectors, and rising living costs impacting households, investors might find solace in dividend stocks that can offer potential income stability. In this context, exploring strong performers like Nick Scali among others becomes particularly relevant as they may provide a cushion against market volatility and economic pressures.

Top 10 Dividend Stocks In Australia

Name | Dividend Yield | Dividend Rating |

Lindsay Australia (ASX:LAU) | 6.28% | ★★★★★☆ |

Fiducian Group (ASX:FID) | 3.80% | ★★★★★☆ |

Auswide Bank (ASX:ABA) | 9.89% | ★★★★★☆ |

Nick Scali (ASX:NCK) | 4.49% | ★★★★★☆ |

Centuria Capital Group (ASX:CNI) | 6.67% | ★★★★★☆ |

Charter Hall Group (ASX:CHC) | 3.68% | ★★★★★☆ |

Premier Investments (ASX:PMV) | 4.50% | ★★★★★☆ |

Fortescue (ASX:FMG) | 7.83% | ★★★★★☆ |

Diversified United Investment (ASX:DUI) | 3.25% | ★★★★★☆ |

New Hope (ASX:NHC) | 9.45% | ★★★★☆☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

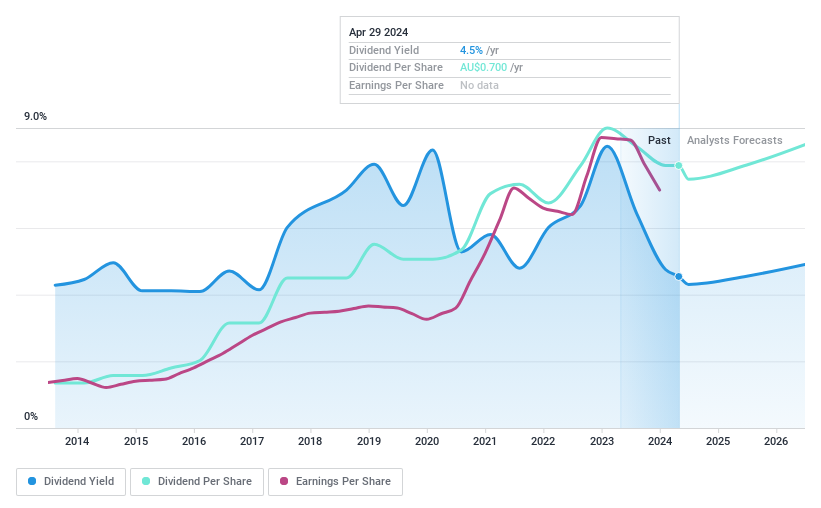

Nick Scali

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nick Scali Limited operates in the sourcing and retailing of household furniture and related accessories across Australia and New Zealand, with a market capitalization of approximately A$1.26 billion.

Operations: Nick Scali Limited generates its revenue primarily through the retailing of furniture, amounting to A$450.45 million.

Dividend Yield: 4.5%

Nick Scali Limited, an Australian furniture retailer, has recently completed follow-on equity offerings totaling A$60 million to support its operations and potential growth strategies, including a merger and acquisition call with Anglia Home Furnishings. Despite a dip in half-year sales from A$283.91 million to A$226.63 million and net income decreasing from A$60.57 million to A$43.01 million, the company maintains a stable dividend history with a recent payment of A$0.35 per share. Its dividends are well-covered by earnings with a payout ratio of 67.9% and cash flows with a cash payout ratio of 43.4%, although its dividend yield of 4.49% is lower than the top Australian dividend payers.

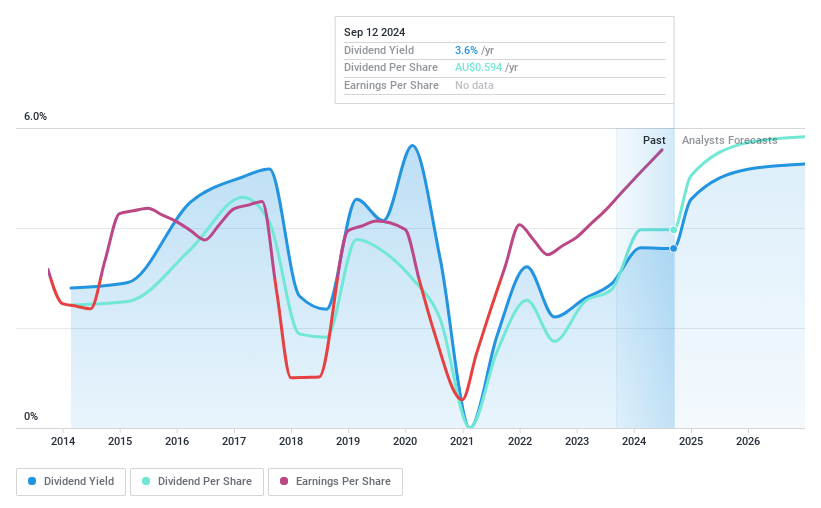

QBE Insurance Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: QBE Insurance Group Limited is a global insurer and reinsurer, operating across Australia Pacific, North America, and other international markets with a market capitalization of A$26.64 billion.

Operations: QBE Insurance Group Limited generates revenue through its operations in North America (A$11.12 billion), internationally (A$9.56 billion), and the Australia Pacific region (A$5.97 billion).

Dividend Yield: 3.4%

QBE Insurance Group has seen a notable increase in dividends, declaring a final dividend of A$0.48 per share for 2023, up from A$0.30 in 2022. Despite this growth, the company's dividend track record over the past decade has been inconsistent with occasional significant drops. Financially, QBE is on solid ground with its dividends well-covered by both earnings and cash flows, sporting payout ratios of 48.3% and 44.7% respectively. However, its dividend yield at 3.43% remains below the top quartile of Australian dividend stocks which average around 6.25%. Recent executive changes and inclusion in the S&P/ASX 20 Index could influence future performance and sustainability strategies.

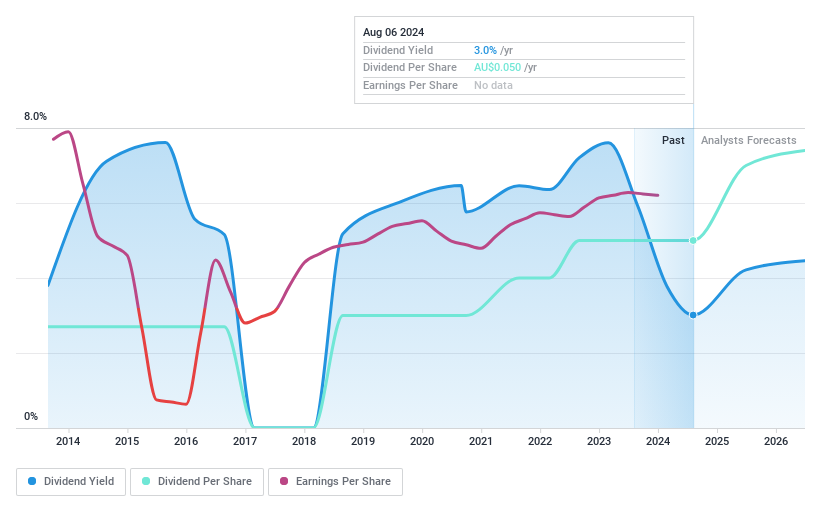

Southern Cross Electrical Engineering

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering Limited, operating in Australia, offers electrical, instrumentation, communication, and maintenance services with a market capitalization of approximately A$323.75 million.

Operations: Southern Cross Electrical Engineering Limited generates its revenue primarily through the provision of electrical services, amounting to A$464.88 million.

Dividend Yield: 4.1%

Southern Cross Electrical Engineering's dividend sustainability is moderately supported with a payout ratio of 66.5% and cash payout ratio of 78.2%. Despite a history of increasing dividends over the past decade, the company has experienced volatility in its dividend payments. Earnings have grown at an annual rate of 13.3% over the past five years, with forecasts suggesting continued growth at 14.35% per year. However, its current dividend yield stands at 4.07%, which is lower than the top quartile in the Australian market (6.25%). Recent inclusion in the S&P/ASX All Ordinaries and Emerging Companies Indexes may impact visibility and investor interest.

Where To Now?

Dive into all 31 of the Top Dividend Stocks we have identified here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:NCKASX:QBEASX:SXE and .

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance